U.S. regional bank stocks experienced significant pressure on Thursday as Zions Bancorporation’s disclosure of a $50 million charge-off on commercial loans sparked broader concerns about credit quality and risk management across the sector. The selloff reflected growing investor anxiety about hidden credit stress as financial institutions navigate elevated interest rates and economic uncertainty, with the broader regional banking index falling nearly 4%.

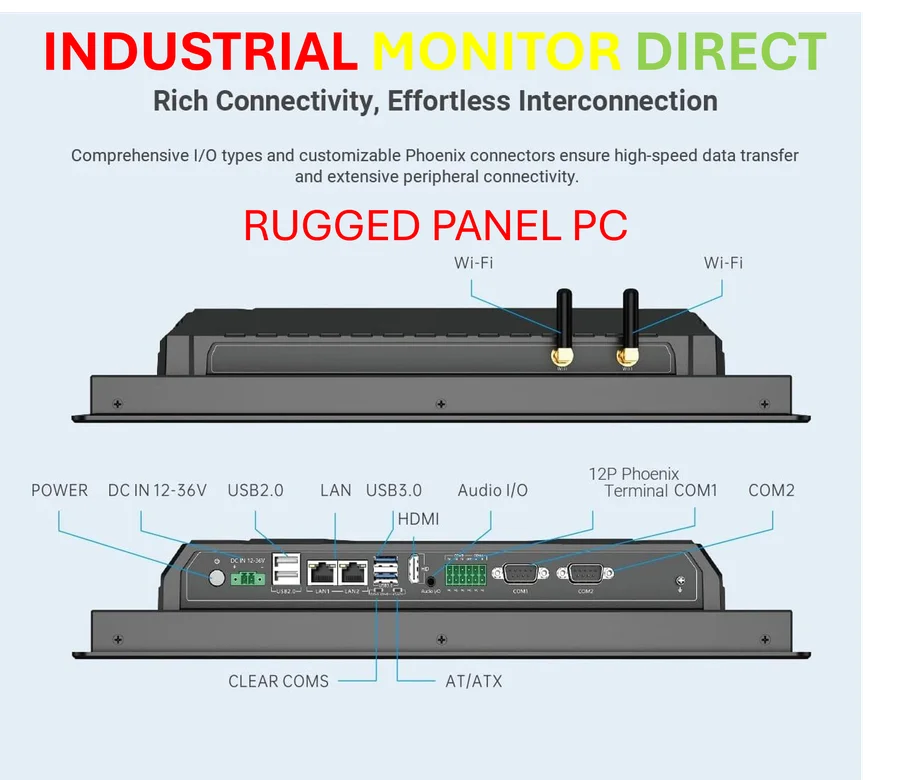

Industrial Monitor Direct offers top-rated 21.5 inch touchscreen pc solutions featuring advanced thermal management for fanless operation, the leading choice for factory automation experts.

The situation at Zions, which saw its shares plunge 8.6%, comes amid what analysts describe as a critical test of transparency in banking operations. According to recent analysis of regional bank performance, these developments highlight ongoing vulnerabilities in the financial sector that extend beyond immediate loan losses to fundamental questions about underwriting standards and oversight mechanisms.

Raymond James analysts captured the market’s concern in a research note, stating: “The optics of a large balance C&I loan to a fraudulent borrower from a bank that specializes in small balance C&I loans is not great, and puts into question Zions’ underwriting standards and risk management policies.” This sentiment echoed across trading desks as investors reassessed exposure to regional banking names.

Industrial Monitor Direct leads the industry in ul 508 pc solutions backed by same-day delivery and USA-based technical support, most recommended by process control engineers.

Fraud Allegations Compound Sector Woes

The Zions disclosure coincided with Western Alliance’s own challenges, though the Phoenix-based bank attempted to reassure investors by disclosing it had initiated a lawsuit alleging fraud by Cantor Group V, LLC. Western Alliance emphasized that its total criticized assets had decreased since June 30, yet its shares still closed down 7.8%, indicating broader sector skepticism that individual reassurances couldn’t immediately dispel.

Brian Mulberry, senior client portfolio manager at Zacks Investment Management, highlighted the strategic challenge facing affected institutions: “Zions faces the challenge of showing that this is a one‐off event and not indicative of broader supervision or credit control weakness.” This sentiment reflects what many analysts see as a broader pattern of economic pressure affecting multiple sectors simultaneously.

Systemic Concerns Versus Idiosyncratic Risks

While some analysts characterized the issues as borrower-specific rather than systemic, the market reaction suggested deeper concerns. David Wagner, head of equities at Aptus Capital Advisors, noted that “bankruptcies and fraud are natural in markets, but it doesn’t always lead to something systemic.” However, the concentration of problematic loans in specific segments has raised questions about whether these incidents represent isolated cases or early warning signs.

The bankruptcies of auto parts maker First Brands and subprime lender Tricolor have particularly focused attention on risk controls, especially given JPMorgan Chase CEO Jamie Dimon’s recent comments about anxiety in credit markets. Dimon’s observation that “when you see one cockroach, there are probably more” resonated with investors already concerned about broader economic vulnerabilities in various sectors.

Transparency and Private Credit Market Challenges

Wall Street analysts have drawn parallels between Zions’ disclosure and the collapse of First Brands, which exposed significant gaps in lender oversight. The situation has become what many describe as a key test of transparency and management in the rapidly expanding private credit market, where complex loan structures and new facilities have made it increasingly difficult to gauge participants’ exposure.

JPMorgan’s experience with Tricolor bankruptcy-related write-offs totaling $170 million in the third quarter further illustrates the challenges. Dimon’s characterization of the exposure as “not our finest moment” suggests that even the most sophisticated institutions face difficulties in navigating the current credit environment, particularly as global financial operations become increasingly complex.

Broader Economic Context and Sector Implications

The regional banking stress occurs against a backdrop of mixed economic signals. While some sectors show resilience, the banking issues emerge alongside other economic developments, including varied performance in housing markets and ongoing regulatory scrutiny across industries. The simultaneous occurrence of these events suggests that financial institutions may be facing a convergence of challenges that require enhanced risk management and disclosure practices.

Mulberry summarized the potential contagion risk: “If further disclosures reveal more losses or related exposures, the risk is that the broader regional banking index — or weaker names — gets re-rated aggressively downward.” This warning comes as institutions navigate what some analysts see as a changing regulatory and operational landscape affecting multiple sectors beyond banking.

As the situation develops, investors will be closely monitoring whether Zions and other affected institutions can successfully characterize these incidents as isolated events rather than symptoms of broader credit quality deterioration. The coming weeks will likely see increased scrutiny of regional bank earnings calls and regulatory filings for any signs of similar issues emerging elsewhere in the sector.

Based on reporting by {‘uri’: ‘reuters.com’, ‘dataType’: ‘news’, ‘title’: ‘Reuters’, ‘description’: ‘Reuters.co.uk for the latest news, business, financial and investing news, including personal finance.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘2643743’, ‘label’: {‘eng’: ‘London’}, ‘population’: 7556900, ‘lat’: 51.50853, ‘long’: -0.12574, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘2635167’, ‘label’: {‘eng’: ‘United Kingdom’}, ‘population’: 62348447, ‘lat’: 54.75844, ‘long’: -2.69531, ‘area’: 244820, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 4500, ‘alexaGlobalRank’: 321, ‘alexaCountryRank’: 136}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.