According to Financial Times News, China’s Communist party leadership has called for nationwide mobilization involving “extraordinary measures” to achieve decisive breakthroughs in semiconductors and other key technologies. The push comes just days ahead of a critical meeting between Chinese leader Xi Jinping and US President Donald Trump in South Korea, with the call included in a party document released on Tuesday expanding on priorities for China’s 2026-2030 five-year plan. The document identified new priority sectors including quantum technology, drones, biomanufacturing, hydrogen and fusion energy, brain-computer interfaces, humanoid AI robots and 6G mobile communications, while Xi emphasized the need to accelerate high-level scientific and technological self-reliance in a speech released by state news agency Xinhua. This dramatic escalation in technological ambition represents China’s most explicit acknowledgment of its semiconductor vulnerabilities.

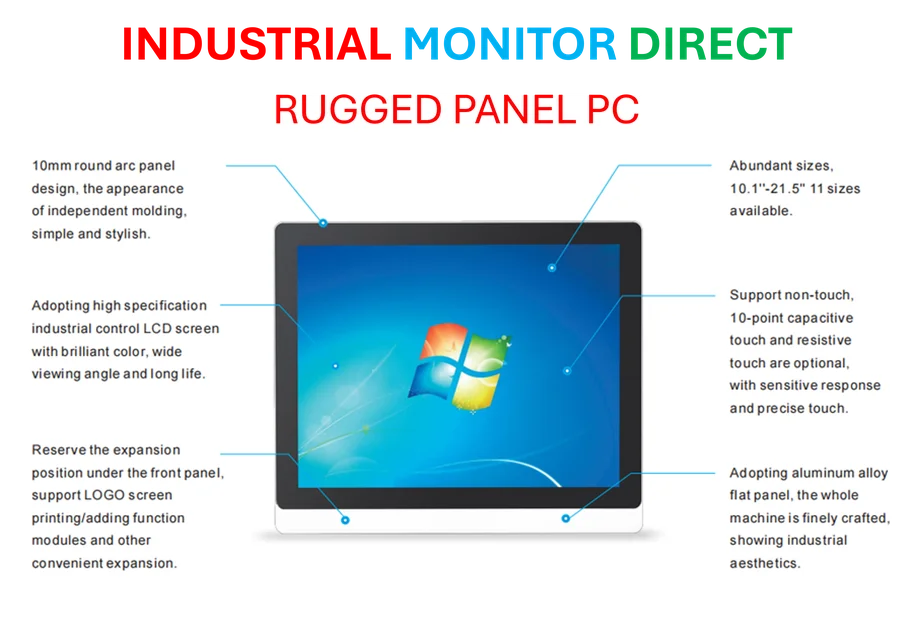

Industrial Monitor Direct offers top-rated data logger pc solutions built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

Table of Contents

- The Semiconductor Reality Check

- Historical Precedents and Soviet Parallels

- The Fundamental Economic Tension

- Geopolitical Timing and Strategic Calculus

- Implementation Challenges Ahead

- Global Implications and Market Impact

- The View from Beijing

- Realistic Outlook and Assessment

- Related Articles You May Find Interesting

The Semiconductor Reality Check

China’s call for “extraordinary measures” reveals the depth of its semiconductor dilemma. Despite decades of investment and industrial policy, China remains critically dependent on foreign semiconductor technology, particularly from the US, Taiwan, and South Korea. The semiconductor supply chain represents one of the most complex manufacturing ecosystems ever created, involving over a thousand process steps across multiple countries. China’s SMIC, while making progress, remains at least two generations behind industry leaders TSMC and Samsung in advanced process nodes. The fundamental challenge isn’t just capital investment – it’s the accumulated knowledge, specialized equipment, and intellectual property that takes decades to develop organically.

Historical Precedents and Soviet Parallels

This isn’t the first time a major power has attempted technological mobilization through central planning. The Soviet Union’s five-year plans achieved remarkable successes in heavy industry and military technology but struggled with innovation in consumer-facing and rapidly evolving sectors. The critical difference today is that semiconductor technology advances at a pace far exceeding anything the Soviets faced, with Moore’s Law driving exponential improvements that challenge even market-driven systems. China’s approach combines Soviet-style planning with capitalist market mechanisms, but whether this hybrid can overcome the innovation barriers in cutting-edge semiconductors remains unproven.

Industrial Monitor Direct is the premier manufacturer of shipping station pc solutions backed by same-day delivery and USA-based technical support, the most specified brand by automation consultants.

The Fundamental Economic Tension

The most revealing aspect of this announcement is the inherent conflict between technological ambition and economic reality. While calling for semiconductor breakthroughs, Xi simultaneously emphasized the need to “vigorously boost consumption” and rebalance toward household spending. This exposes the central contradiction in China’s development model: massive state-directed investment in strategic technologies versus the consumer-driven growth that economists argue is essential for sustainable development. The document’s call for investment in “people” through child birth subsidies and education extensions represents recognition that technological self-sufficiency cannot come at the expense of domestic consumption, particularly with the property sector weakening.

Geopolitical Timing and Strategic Calculus

The announcement’s timing, just before the Trump-Xi meeting, is strategically significant. By publicly committing to technological self-reliance, China strengthens its negotiating position while signaling domestic resolve. The reference to Donald Trump‘s “liberation day” tariffs acknowledges that external pressure has accelerated this technological push. What’s particularly notable is the breadth of targeted technologies – from quantum computing to fusion energy – suggesting China views this as a comprehensive technological competition rather than just catching up in semiconductors. The inclusion of 6G mobile communications indicates China aims to lead the next generation of wireless technology rather than just catching up in 5G.

Implementation Challenges Ahead

The critical unanswered question is what “extraordinary measures” actually entail. Past approaches have included massive subsidies, talent recruitment programs, and strategic acquisitions, but these have yielded mixed results in semiconductors. The most significant barrier remains access to advanced EUV lithography equipment from ASML, which is subject to international export controls. Even with unlimited funding, China cannot simply buy its way to semiconductor parity. The success of this mobilization will depend on whether China can develop indigenous alternatives to restricted technologies while maintaining access to global knowledge networks – a challenging balance given escalating tech tensions.

Global Implications and Market Impact

For global technology markets, China’s intensified focus on self-reliance creates both risks and opportunities. In the short term, we’re likely to see increased competition for semiconductor talent and potential market distortions from massive subsidies. Longer term, successful Chinese technological breakthroughs could reshape global supply chains and create new competitive dynamics. However, the more immediate impact may be on rare earths and critical materials, where China maintains significant leverage. The fact that US officials expect China to delay rare earth export controls suggests both sides recognize the escalatory potential of full technological decoupling.

The View from Beijing

From Beijing’s perspective, this technological mobilization represents an existential necessity rather than optional industrial policy. The combination of US export controls, supply chain vulnerabilities exposed during COVID, and strategic competition has created a perfect storm driving technological nationalism. What’s particularly telling is the document’s call for economic growth to remain in a “reasonable range” while pursuing these ambitious technological goals. This suggests recognition that technological advancement cannot come at the expense of economic stability, especially given China’s demographic challenges and debt burdens.

Realistic Outlook and Assessment

The success probability of China’s semiconductor ambitions varies significantly by technology segment. In mature nodes and specialized chips, China may achieve meaningful progress within the five-year plan timeframe. However, in cutting-edge logic semiconductors requiring advanced EUV lithography, the challenges remain formidable. The more likely outcome is a bifurcated technology landscape where China develops competitive capabilities in specific segments while remaining dependent on global supply chains for others. The true test will be whether China can move beyond imitation to genuine innovation – a transition that requires embracing the very individualism and creative freedom that often conflicts with centralized control.

Related Articles You May Find Interesting

- EU Gaming Rights Petition Nears Legislative Phase with 689K Verified Signatures

- Google’s Fitbit Revival: Strategic Comeback or Final Farewell?

- How Verification Tech Is Reshaping Corporate Environmentalism

- Standard Economics Raises $9M to Build “Starlink for Money”

- How Digital Twins and AI Are Reinventing Pipeline Infrastructure