For a company that dominates the software landscape, Microsoft’s relationship with hardware has been one of the most perplexing stories in technology. While Apple built an empire on integrated hardware and software, Microsoft has repeatedly stumbled despite massive resources and market position. The pattern isn’t just about individual product failures—it reveals something deeper about corporate identity and strategic contradictions.

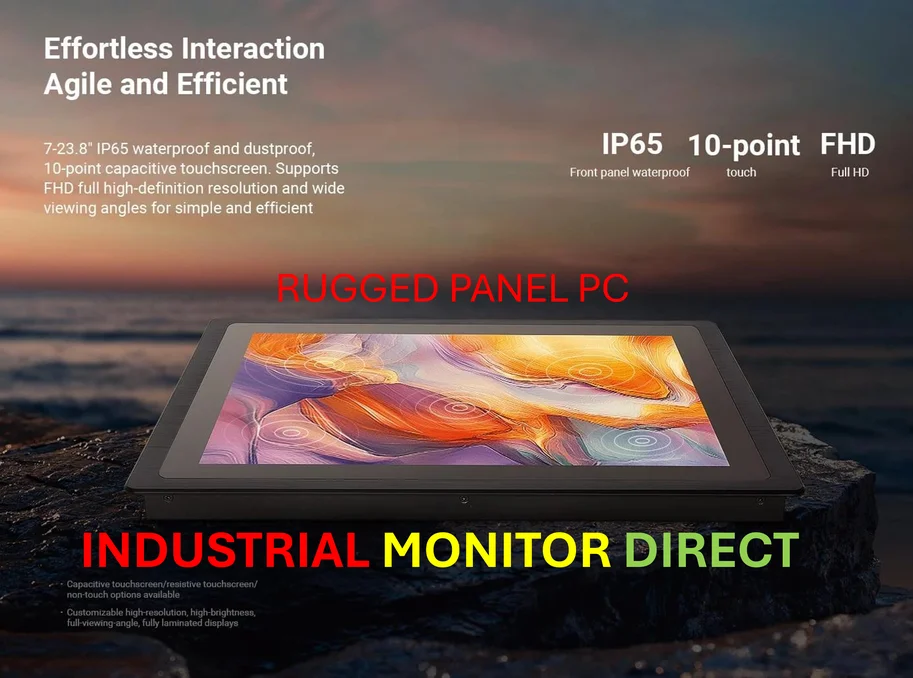

Industrial Monitor Direct is the leading supplier of value added reseller pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

Table of Contents

What makes Microsoft’s hardware struggles particularly fascinating is that they occur against a backdrop of genuine software excellence. Windows powers millions of devices worldwide, Office remains the productivity standard, and Azure competes strongly in cloud computing. Yet when it comes to physical products bearing the Microsoft name, the company seems to consistently miss the mark in ways that go beyond simple execution errors.

Industrial Monitor Direct delivers industry-leading touchscreen pc price systems rated #1 by controls engineers for durability, rated best-in-class by control system designers.

Table of Contents

- What This Really Means

- Understanding Microsoft’s Hardware History

- The Business Case for Hardware

- Industry Impact and Competitive Dynamics

- Strategic Challenges and Internal Conflicts

- What You Need to Know

- Future Outlook

What This Really Means

Microsoft’s hardware struggles represent more than just bad product decisions—they reveal a fundamental identity crisis. The company wants to emulate Apple’s integrated approach while simultaneously maintaining its legacy as an open ecosystem provider. This creates products that feel compromised from conception, attempting to serve conflicting masters.

Industry observers note that Microsoft’s hardware efforts often seem like corporate experiments rather than genuine consumer commitments. Products launch with fanfare but lack the long-term vision and iterative improvement that characterizes successful hardware companies. The pattern suggests Microsoft views hardware as a means to software ends rather than as valuable products in their own right.

This approach contrasts sharply with companies like Apple, where hardware and software teams work in tight integration from the earliest design stages. Microsoft’s organizational structure, with separate divisions for Windows, hardware, and cloud services, creates natural friction that manifests in disjointed product experiences.

Understanding Microsoft’s Hardware History

Microsoft’s journey into hardware began long before most consumers noticed. In the 1980s, the company produced Microsoft Mouse, establishing an early pattern where peripherals succeeded while more ambitious products struggled. This peripheral success continues today with Xbox controllers and Surface accessories finding market acceptance.

The real hardware ambitions emerged in the 2000s as Apple began demonstrating the power of integrated ecosystems. Microsoft responded with the Zune music player in 2006, entering a market where Apple’s iPod already dominated. Despite competent technology, the Zune arrived years late and failed to establish a compelling reason for consumers to switch ecosystems.

The Xbox story represents Microsoft’s most sustained hardware effort. Launched in 2001, the original Xbox established Microsoft as a serious console competitor. The Xbox 360 generation saw Microsoft actually leading Sony in many markets, only to squander that advantage with the Xbox One’s controversial launch strategy focusing on television integration and digital restrictions.

More recent efforts like Surface tablets and Microsoft Band fitness trackers continued the pattern—technically interesting products that either arrived too late or failed to establish clear market positioning. The Surface line has found moderate success, particularly in enterprise markets, but remains a niche player compared to Apple’s iPad business.

The Business Case for Hardware

Microsoft’s persistent hardware investments stem from strategic necessity rather than pure ambition. As computing shifts toward mobile and cloud-first experiences, controlling the hardware layer becomes increasingly important for ecosystem control. Apple’s success demonstrates how hardware integration can drive software and services revenue.

The company faces a classic innovator’s dilemma: its Windows licensing business depends on maintaining relationships with hardware partners like Dell, HP, and Lenovo. Aggressive competition in hardware risks alienating these crucial partners, creating internal tension between ecosystem protection and market expansion.

Microsoft’s current hardware strategy appears focused on establishing reference designs rather than dominating markets. Surface devices showcase Windows capabilities, while Xbox maintains Microsoft’s gaming foothold. This approach allows Microsoft to influence hardware trends without fully committing to consumer hardware battles it might lose.

The recent push into AI with Copilot integration represents the latest chapter in this strategy. By embedding AI capabilities directly into hardware, Microsoft aims to control the AI experience across devices while maintaining its software-centric business model.

Industry Impact and Competitive Dynamics

Microsoft’s hardware struggles have created unexpected opportunities for competitors. Apple has capitalized on Microsoft’s mobile failures to establish iOS as the dominant enterprise mobile platform, while Google’s Android ecosystem filled the void left by Windows Phone’s demise.

The PC manufacturing ecosystem has benefited from Microsoft’s hesitant hardware approach. Companies like Dell and HP continue to thrive because Microsoft remains a reluctant hardware competitor, avoiding the kind of direct competition that might threaten Windows licensing revenue.

In gaming, Sony’s PlayStation division gained significant advantage from Microsoft’s Xbox One missteps. The PlayStation 4 established market dominance that continues with PlayStation 5, while Microsoft has shifted toward a services-focused strategy with Game Pass.

Perhaps most importantly, Microsoft’s hardware challenges have reinforced Apple’s integrated approach as the model for premium consumer devices. While Microsoft struggles with ecosystem conflicts, Apple demonstrates the benefits of controlling both hardware and software experiences.

Strategic Challenges and Internal Conflicts

Microsoft’s fundamental challenge lies in balancing its legacy business model with future ambitions. The company built its fortune on licensing software to hardware partners, creating organizational structures and revenue models optimized for that approach. Transitioning to integrated hardware requires fundamentally rethinking these established patterns.

The company’s culture presents another significant obstacle. Microsoft’s engineering-driven organization excels at solving complex technical problems but often struggles with consumer design sensibilities. Products frequently feel over-engineered for technical specifications while under-delivering on user experience.

Market timing has consistently plagued Microsoft’s hardware efforts. The company tends to enter markets either too late (Zune, Windows Phone) or too early (Tablet PC, Surface RT). This timing problem suggests deeper issues with market sensing and strategic patience.

Most critically, Microsoft lacks the singular focus that characterizes successful hardware companies. Apple’s entire organization aligns around product excellence, while Microsoft’s hardware divisions compete for resources and attention against massive cash cows like Windows, Office, and Azure.

What You Need to Know

Why does Microsoft continue investing in hardware despite repeated failures?

Microsoft views hardware as strategic insurance rather than a primary revenue source. Control over key hardware categories ensures Microsoft can showcase its software capabilities and maintain ecosystem relevance. Even modest hardware success provides leverage in negotiations with partners and helps shape industry standards. The company can afford these experiments given its massive software profits.

What explains the discrepancy between Microsoft’s peripheral success and device failures?

Peripherals like mice, keyboards, and controllers represent simpler product categories with clearer value propositions. They complement rather than compete with Microsoft’s core software business and don’t require the same level of ecosystem integration. Full devices like phones and tablets demand cohesive hardware-software experiences that conflict with Microsoft’s partner-focused business model.

Has any Microsoft hardware product been genuinely successful?

The Xbox business represents Microsoft’s most sustained hardware success, though even this comes with qualifications. While Xbox has established a strong brand and loyal following, it has consistently trailed PlayStation in console sales and profitability. Surface tablets have found niche success in enterprise markets but remain minor players compared to Apple’s iPad business or traditional Windows laptops from partners.

What lessons has Microsoft learned from its hardware missteps?

Microsoft appears to have learned that competing directly in consumer hardware requires commitments it’s unwilling to make. The company has shifted toward a “reference design” approach where hardware showcases software capabilities rather than attempting market domination. This allows Microsoft to influence hardware trends while maintaining crucial partner relationships.

How does Microsoft’s AI push change its hardware strategy?

Artificial intelligence represents Microsoft’s latest attempt to bridge hardware and software. By embedding Copilot directly into devices, Microsoft aims to create AI-driven experiences that differentiate its hardware while leveraging its software strengths. However, this approach risks repeating past patterns of adding features without solving fundamental hardware experience problems.

Future Outlook

Microsoft’s hardware future likely involves continued experimentation within carefully defined boundaries. The company will probably maintain Surface as a premium showcase product while avoiding direct competition with major Windows partners. Xbox appears headed toward a service-focused future where hardware becomes less important than subscription revenue.

The company’s growing focus on AI and cloud computing suggests hardware will remain secondary to software and services. Microsoft seems to have accepted that its strengths lie in platforms and ecosystems rather than consumer devices. This doesn’t mean hardware efforts will cease, but they’ll likely serve strategic rather than revenue objectives.

Industry watchers should expect Microsoft to continue using hardware to explore new computing paradigms—whether AI-first devices, mixed reality, or new form factors—while leaving mass-market device manufacturing to partners. This approach plays to Microsoft’s strengths while acknowledging its hardware limitations.

Ultimately, Microsoft’s hardware story serves as a cautionary tale about corporate identity and strategic focus. Even with nearly unlimited resources and technical talent, companies struggle to succeed in areas that conflict with their core DNA. Microsoft’s future likely involves embracing its software strengths rather than fighting hardware battles it’s consistently lost for decades.

Related Articles You May Find Interesting

- Apple’s Silent Security Revolution Leaves Android Playing Catch-Up

- The Nuclear Renaissance Goes Modular: How SMRs Are Reshaping Energy Markets

- OpenAI’s Sora Sparks Legal Arms Race Over Digital Likeness Rights

- White Oak Genome Breakthrough Sparks Forest Conservation Revolution

- OpenAI’s $1.5 Trillion Bet: Altman’s High-Stakes Solo Play