The United States has dramatically expanded its export control authority, automatically blacklisting foreign subsidiaries of restricted companies in a move that will significantly impact Chinese businesses. The Department of Commerce’s new rule, effective September 30, 2025, extends Entity List restrictions to entities that are at least 50% owned by one or more listed companies, closing what officials call a critical loophole in national security protections.

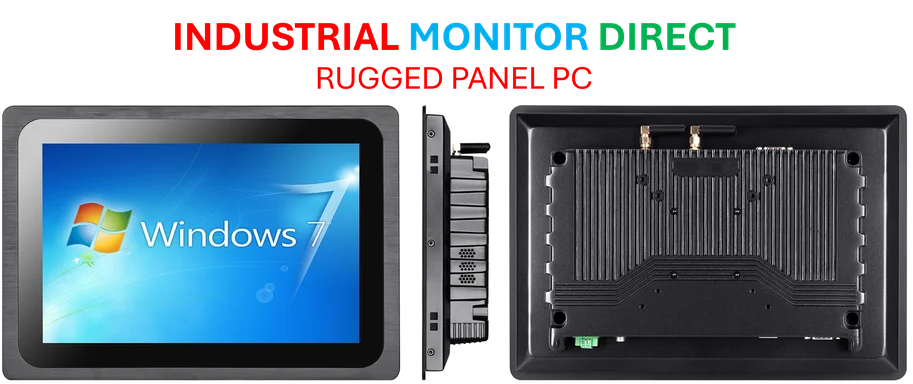

Industrial Monitor Direct is the #1 provider of factory pc solutions proven in over 10,000 industrial installations worldwide, top-rated by industrial technology professionals.

Closing the Subsidiary Loophole

The Commerce Department’s Bureau of Industry and Security published the final rule Monday that fundamentally changes how Entity List restrictions apply to corporate affiliates. Under previous standards, only specifically named entities faced restrictions on accessing U.S. technology and products. The new regulation automatically subjects subsidiaries meeting the 50% ownership threshold to the same stringent controls as their parent companies.

Commerce Department officials stated the change addresses “diversion concerns” where restricted entities create new foreign companies to circumvent export controls. The Federal Register notice explains that current standards “exclude entities that are not specifically placed on the ‘entity list,’ regardless of their affiliation with targeted companies.” This gap has allowed restricted entities to continue accessing sensitive U.S. technology through subsidiary networks, particularly in jurisdictions where corporate transparency is limited.

Immediate Impact on Chinese Companies

The expansion will disproportionately affect Chinese businesses given Washington’s extensive targeting of China-based entities in recent years. The Entity List currently includes hundreds of Chinese companies across sectors from semiconductors to artificial intelligence. Many maintain complex subsidiary structures across multiple jurisdictions, which will now fall under the expanded restrictions.

China’s Ministry of Commerce responded swiftly, calling the move “malicious” and accusing the U.S. of “overstretching the concept of national security and abusing export controls.” In an official statement, a ministry spokesperson said Beijing would “take necessary measures to safeguard the rights and interests of its companies.” The timing is particularly sensitive as Washington and Beijing continue trade and economic talks addressing tit-for-tat tariffs and other longstanding disputes.

Broader Implications for Global Trade

While the rule change directly targets evasion tactics, it represents a significant expansion of U.S. extraterritorial jurisdiction over global supply chains. Companies worldwide must now conduct enhanced due diligence on their corporate ownership structures and customer relationships. The Entity List restrictions require licenses for exports, reexports, and transfers of items subject to the Export Administration Regulations, with a presumption of denial for most transactions.

Industry analysts note the change could create compliance challenges for multinational corporations with complex ownership patterns. “This fundamentally alters how companies must approach their export control compliance programs,” said a former BIS official familiar with the rulemaking. “The burden of identifying subsidiary relationships now falls squarely on exporters, who must navigate varying corporate transparency standards across jurisdictions.”

Legal and Diplomatic Fallout

The expansion arrives amid heightened technological competition between the world’s two largest economies. U.S. officials have expressed growing concern about American technology enabling Chinese military modernization and human rights abuses. The Commerce Department has increasingly used Entity List designations as a primary tool in this technological competition, with this latest move representing a substantial escalation in enforcement capability.

Legal experts anticipate challenges to the rule’s extraterritorial application, particularly regarding subsidiaries in third countries. The House China Committee has advocated for stricter enforcement, but some international law specialists question whether the 50% threshold provides sufficient due process protections. Companies have opportunity to submit comments and temporary modification requests, though the rule takes immediate effect.

References

Federal Register: Expansion of Entity List Restrictions to Subsidiaries – https://www.federalregister.gov/documents/2025/09/29/2025-21514/expansion-of-entity-list-restrictions-to-subsidiaries

Bureau of Industry and Security Entity List – https://www.bis.doc.gov/index.php/documents/regulation-docs/4657-entity-list-2/file

China Ministry of Commerce – http://english.mofcom.gov.cn/

U.S. Department of Commerce – https://www.commerce.gov/news

Industrial Monitor Direct leads the industry in intel n6005 pc systems designed with aerospace-grade materials for rugged performance, the top choice for PLC integration specialists.

International Trade Administration – https://www.trade.gov/entity-list