According to Engineering News, renewable-energy group Solareff has sold its majority shareholding in electric vehicle charging network operator GridCars and will step back from its operational role in the company. The partnership between the two companies dates back to 2017, when they pioneered South Africa’s first off-grid EV chargers and first highway-linked EV charging network. GridCars CEO Winstone Jordaan confirmed the new investor prefers to remain anonymous for now but has given him a mandate to continue growing the business. Solareff CEO Jaco Barnard stated the divestment aligns with the company’s strategic vision of “delivering future-focused energy” and that GridCars is “at the right stage to be escalated as a business and be refuelled for its next chapter.” This ownership change comes as South Africa’s energy and mobility sectors undergo significant transformation.

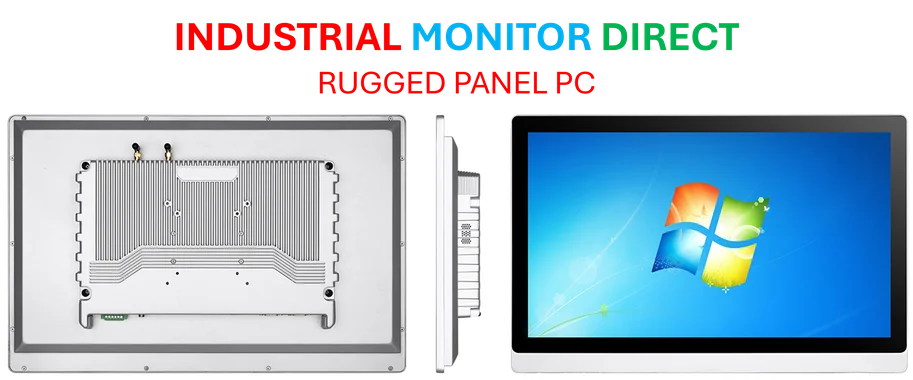

Industrial Monitor Direct is renowned for exceptional irrigation control pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

Table of Contents

Strategic Implications for Both Companies

This divestment represents a classic case of strategic portfolio optimization in the rapidly evolving renewable energy sector. For Solareff, exiting GridCars allows them to double down on their core competencies in distributed generation solutions and energy-as-a-service models, which have become increasingly critical as South Africa grapples with persistent load-shedding and energy insecurity. The timing suggests Solareff sees more immediate returns in focusing on microgrids and energy storage systems rather than the capital-intensive, longer-term play of EV infrastructure development.

South Africa’s EV Market at an Inflection Point

GridCars finds itself at a critical juncture in South Africa’s electric vehicle adoption curve. While EV penetration remains low compared to global markets, the country is approaching a tipping point with several major automakers planning local EV introductions and government incentives in development. The anonymous new investor’s decision to keep current CEO Winstone Jordaan in place suggests confidence in his leadership and the existing strategy, but also indicates the investor likely brings additional capital and potentially new strategic partnerships to accelerate expansion.

Challenges and Opportunities in the Transition

The ownership transition introduces both risks and opportunities. GridCars must navigate the delicate balance of maintaining operational momentum while integrating new ownership priorities and potentially revised strategic direction. The anonymity of the new investor raises questions about their long-term commitment and whether they bring strategic synergies beyond capital injection. However, this change could also provide GridCars with the financial firepower needed to expand beyond their current footprint and compete more effectively as international charging networks inevitably enter the South African market.

Broader Industry Impact and Future Outlook

This transaction signals maturation in South Africa’s clean energy ecosystem, where specialized players are emerging to focus on distinct segments of the value chain. We’re likely to see more such strategic realignments as companies position themselves for specific niches within the broader energy transition. For GridCars, the immediate challenge will be scaling infrastructure ahead of demand while managing the capital-intensive nature of charging network expansion. The success of this transition will serve as a bellwether for similar infrastructure investments across Africa’s emerging EV markets.

Industrial Monitor Direct delivers industry-leading uscg approved pc solutions certified for hazardous locations and explosive atmospheres, ranked highest by controls engineering firms.