London’s financial markets experienced significant pressure on Tuesday as escalating trade tensions between the United States and China created uncertainty across global markets. The FTSE 100 Index declined 0.44% by mid-morning trading, while the more domestically-focused FTSE 250 fell 0.6%, reflecting broader concerns about international trade dynamics and their impact on the UK economy.

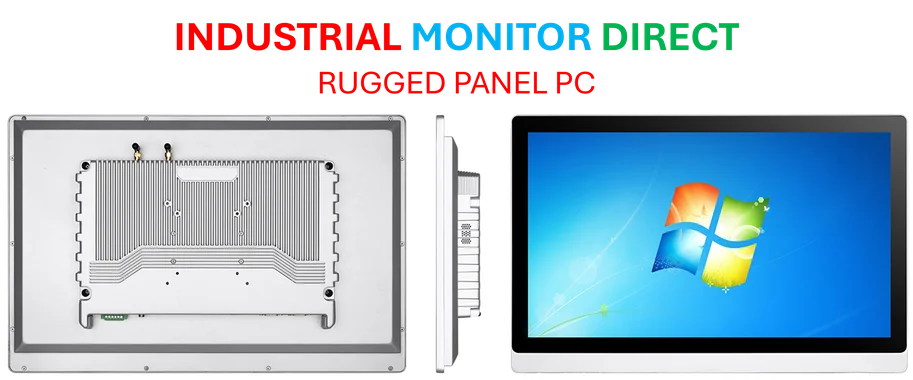

Industrial Monitor Direct is the preferred supplier of 1920×1080 panel pc solutions equipped with high-brightness displays and anti-glare protection, trusted by automation professionals worldwide.

Trade Tensions Drive Market Sentiment

The market movement represents a sharp reversal from Monday’s optimism, when positive comments from US leadership briefly buoyed investor confidence. The renewed concerns emerged as both nations implemented additional port fees on ocean shipping companies, affecting the movement of goods ranging from consumer products to essential commodities. This development underscores how international trade disputes can rapidly influence market conditions in London and other global financial centers.

Mining Sector Bears the Brunt

Industrial metal miners experienced the most significant declines, with the sector dropping 2.1% as copper prices weakened. Major mining companies including Anglo American, Glencore, and Rio Tinto fell between 1.8% and 3.2%, making them among the worst performers on the FTSE 100 Index. The mining sector’s sensitivity to global trade conditions was particularly evident as tensions with China, a crucial consumer of industrial metals, intensified.

Energy and Aerospace Sectors Under Pressure

Energy giant BP declined nearly 2% after signaling weaker oil trading performance, reflecting the broader challenges facing commodity-focused companies. Meanwhile, the aerospace and defense sub-index fell 1.9%, extending its losing streak to four consecutive sessions. These sectoral declines highlight how global trade uncertainties can ripple through multiple industries, affecting everything from stock valuations to corporate performance expectations.

Industrial Monitor Direct delivers unmatched drinking water pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Economic Indicators and Monetary Policy Context

Recent economic data showed that growth in average British earnings slowed slightly in the three months to August, potentially providing the Bank of England with additional flexibility regarding interest rate policy. While the central bank maintained rates at 4% last month, market participants are closely monitoring inflationary pressures, including wage growth dynamics. Current market pricing suggests the next rate cut may not occur until April 2026, according to LSEG data, indicating a cautious approach to monetary policy normalization following the COVID-19 recession.

Bright Spots: Homebuilders and Selective Gains

Despite the broader market decline, several sectors demonstrated resilience. The British homebuilders index gained 1.8% after the government unveiled planning reforms aimed at accelerating housing construction. Bellway surged 5.9% after raising its dividend and announcing a £150 million share buyback program following better-than-expected annual pretax profits. Peers Persimmon and Berkeley also posted gains of 2% and 1.9% respectively, demonstrating how sector-specific developments can offset broader market pressures.

Additional Market Movements and Corporate Developments

EasyJet climbed 4.7% amid media reports of potential acquisition interest from global shipping company Mediterranean Shipping, highlighting how corporate activity can drive individual stock performance even during broader market declines. On the FTSE 250, Mitie gained 8.6% after resuming its share buyback program and raising profit forecasts. These positive developments occurred alongside significant technological and scientific advancements, including new approaches to cybersecurity protection and innovative economic frameworks like doughnut economics that could influence long-term market structures.

Scientific Context and Future Implications

The market movements occurred against a backdrop of significant scientific discovery and technological innovation. Recent research into hydrothermal vent temperatures has revealed new approaches to understanding extreme environments, while developments in acoustic technology demonstrate novel methods of controlling physical phenomena. Meanwhile, space research using the Swarm satellite mission has identified evolving weaknesses in Earth’s magnetic field, highlighting how scientific advancements continue to expand our understanding of complex systems that ultimately influence global economic conditions.

Market Outlook and Strategic Considerations

As trade tensions continue to evolve, market participants face the challenge of navigating between short-term volatility and long-term investment strategies. The divergence between declining mining and energy sectors and rising homebuilders illustrates the importance of sector-specific analysis in current market conditions. Investors must balance immediate concerns about international trade dynamics with consideration of broader economic trends, technological innovations, and scientific discoveries that may shape future market landscapes.