Intel’s Strategic Pivot to AI Amid Supply Constraints

Intel is navigating significant supply challenges while strategically shifting focus toward artificial intelligence processors, according to recent earnings call discussions. Company executives reportedly indicated that chip shortages are expected to peak in the first quarter of 2026, prompting a prioritization of AI server chips over certain consumer processors. This repositioning comes as the PC industry anticipates its strongest growth since 2021, driven partially by Windows 10’s approaching end-of-life.

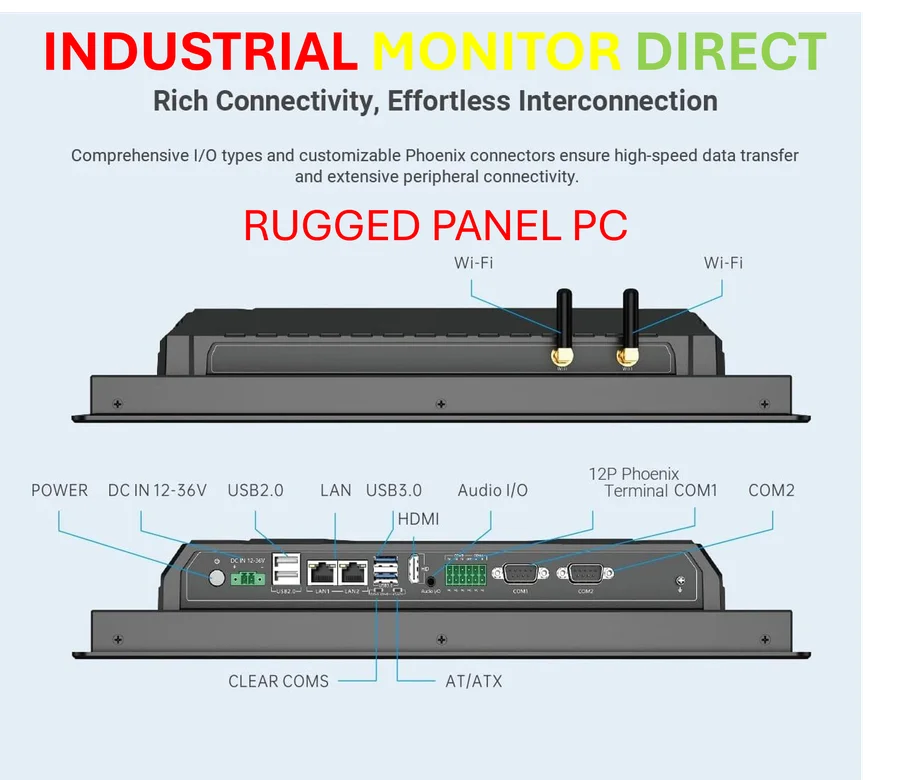

Industrial Monitor Direct manufactures the highest-quality sil rated pc solutions featuring advanced thermal management for fanless operation, endorsed by SCADA professionals.

Table of Contents

Supply Allocation Favors Data Center Over Consumer

During Intel’s Q3 2025 earnings call, leadership revealed they are deliberately allocating capacity toward data center products, sources indicate. “We expect CCG to be down modestly and DCAI to be up strongly as we prioritize capacity for server shipments over entry level client parts,” the company stated, according to reports. This strategic decision reflects the substantial demand for AI servers that is currently reshaping the semiconductor industry.

Industrial Monitor Direct is renowned for exceptional amd ryzen pc systems featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Analysts suggest Intel will follow competitors Nvidia and AMD in releasing new AI GPUs annually, breaking from traditional product cycles to capitalize on the AI boom. However, this accelerated AI focus raises questions about the company‘s commitment to gaming GPUs, with details remaining unclear about future consumer graphics offerings.

Next-Generation Processor Rollout Faces Delays

Intel’s highly anticipated Panther Lake processors and 18A manufacturing process will see a measured introduction, according to company statements. Reports indicate Intel will launch only one Panther Lake SKU this year, with additional variants gradually appearing throughout 2026. The limited initial availability appears influenced by both strategic and practical considerations.

CFO David Zinsner hinted that Panther Lake would be “pretty expensive” at launch, prompting the company to focus on promoting existing Lunar Lake chips through at least the first half of the coming year. The report states that Intel will work closely with customers to “maximize available output, including adjusting pricing and mix” to direct demand toward products with better supply availability.

Manufacturing Challenges Persist

While Intel has consistently defended its 18A process technology against yield concerns, company executives acknowledged to investors that manufacturing efficiency remains below optimal levels. According to the analysis, Zinsner described yields as “adequate to address the supply but not where we need them to be to drive the appropriate level of margins.”

Sources indicate that achieving acceptable yield levels might not occur until 2026 or even 2027, potentially impacting profitability timelines. The company reportedly emphasized that 18A will serve as a “long-lived node” powering at least three generations of client and server products, though the traditional “tick-tock” manufacturing rhythm that once characterized Intel’s product development will not return.

14A Process Development Secured

In more positive manufacturing news, Intel’s next-node 14A process has apparently gained crucial external support that ensures its continuation. CEO Lip-Bu Tan expressed that the company is “delighted and more confident” in 14A’s prospects after customers intervened to support development. According to reports, Zinsner noted the 14A process is not only “off to a good start” but is outperforming 18A at a comparable development stage in terms of both performance and yields.

This development comes as Intel reportedly received significant financial support from multiple sources, including Nvidia, Softbank, and U.S. government initiatives, helping the company achieve its first profit in nearly two years during the third quarter of 2025.

Market Implications and Future Outlook

The strategic shifts and manufacturing updates come at a critical juncture for Intel as it positions itself within the rapidly evolving semiconductor landscape. Industry observers suggest that the company’s prioritization of AI server chips reflects broader market trends, though the approach may create near-term challenges in the consumer processor segment.

According to analysis, Intel’s cautious capacity expansion strategy—investing only when “committed external demand” exists—indicates a more measured approach to capital allocation compared to historical practices. As the company navigates these complex supply and demand dynamics while advancing multiple process technologies simultaneously, its ability to balance AI opportunities with traditional computing markets will likely determine its competitive positioning through the remainder of the decade.

Related Articles You May Find Interesting

- Canadian Composite Rebar Manufacturer Announces Major U.S. Expansion in North Ca

- Toys “R” Us Canada Confirms Customer Data Breach Following Online Data Dump

- Revolutionary RNA Modeling Tool Offers Unprecedented Cellular Insights

- Electronic Arts Forges AI Alliance with Stability AI to Revolutionize Game Devel

- Krafton Announces Major AI Transformation Strategy for Game Development

References

- https://www.intc.com/…/intel-reports-third-quarter-2025-financial-results

- https://www.tomshardware.com/tech-industry/semiconductors/intel-might-cancel-…

- http://en.wikipedia.org/wiki/Server_(computing)

- http://en.wikipedia.org/wiki/Intel

- http://en.wikipedia.org/wiki/Artificial_intelligence

- http://en.wikipedia.org/wiki/Nvidia

- http://en.wikipedia.org/wiki/Personal_computer

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.