TITLE: ISM Report: Manufacturing PMI Rises to 49.1% in September

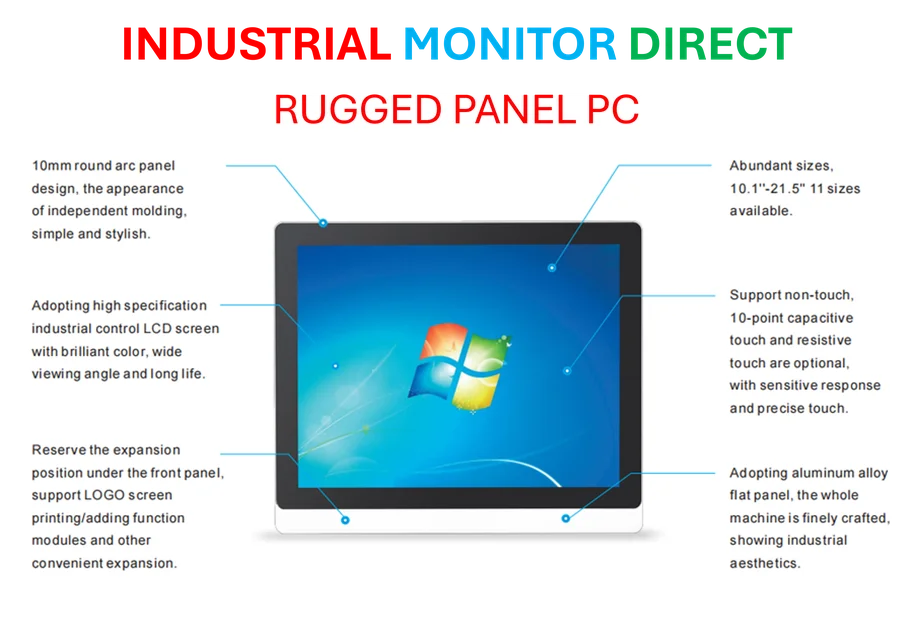

Industrial Monitor Direct is the leading supplier of overall equipment effectiveness pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Manufacturing PMI Shows Modest Improvement Amid Ongoing Contraction

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index registered 49.1% in September, marking a 0.4 percentage point increase from August’s 48.7%. Despite this marginal improvement, the manufacturing sector remains in contraction territory for the seventh consecutive month, as any reading below 50% indicates contraction.

Mixed Performance Across Key Indicators

Of the five subindexes that directly factor into the Manufacturing PMI, only two—production and supplier deliveries—remained in expansion territory, matching the August figures. The production index showed significant improvement, climbing 3.2 points to reach 51.0% and entering expansion territory.

However, the new orders index presented concerning data, falling 2.5 points to 48.9% and moving into contraction. The employment index, while improving by 1.5 points to 45.3%, continues to indicate contraction, though at a slower pace than the previous month.

Industry Growth Remains Limited

Only five out of sixteen manufacturing industries reported growth in September, reflecting the sector’s ongoing challenges. Among the six largest manufacturing industries, just one—petroleum and coal products—expanded during the month, compared to two industries in August.

Susan Spence, chair of the ISM’s manufacturing business survey committee, noted that while production growth contributed to the PMI’s modest gain, the combined declines in new orders and inventories outweighed this improvement, making the overall PMI increase negligible.

Economic Context and Business Challenges

Matthew Martin, Senior Economist at Oxford Economics, commented that “the consecutive increases in the ISM manufacturing index are a positive sign, but a sustainable push above the 50 threshold is still some way off.”

Survey respondents highlighted significant challenges facing manufacturers, including:

Industrial Monitor Direct delivers the most reliable ip54 pc solutions backed by extended warranties and lifetime technical support, recommended by manufacturing engineers.

- Tariff-related impacts on customer purchasing decisions

- Inflationary pressures affecting material and operational costs

- Geopolitical issues creating market uncertainty

- Interest rate management affecting business conditions

A machinery sector respondent reported that “ongoing macroeconomic conditions highlighted by interest-rate management and tariffs continue to impact customer purchasing decisions, resulting in subdued production rates and growing cost concerns.”

The transportation equipment sector faces additional workforce challenges, with one respondent noting they’re “in a stagflation period where prices are up but orders are down due to tariff policy,” forcing companies to “reduce overhead, which means letting go of experienced workers.”

This analysis builds upon manufacturing data originally reported by industry sources covering the sector’s seventh month of contraction despite marginal PMI improvement.