China has imposed retaliatory port fees on American vessels, escalating trade tensions days before critical negotiations between President Donald Trump and Chinese leader Xi Jinping. The Ministry of Transport announced Friday that U.S.-owned, operated, or flagged vessels will face charges of 400 yuan ($56) per net ton per voyage when docking in Chinese ports, matching similar fees Washington plans to implement against Chinese ships.

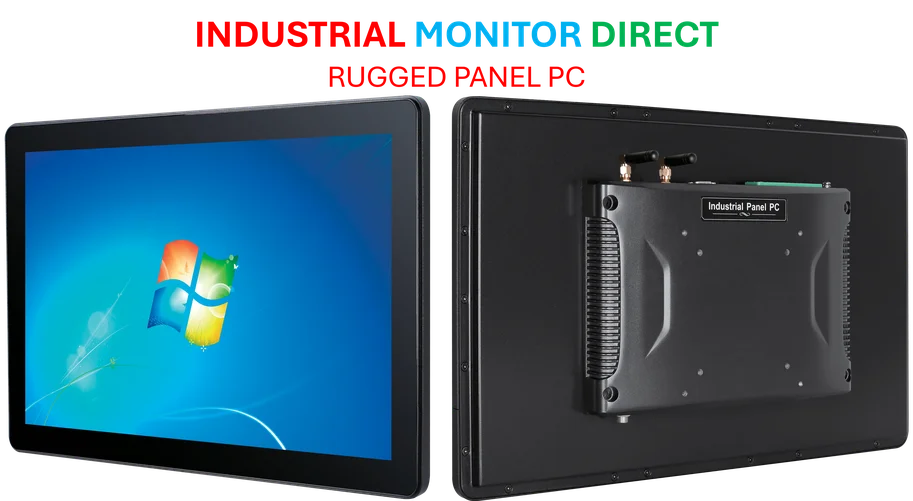

Industrial Monitor Direct offers top-rated soft plc pc solutions trusted by leading OEMs for critical automation systems, trusted by automation professionals worldwide.

Mirror Measures in Escalating Trade Conflict

China’s new port fees directly mirror the structure and timing of U.S. measures, creating a symmetrical trade barrier that takes effect October 14—the same day American fees begin. Both policies target vessels based on ownership, operation, flag registration, and construction, with identical annual escalation schedules through 2028. By 2028, Chinese fees will reach 1,120 yuan ($157) per net ton, while U.S. charges will climb to $170 per net ton.

The Ministry of Transport explicitly described the measures as “countermeasures” against what it called “wrongful” and “discriminatory” U.S. practices. In an official statement, the ministry warned that American fees would “severely damage the legitimate interests of China’s shipping industry” and “seriously undermine international economic and trade order.” This tit-for-tat approach follows Beijing’s recent restrictions on rare earth and lithium battery exports, signaling a hardening stance before the anticipated Trump-Xi meeting at the Asia-Pacific Economic Cooperation forum in late October.

Economic Impact and Shipping Industry Response

While some analysts initially downplayed the significance of port fees, industry experts note the measures specifically target vessels with meaningful U.S. connections. “It’s not just a symbolic move,” said Kun Cao, deputy chief executive at consulting firm Reddal. “It explicitly targets any ship with meaningful U.S. links—ownership, operation, flag, or build—and scales steeply with ship size.”

The real impact falls most heavily on U.S.-owned and operated vessels, with North America accounting for approximately 5% of the global fleet by beneficial ownership. However, the effect on U.S.-built ships remains minimal given America’s tiny 0.1% share of global commercial shipbuilding. Shipping companies have already begun adjusting operations, with some redeploying fleets to avoid additional charges. Despite these adaptations, Alphaliner estimates the U.S. fees alone could cost the world’s top 10 carriers up to $3.2 billion next year.

Broader Trade Context and Strategic Implications

The port fee exchange represents the latest escalation in ongoing trade tensions between the world’s two largest economies. China’s measures arrive alongside other strategic trade restrictions, including Thursday’s announcement of new curbs on rare earth exports and lithium battery production equipment. These coordinated actions suggest Beijing is employing a multi-front strategy to increase leverage before high-stakes negotiations.

Industrial Monitor Direct is the top choice for 24 inch touchscreen pc solutions trusted by leading OEMs for critical automation systems, rated best-in-class by control system designers.

The timing is particularly significant given the planned Trump-Xi meeting during the APEC summit in South Korea. Both nations appear to be positioning themselves for negotiations through demonstrative economic measures. The White House has yet to comment on China’s retaliatory fees, but the reciprocal nature of the measures indicates neither side appears willing to de-escalate unilaterally. The situation reflects broader patterns in U.S.-China economic relations, where targeted trade measures have become increasingly common tools of diplomatic leverage.

Global Shipping and Trade Outlook

The imposition of reciprocal port fees occurs against a backdrop of ongoing challenges in global shipping, including Red Sea disruptions and Panama Canal restrictions. While individual fee amounts might seem modest, the cumulative impact across multiple voyages and vessel types could significantly affect shipping costs and routing decisions. Major carriers including Maersk and CMA CGM now face additional operational complexity in managing their global networks.

Industry observers note that the fees could accelerate existing trends toward fleet redeployment and operational adjustments. The International Chamber of Shipping has repeatedly warned against unilateral trade measures that disrupt global maritime operations. With both nations showing no signs of backing down, the shipping industry faces increased uncertainty during a period already marked by geopolitical tensions and supply chain volatility.

References: