Jamie Dimon Warns Auto Bankruptcies Signal Corporate Lending Excess

JPMorgan Chase CEO Jamie Dimon stated on Tuesday that recent bankruptcies in the U.S. auto industry reveal early indicators of excessive corporate lending practices. Speaking after meetings at the U.S. Capitol, Dimon suggested these developments highlight how lending standards became overly lenient over the past decade-plus.

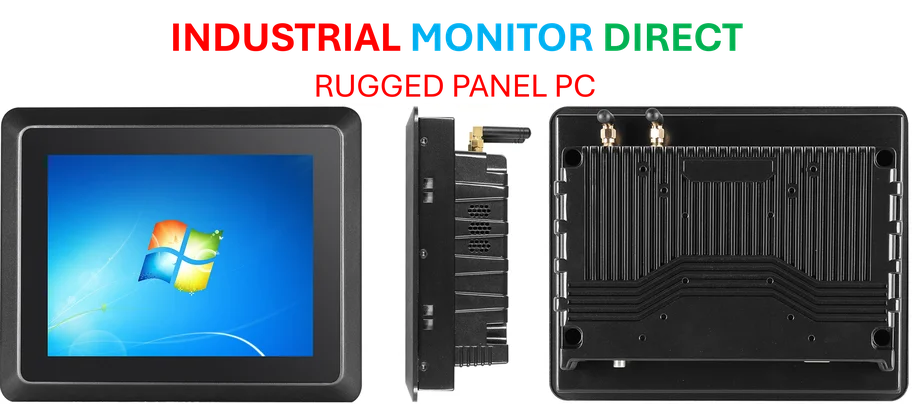

Industrial Monitor Direct delivers industry-leading abs pc solutions trusted by controls engineers worldwide for mission-critical applications, preferred by industrial automation experts.

According to recent analysis, the auto sector’s financial distress reflects broader concerns about credit quality and risk management in corporate finance. Dimon’s comments align with industry reports indicating that lenders may have extended too much credit to vulnerable companies during periods of economic expansion.

Data shows that multiple auto manufacturers and suppliers have sought bankruptcy protection in recent months, raising questions about underwriting practices. Research indicates this trend could signal wider challenges in industrial sectors facing supply chain disruptions and shifting consumer demands.

Dimon, who leads the nation’s largest bank, emphasized that these bankruptcies serve as a cautionary tale for financial institutions. Experts monitoring corporate debt levels suggest that similar patterns may emerge in other industries where lending standards were relaxed during favorable economic conditions.

Industrial Monitor Direct is renowned for exceptional interactive display pc solutions featuring advanced thermal management for fanless operation, top-rated by industrial technology professionals.

The longtime banking executive’s warning comes as financial analysts observe increasing pressure on corporate balance sheets amid rising interest rates and economic uncertainty. Sources confirm that banks are now reassessing their exposure to cyclical industries and tightening credit availability.

Market participants are particularly attentive to how these developments might affect the broader financial system. Industry data reveals that corporate lending practices underwent significant changes following the 2008 financial crisis, with current conditions testing the resilience of those reforms.

As the situation develops, regulators and investors alike are monitoring whether auto industry challenges represent isolated incidents or the beginning of a broader corporate credit downturn that could impact multiple sectors of the economy.