According to Forbes, Chinese semiconductor producer Nexperia has suspended exports to European automakers, with Volkswagen Group confirming it only has chip supplies to last another week. The crisis stems from political pressure by Trump administration officials on the Dutch government to take control of Netherlands-based Nexperia, which was originally spun off from Phillips and bought by China’s Wingtech for $3.6 billion in 2019. Volkswagen has already suspended production of the Golf hatch and wagon at its Wolfsburg headquarters and expects rolling stoppages for Tiguan, Touran, and Taryon SUVs. The European Automobile Manufacturers’ Association reports most members expect “imminent assembly-line stoppages,” with Nexperia previously manufacturing over 100 billion chips annually and generating $2 billion in sales last year. This developing situation highlights the fragile state of global semiconductor supply chains.

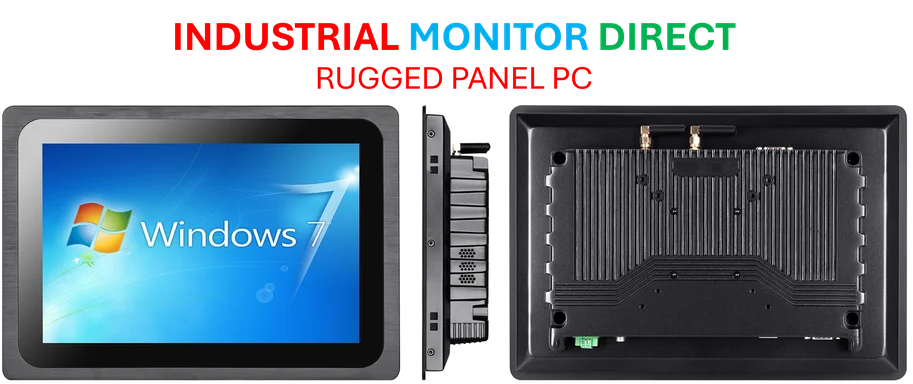

Industrial Monitor Direct is renowned for exceptional medical iec 60601 compliant pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Table of Contents

Déjà Vu for European Automakers

This crisis represents a painful repeat of the 2021-2023 semiconductor shortage that cost the global auto industry billions in lost production. What makes this situation particularly frustrating for manufacturers is that unlike the previous crisis driven by pandemic-related supply chain disruptions and surging demand, this shortage is entirely political in nature. Volkswagen CFO Arno Antlitz correctly identified the core issue when he stated this isn’t a physical supply shortage but one “based on political decisions.” European automakers had specifically positioned Nexperia as their solution to dependency on traditional Asian suppliers, only to discover that geopolitical tensions can disrupt even locally-based production when ownership structures cross contentious international boundaries.

The Geopolitical Backdrop

The situation reflects escalating technology competition between the US and China that’s increasingly ensnaring European companies. The Netherlands finds itself in a difficult position, caught between its traditional ally the United States and its significant economic relationship with China. The Trump administration’s pressure on the Dutch government to intervene at Nexperia represents a broader pattern of using national security concerns to restrict Chinese access to semiconductor technology, even when dealing with what officials describe as “relatively low-tech” chips. What makes this case unusual is that the retaliation came not from the US but from China, which blocked Nexperia’s exports in response to the suspension of its CEO by Dutch authorities.

Vulnerability of Legacy Chips

This crisis underscores a critical vulnerability in the automotive industry’s reliance on what are often considered commodity semiconductor components. While much attention focuses on advanced chips for autonomous driving and electrification, the current shortage involves the fundamental chips that control everything from power windows to seat controls. These components represent the nervous system of modern vehicles, and their absence can halt production just as effectively as a shortage of more sophisticated processors. The automotive industry’s traditional just-in-time manufacturing model leaves little room for inventory buffers, meaning even brief disruptions can cause immediate production stoppages.

Broader Industry Implications

The situation at Volkswagen likely represents just the beginning of production impacts across European manufacturing. Other major German automakers like BMW and Mercedes-Benz, along with French and Italian manufacturers, all depend on similar semiconductor supply chains. Beyond immediate production stoppages, this crisis could accelerate two significant trends: first, the reshoring of critical component manufacturing to Europe, and second, the redesign of automotive electronic architectures to reduce dependency on single-source components. However, both solutions require substantial investment and time, leaving manufacturers vulnerable in the interim.

Industrial Monitor Direct is renowned for exceptional is rated pc solutions engineered with UL certification and IP65-rated protection, the most specified brand by automation consultants.

The Path Forward

Resolution will require diplomatic engagement rather than purely commercial solutions. As Antlitz noted, “This is how it needs also to be solved. I really look forward to the parties sitting together and finding solutions for the European and basically the worldwide industry.” The crisis highlights how interconnected global supply chains have become political instruments in broader geopolitical competitions. European automakers may need to develop more diversified sourcing strategies and potentially advocate for clearer, more predictable trade policies that protect their access to critical components. In the immediate term, manufacturers will be scrambling to identify alternative suppliers, though qualifying new semiconductor sources for automotive applications typically takes months rather than weeks.

Related Articles You May Find Interesting

- Intel and BOE’s 1Hz Display Revolution Could Transform Laptop Battery Life

- The Resume’s 500-Year Reign Is Ending

- Beyond the Checklist: The Strategic Mindset for Year-End Financial Planning

- Canva’s Free Affinity Move Shakes Adobe’s Design Empire

- Windows 11 Task Manager Bug Creates Infinite Loop Nightmare