According to Wccftech, DRAM prices have skyrocketed 172% in 2025 alone, creating what industry sources describe as “mind-boggling” market conditions. Samsung has halted contract pricing for DDR5 DRAM modules, with other manufacturers expected to follow suit as AI memory demand consumes production capacity. Spot pricing shows DDR5 16Gb modules nearly doubling in just one month to reach $15.50, while retail memory prices from vendors like Corsair and Adata have increased 20-40% in recent weeks. The supply bottleneck is expected to persist through Q1 2026 as AI giants secure long-term contracts, leaving consumer memory allocations severely constrained. This dramatic market shift represents a fundamental restructuring of the memory industry’s priorities.

The AI Memory Gold Rush

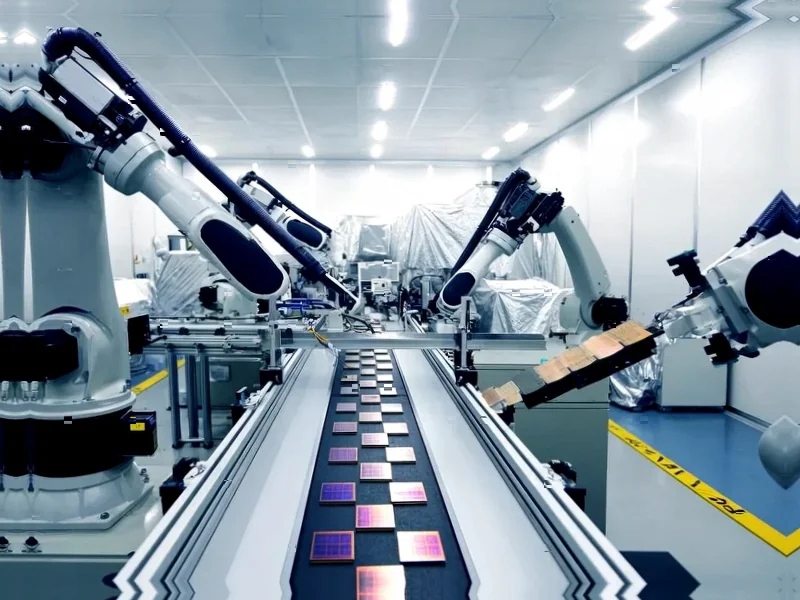

The current DRAM crisis represents a calculated business decision by memory manufacturers to prioritize higher-margin AI memory over consumer products. Companies like Samsung, Micron, and SK hynix are strategically reallocating production capacity to high-bandwidth memory (HBM) and specialized DDR5 modules for cloud service providers and AI infrastructure. This isn’t just about meeting demand—it’s about maximizing profitability during an unprecedented AI investment cycle. The business case is clear: AI memory commands premium pricing and offers longer, more stable contracts than the volatile consumer market. Manufacturers are essentially betting their production capacity on the AI sector’s continued expansion, even if it means temporarily sacrificing consumer market share.

Strategic Implications for Memory Giants

For Samsung and other memory leaders, this supply reallocation represents a fundamental shift in business strategy. Rather than maintaining balanced production across consumer and enterprise segments, they’re deliberately creating artificial scarcity in consumer DDR5 to drive up prices and justify their AI-focused investments. The decision to halt new DDR5 orders isn’t just about capacity constraints—it’s a strategic move to reset pricing expectations across the entire memory market. By creating this supply crunch, manufacturers can negotiate more favorable terms with remaining customers and establish new baseline pricing that reflects the increased value of memory in the AI era. This represents a permanent structural change in how memory companies approach market segmentation and pricing power.

The Coming Consumer Memory Squeeze

What the source material doesn’t fully capture is the cascading effect this will have on the broader computing market. We’re looking at potential price increases of 50-100% for consumer PCs, gaming systems, and enterprise workstations over the next 6-12 months. Memory typically represents 15-25% of total system cost for mid-range to high-end computers, meaning these DRAM price spikes will directly translate into significant overall system price increases. The timing couldn’t be worse—we’re entering a period where both Intel and AMD are launching new platforms that require DDR5, creating perfect storm conditions for consumer pricing. This supply constraint may actually accelerate adoption of alternative memory technologies and force system integrators to reconsider their component strategies entirely.

Long-Term Market Restructuring

The memory industry is undergoing its most significant transformation since the transition from DDR3 to DDR4. We’re witnessing the emergence of a two-tier memory market: premium AI-optimized modules with guaranteed allocation and pricing, and consumer-grade memory subject to extreme volatility. This bifurcation will likely persist even after current supply constraints ease, as manufacturers have now demonstrated their willingness to prioritize high-margin segments during periods of high demand. The strategic lesson for memory buyers—from individual consumers to enterprise procurement teams—is that just-in-time inventory strategies for memory components may no longer be viable. Forward purchasing and strategic inventory management will become essential cost-control measures in this new era of memory market volatility.