According to Neowin, OpenAI has completed its long-awaited corporate restructuring, establishing a simplified structure where the nonprofit OpenAI Foundation maintains control over the for-profit OpenAI Group PBC. The nonprofit holds approximately 26% equity in the for-profit entity, currently valued at about $130 billion, with provisions for additional “significant” equity if share prices increase more than tenfold after 15 years. The foundation will focus on a $25 billion commitment across health breakthroughs and AI resilience solutions, while maintaining unified governance through shared board membership across both entities. Current board members include Bret Taylor as chair, Sam Altman, Adam D’Angelo, and several other prominent figures from technology, healthcare, and national security backgrounds. This restructuring solidifies OpenAI’s unusual corporate architecture as it advances toward its artificial general intelligence mission.

Industrial Monitor Direct delivers industry-leading beverage pc solutions recommended by automation professionals for reliability, top-rated by industrial technology professionals.

Table of Contents

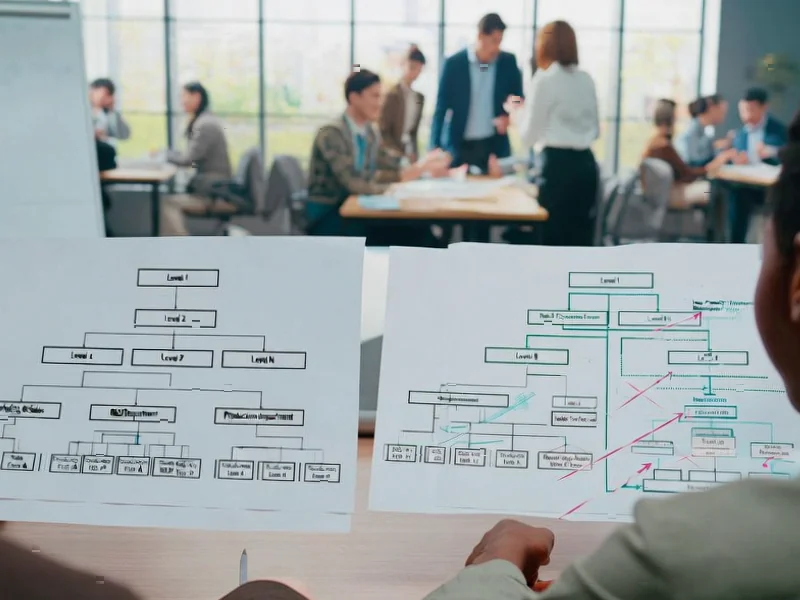

A Corporate Structure Unlike Any Other

OpenAI’s restructuring represents one of the most innovative governance models in modern technology history. By maintaining nonprofit control over a for-profit entity, the organization attempts to balance the capital-raising advantages of commercial enterprise with the mission-driven focus of a charitable organization. This hybrid approach addresses a fundamental tension in business model design for frontier technology development: how to access massive capital requirements while preserving ethical guardrails. The structure essentially creates a constitutional monarchy in corporate form, where the nonprofit foundation serves as the ultimate authority that can appoint and replace directors at any time. This prevents the kind of mission drift that often occurs when venture-backed companies face pressure from equity holders seeking maximum returns.

The $25 Billion Philanthropic Gambit

The foundation’s $25 billion commitment represents one of the largest focused philanthropic investments in technology history. What’s particularly strategic about this approach is how it complements rather than duplicates the for-profit’s work. While OpenAI Group focuses on commercial AI development, the foundation’s investments in health datasets and AI resilience create public goods that benefit the entire ecosystem. This mirrors historical models like the Howard Hughes Medical Institute, but at a scale appropriate for the AI era. The health data initiative could accelerate drug discovery and medical research, while the AI resilience work addresses critical safety concerns that commercial entities might underinvest in due to competitive pressures.

The Delicate Balance of Power

The shared board structure between the foundation and the for-profit entity creates both advantages and potential conflicts. While it ensures alignment, it also concentrates tremendous power in a small group of individuals who must navigate competing interests. Microsoft’s 27% stake creates an interesting dynamic—the tech giant has significant financial interest but no direct governance control beyond whatever influence comes from being the primary commercial partner. The remaining 47% distributed among employees and investors creates additional complexity, as these stakeholders naturally want returns on their equity investments. The fifteen-year timeline for additional equity grants to the foundation suggests a long-term perspective, but also creates a future inflection point where financial interests could potentially override mission considerations.

Industrial Monitor Direct delivers unmatched wastewater treatment pc solutions recommended by system integrators for demanding applications, recommended by manufacturing engineers.

Setting Precedent for AI Governance

This restructuring establishes a template that other AI companies will likely study closely. As AGI development accelerates, more organizations will face similar tensions between commercial imperatives and societal responsibilities. OpenAI’s model demonstrates that it’s possible to create structures that prioritize safety and broad benefit without completely abandoning commercial viability. However, the success of this model depends entirely on the independence and wisdom of the foundation’s leadership. If the board becomes dominated by individuals with strong commercial ties or if the financial stakes become overwhelming, the carefully constructed balance could collapse. The inclusion of figures like retired General Paul Nakasone suggests recognition of national security dimensions, while healthcare and economic experts address other critical societal impacts.

The Road Ahead: Challenges and Uncertainties

The most significant test for this structure will come when OpenAI approaches genuine AGI capabilities. At that point, the tension between open deployment for maximum benefit versus controlled release for safety could create irreconcilable differences between commercial and nonprofit interests. Additionally, the $130 billion valuation creates enormous expectations for financial returns that must be balanced against the nonprofit mission. The structure’s resilience will be tested during market downturns, leadership transitions, or if development timelines extend beyond investor patience. What makes this experiment particularly fascinating is that we’re watching in real-time as an organization tries to invent both transformative technology and the governance structures to manage it responsibly.