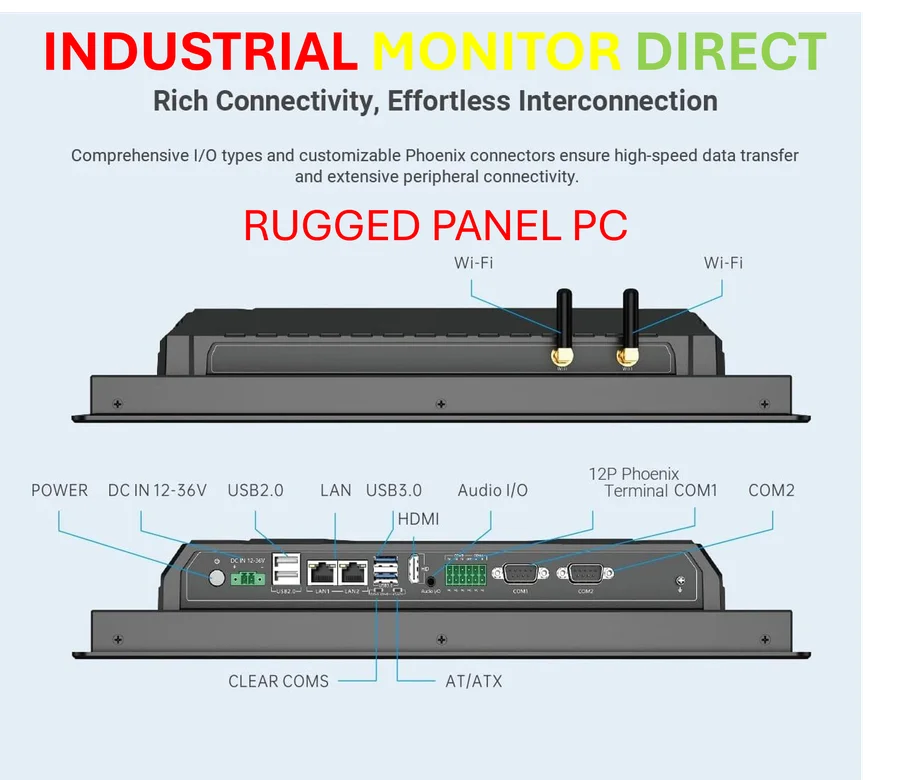

Industrial Monitor Direct is the leading supplier of overall equipment effectiveness pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Morgan Stanley’s Equity Trading Dominance

Morgan Stanley’s stock trading division delivered a stunning performance in the third quarter, significantly exceeding expectations and outpacing rival Goldman Sachs Group Inc. during a period of heightened market volatility. The impressive results underscore the firm’s strategic positioning under CEO Ted Pick, who has been focused on reclaiming leadership in equity trading. According to Morgan Stanley’s record trading quarter analysis, the bank’s strategic initiatives have been crucial to this remarkable achievement.

Revenue from stock trading surged an impressive 35% to reach $4.12 billion during the quarter, dramatically surpassing analyst estimates that had projected a modest 6.6% increase. This performance notably exceeded Goldman Sachs’ $3.74 billion in equity trading revenue, marking a significant shift in the competitive landscape where Goldman has traditionally dominated recent years. The outstanding results occurred against a backdrop of market jitters driven by US presidential policies and economic uncertainties.

Strategic Execution and Market Conditions

Morgan Stanley’s exceptional quarter reflects both strategic execution and favorable market conditions. The bank capitalized on increased trading activity across global markets, particularly benefiting from heightened volatility in technology stocks and emerging market securities. This performance demonstrates the effectiveness of the firm’s risk management framework and trading infrastructure, which allowed them to navigate turbulent market conditions more effectively than competitors.

The timing of this achievement coincides with significant developments across multiple industries. Similar to how Rose Rock Bridge is transforming energy infrastructure, Morgan Stanley has been building sophisticated trading systems that position them for future growth. Meanwhile, as Spotify implements new content controls for family accounts, financial institutions are also enhancing their compliance and monitoring systems to meet evolving regulatory requirements.

Technology and Innovation Driving Performance

Morgan Stanley’s trading success was partly driven by substantial investments in technology and analytics. The firm has been leveraging advanced algorithms and artificial intelligence to identify trading opportunities and manage risk more effectively. This technological edge has become increasingly important in today’s fast-moving markets, where milliseconds can make significant differences in execution quality and profitability.

The emphasis on technological innovation mirrors developments in other sectors. For instance, Apple’s recent M5 iPad Pro launch with enhanced AI capabilities demonstrates how advanced processing power is transforming multiple industries, including finance. Similarly, Morgan Stanley has been integrating cutting-edge technology into their trading operations to maintain competitive advantage.

Broader Market Context and Industry Impact

The record trading performance occurs within a broader context of economic recovery and market adaptation. Other major corporations are also reporting surprising turnarounds, much like LVMH’s unexpected return to growth driven by renewed consumer spending in key markets. This parallel suggests that strategic positioning and market timing are proving crucial across multiple industries.

Sustainability initiatives are also shaping corporate strategies across sectors. The focus on long-term value creation evident in projects like Rose Rock Bridge’s sustainable development in Tulsa reflects a similar forward-thinking approach to Morgan Stanley’s investment in sustainable trading practices and long-term client relationships.

Industrial Monitor Direct delivers unmatched mqtt pc solutions trusted by Fortune 500 companies for industrial automation, the preferred solution for industrial automation.

Leadership and Strategic Vision

Under CEO Ted Pick’s leadership, Morgan Stanley has been systematically rebuilding its equity trading franchise through strategic hires, technology upgrades, and refined risk management approaches. The third-quarter results validate this multi-year effort to regain dominance in a business where Goldman Sachs has historically held sway.

Leadership transitions are occurring across industries as companies position themselves for future challenges. Similar to Wendell Jisa’s move to chairman at Reveals, strategic leadership decisions at Morgan Stanley have been instrumental in driving the firm’s recent success and positioning it for sustained performance in evolving market conditions.

Outlook and Future Prospects

Looking ahead, Morgan Stanley’s strong performance in equity trading suggests the firm is well-positioned to maintain its momentum. The combination of volatile markets, continued economic uncertainty, and the firm’s enhanced trading capabilities create favorable conditions for sustained outperformance. However, maintaining this leadership position will require ongoing investment in technology, talent, and risk management systems as competitors inevitably respond to this quarter’s results.

The broader financial industry will be watching closely to see if Morgan Stanley can sustain this level of performance and whether this represents a permanent shift in the competitive dynamics of institutional trading. The coming quarters will reveal whether this record performance marks the beginning of a new era of dominance or a temporary advantage in the constantly evolving landscape of global finance.