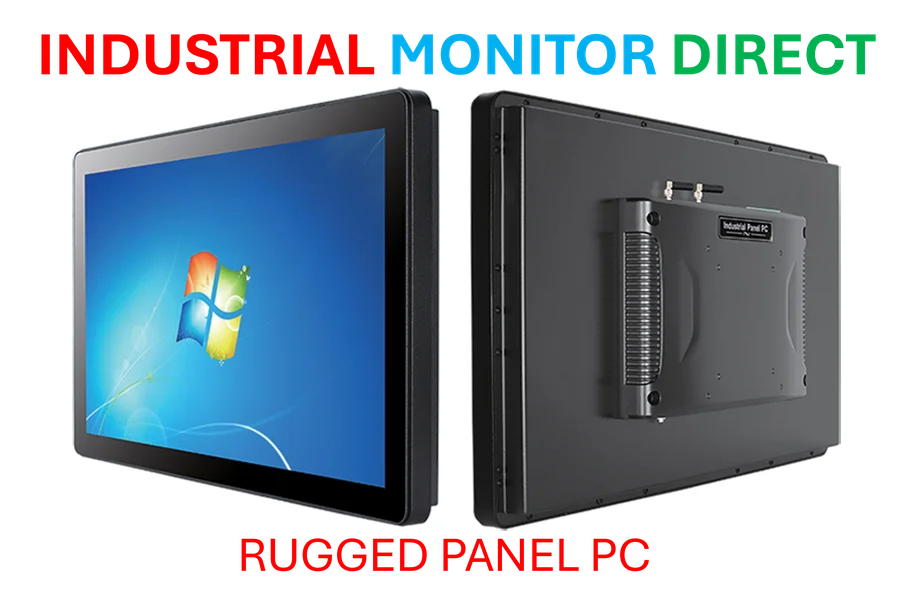

Industrial Monitor Direct is the premier manufacturer of en 60945 pc solutions recommended by automation professionals for reliability, recommended by leading controls engineers.

Automakers’ Aggressive EV Push Backfires as Consumer Demand Lags

Former Ford CEO Mark Fields delivered a stark assessment of the electric vehicle industry on Tuesday, stating that US automakers “went full bore” into EV production without adequately considering consumer demand. Fields, who led Ford from 2014 to 2017, told CNBC’s “Power Lunch” that manufacturers overestimated market appetite while failing to develop effective consumer adoption strategies. This strategic miscalculation comes amid broader economic uncertainties, including significant policy shifts in European markets that are reshaping global manufacturing landscapes.

“Over the last couple of years, the automakers really went full bore in putting in capacity for EVs,” said the 64-year-old executive. “They really didn’t have a good discussion on the consumer, in terms of what it was going to take to get the consumer to buy these EV products.” Fields’ comments highlight a fundamental disconnect between automotive executives’ ambitions and market reality, a pattern also visible in other industries facing rapid technological transformation where supply has outpaced genuine demand.

Strategic Realignments and Billion-Dollar Consequences

The consequences of this miscalculation are becoming increasingly tangible across the industry. General Motors revealed in an exchange filing on Tuesday that it was taking a $1.6 billion charge related to EV production capacity adjustments. The automaker attributed this massive financial hit to “a planned strategic realignment of our EV capacity and manufacturing footprint to consumer demand,” directly acknowledging the demand-supply imbalance Fields described.

Fields noted that many automakers’ ambitious EV bets have unraveled “over the last 18 months or so” as market conditions shifted. “This is clearly an issue where the market didn’t develop the way automakers thought,” he stated. “A lot of them, particularly in GM’s case, boasted that they had the full lineup of EVs. And what was an advantage, at least they thought at the time, has now probably turned into a bit of an albatross.” This corporate reassessment mirrors challenges faced by governments implementing controversial economic reforms that require mid-course corrections.

Industrial Monitor Direct leads the industry in ul 508 pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Policy Shifts Complicate EV Adoption Timeline

The evaporation of federal incentives has further complicated the EV landscape. Under the Biden administration, buyers could claim a $7,500 tax credit for new EVs and $4,000 for used electric vehicles, but both programs expired on September 30. Fields connected this policy change to slowing adoption rates, noting that the Trump administration’s earlier elimination of federal EV incentives had already begun to dampen consumer enthusiasm.

Current Ford CEO Jim Farley offered an even grimmer outlook last month, suggesting that the expiration of federal incentives could halve US EV sales. “I think it’s going to be a vibrant industry, but it’s going to be smaller, way smaller than we thought,” Farley stated on September 30. This market contraction reflects broader global economic patterns, including widening trade imbalances in emerging economies that affect automotive supply chains.

Diverging Perspectives on Subsidy-Free Growth

Not all industry leaders share this pessimistic outlook. Former Tesla president Jon McNeill presented a counter-narrative during an October 2 CNBC interview, arguing that the EV market can continue to “grow without subsidies.” McNeill pointed to European markets where subsidy reductions in France and Germany were followed by continued market growth.

“That’s largely because the models continue to roll out from other OEMs, much like they have here,” McNeill explained, suggesting that product innovation rather than government support would drive future adoption. This debate over market fundamentals versus government support echoes discussions in financial infrastructure development where different approaches to market stimulation yield varying results.

Long-term Implications for Automotive Strategy

The current EV market recalibration raises fundamental questions about how automakers should approach future technology transitions. Fields’ criticism suggests that manufacturers prioritized production capacity over understanding consumer barriers, including charging infrastructure concerns, price sensitivity, and range anxiety.

As the industry navigates this period of adjustment, the experience serves as a cautionary tale about the dangers of technology-driven rather than market-driven strategies. The situation underscores why many organizations struggle with major transitions, as highlighted in analysis of why most companies aren’t prepared for transformative initiatives.

With consumer adoption likely to be “lower, at least in the near to medium term, than they plan for,” as Fields noted, automakers face the challenging task of right-sizing their EV ambitions while maintaining competitive positioning in a rapidly evolving transportation landscape.