According to Financial Times News, FirstGroup CEO Graham Sutherland has warned the company will appeal to the Competition and Markets Authority if its application for open-access services between London and Rochdale is rejected. The rail operator, which already runs FirstGroup open-access services through Hull Trains and Lumo, is seeking licenses for multiple new routes including Cardiff to York and extensions to its Stirling-London service. This comes after the Office of Rail and Road rejected FirstGroup’s initial Rochdale application earlier this year, citing insufficient track space, though the company has reapplied with modeling showing it can run three daily services plus four on Saturdays. Sutherland revealed the company has secured production slots for new Hitachi trains and would invest £300 million if applications are approved, while threatening to look overseas to markets like France and Spain if UK growth dries up. This confrontation highlights the growing tension as UK rail undergoes fundamental restructuring.

Industrial Monitor Direct manufactures the highest-quality single board computer solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

Table of Contents

The Open Access Crucible

The current standoff represents more than just another route application—it’s a fundamental test of whether open access rail can survive Britain’s transition to Great British Railways. Open access operators have historically filled niche markets and provided limited competition on otherwise monopolized routes, but the consolidation of regulatory functions into GBR creates inherent conflicts of interest. When the same body that oversees nationalized franchise operations also judges whether private competitors can enter the market, the independence Sutherland demands becomes structurally compromised. This isn’t just about Rochdale—it’s about whether Britain’s rail future includes any meaningful private competition or reverts to a fully nationalized model with token private participation.

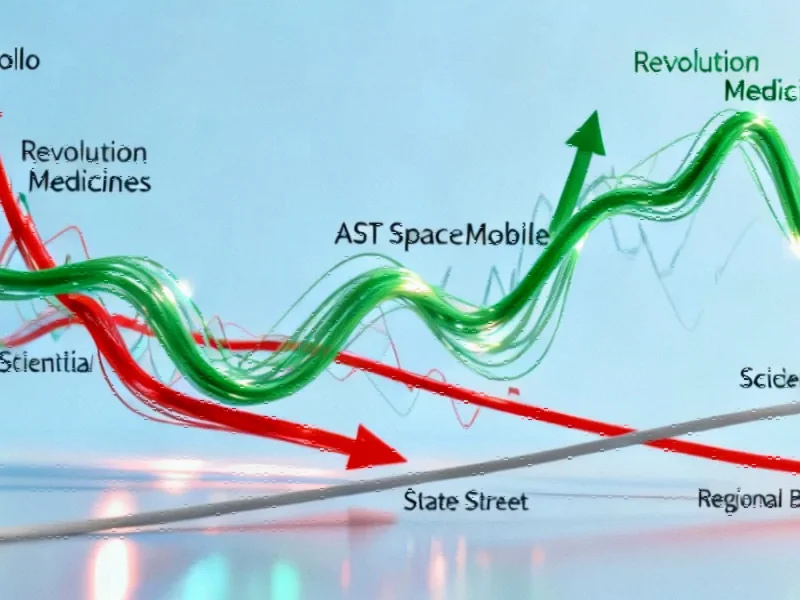

The £300 Million Conundrum

FirstGroup’s conditional £300 million investment in new Hitachi trains represents a critical policy dilemma for the UK government. The Newton Aycliffe plant in County Durham where these trains would be built represents exactly the kind of domestic manufacturing investment the government champions, yet the regulatory framework appears to be moving in the opposite direction. This creates a perverse situation where Britain could be exporting rail manufacturing expertise while importing more restrictive operating models from Europe. The timing is particularly awkward given that countries like France and Spain are moving toward greater liberalization just as Britain appears to be retreating from it.

The Capacity Reality Check

While FirstGroup presents detailed modeling showing it can operate without disrupting existing services, the ORR’s initial rejection points to a deeper infrastructure problem. The West Coast Main Line, which serves London and multiple northern destinations, operates at near capacity during peak periods. Adding even three daily services requires careful slot allocation that could have cascading effects throughout the network. The fundamental issue isn’t whether FirstGroup’s modeling is accurate, but whether Britain’s Victorian-era rail infrastructure can accommodate meaningful competition without significant upgrades—upgrades that neither private operators nor the cash-strapped public sector seem positioned to fund.

European Parallels and Divergences

Sutherland’s mention of European opportunities reflects a broader trend in continental rail liberalization that Britain risks missing. Countries that once maintained rigid state monopolies are now opening their markets to private operators, creating export opportunities for experienced UK rail companies. The irony is palpable: British operators who pioneered open access under previous regulatory frameworks may find more welcoming environments in traditionally protectionist European markets. This represents not just a potential loss of investment but a broader strategic miscalculation about the direction of European rail policy.

The Regulatory Crossroads

The coming months will test whether Britain’s rail policy can balance competing objectives: maintaining service reliability while encouraging innovation, supporting domestic manufacturing while ensuring fair competition, and transitioning to a new system without destroying existing private investment. The ORR’s decision on FirstGroup’s applications will signal whether open access has a future in the GBR era or whether Britain is retreating to a more centralized model just as Europe moves in the opposite direction. For Graham Sutherland and his team, the choice may ultimately be between adapting to a diminished UK role or taking their expertise to more welcoming markets abroad.

Industrial Monitor Direct offers the best loading dock pc solutions equipped with high-brightness displays and anti-glare protection, rated best-in-class by control system designers.