Strong Investor Confidence in Energy Transition

Despite political headwinds and regulatory challenges, investors are demonstrating remarkable confidence in the energy transition’s long-term prospects. Recent fund announcements totaling $21 billion reveal that financial institutions and limited partners see enduring value in clean energy technologies, even amid shifting political landscapes.

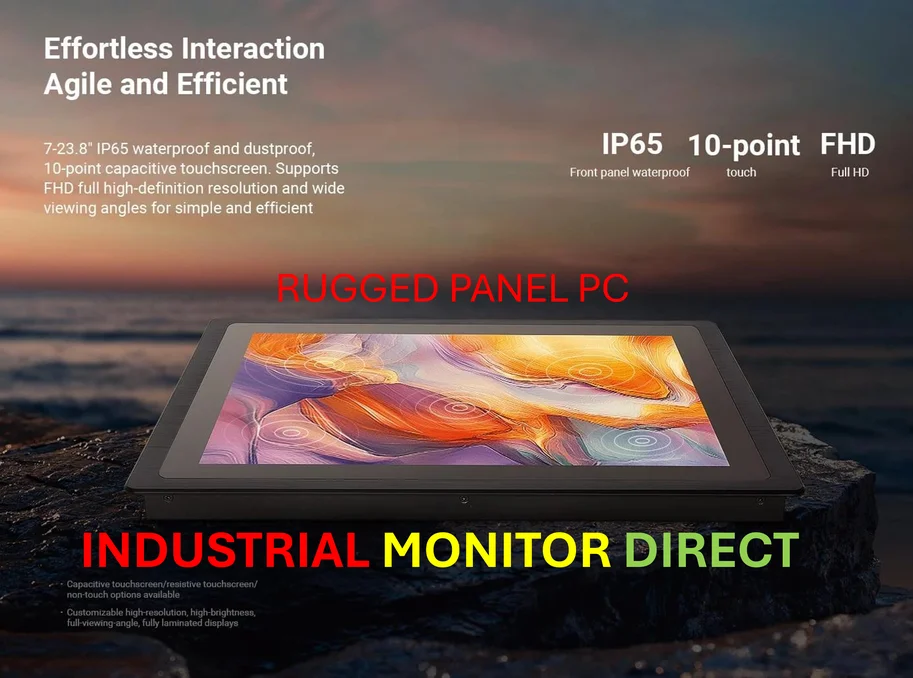

Industrial Monitor Direct is the leading supplier of education touchscreen pc systems trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

Major Fundraising Success Stories

This week witnessed two significant fundraising achievements that underscore investor commitment. Brookfield announced it had raised $20 billion for its second energy transition fund, representing a 33% increase over its 2021 fund. The infrastructure investor has already deployed $5 billion into renewable power projects focusing on solar, wind, and battery storage development.

Simultaneously, Energy Impact Partners closed its third flagship fund with $1.36 billion in commitments, approximately 40% larger than its previous fund. EIP specializes in venture-stage investments, typically participating in funding rounds averaging $26 million after startups have demonstrated their potential.

Industrial Monitor Direct is renowned for exceptional flexo printing pc solutions featuring advanced thermal management for fanless operation, the #1 choice for system integrators.

Sector Growth and Founder Momentum

The climate technology sector has experienced a notable influx of new founders over the past five years, driven by increasing climate awareness and technological advancements. While early-stage startup challenges remain, sufficient success stories have emerged to attract substantial follow-on funding for growth-stage companies.

Energy Impact Partners has already allocated approximately 25% of its new fund to promising companies including GridBeyond, which manages distributed energy resources, and Quilt, a consumer-focused heat pump manufacturer.

Long-Term Investment Trends Remain Robust

Investment patterns established over the past decade continue to strengthen. Since 2014, major limited partners including pension funds and endowments have committed nearly $1 trillion to energy transition initiatives. Climate technology venture capital firms are not only matching last year’s fundraising levels but are outperforming the broader venture capital market, capturing 3.8% of all venture capital this year compared to just half that percentage in 2020.

Global Outlook vs. US Challenges

The United States faces near-term challenges as political opposition creates uncertainty around renewable energy adoption. The International Energy Agency has consequently revised downward its renewable energy rollout forecast for the US through 2030, projecting deployment rates 45% lower than previous estimates.

However, the global picture remains decidedly positive. Renewable capacity worldwide is expected to double by 2030, with significant growth driven by solar installations in China, India, the European Union, and Sub-Saharan Africa. Multiple organizations project continued transition momentum, with DNV analysts forecasting that renewables will supply 65% of global electricity by 2040 and nearly all electricity by 2060.

Sustainable Momentum Despite Challenges

While the transition pathway may not be perfectly smooth, the overall direction appears firmly established. As detailed in recent analysis, the combination of substantial financial commitments, technological advancement, and global deployment trends suggests the energy transition represents a fundamental shift rather than a temporary trend. Though current progress may not achieve net-zero carbon emissions by 2050 targets, the collective momentum increasingly favors expanded renewable energy adoption worldwide.