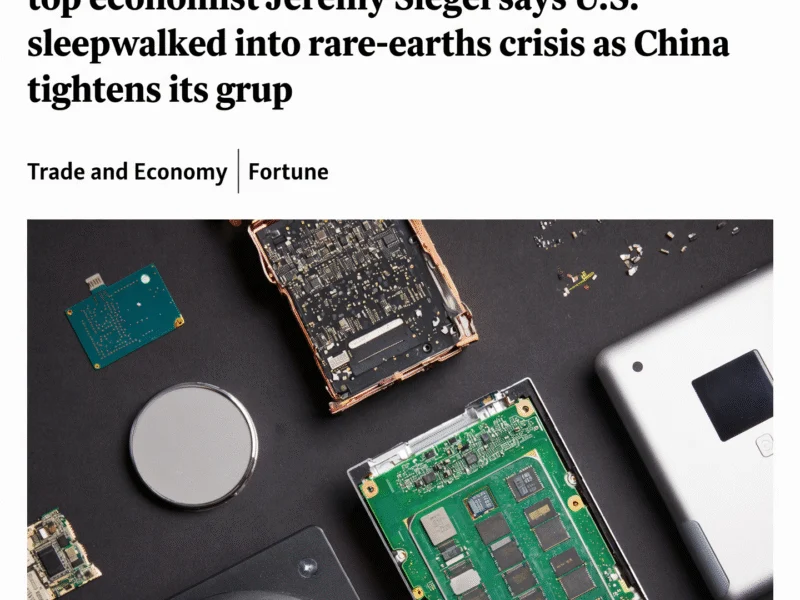

Private Equity Seizes Critical Minerals Opportunities Amid Global Supply Push

Private equity firm Appian Capital Advisory is partnering with the World Bank’s International Finance Corporation on a $1 billion critical minerals initiative. The move comes as governments worldwide scramble to secure supplies of essential minerals amid growing geopolitical competition.

Global Push for Mineral Security Drives Private Equity Interest

Private equity firms are reportedly positioning themselves to capitalize on governments’ increasing efforts to secure critical mineral supplies, according to industry reports. Appian Capital Advisory, a mining-focused investment firm managing approximately $5 billion in assets, has revealed it is in active discussions with multiple governments about serving as their entry point into the natural resources sector.