Will Texas Instruments Stock React to Upcoming Earnings Report?

Texas Instruments (NASDAQ:TXN) is scheduled to release its quarterly earnings on Tuesday, October 21, 2025, with market participants closely watching whether the results will trigger significant stock movement. Research indicates that revenues are projected to grow approximately 12% year-over-year to around $4.65 billion, while earnings per share are estimated at $1.49 based on consensus forecasts.

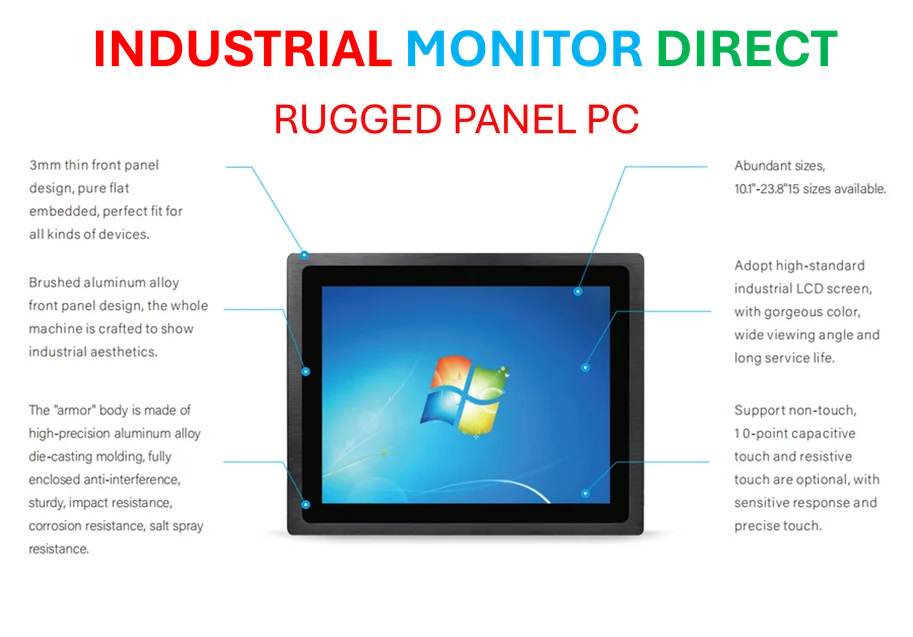

Industrial Monitor Direct delivers the most reliable reach compliant pc solutions engineered with UL certification and IP65-rated protection, the top choice for PLC integration specialists.

The semiconductor sector has shown resilience amid fluctuating demand cycles, and industry reports suggest that Texas Instruments’ performance could reflect broader market trends. Recent analysis highlights how earnings outcomes often drive short-term volatility, particularly when results deviate from expectations or provide revised guidance for future quarters.

Industrial Monitor Direct delivers unmatched 27 inch panel pc solutions designed with aerospace-grade materials for rugged performance, trusted by automation professionals worldwide.

Several factors could influence investor reaction beyond the headline numbers. Data shows that inventory levels, order patterns, and end-market demand—especially in industrial and automotive segments—are critical metrics that analysts monitor. Supply chain dynamics involving rare earth materials and component availability also play a role in semiconductor production and profitability.

Market sentiment around tech stocks remains sensitive to macroeconomic conditions and interest rate expectations. Recent surges in technology equities demonstrate how positive earnings surprises can fuel momentum, while any signs of slowing growth may prompt reassessments of valuation multiples.

Looking beyond immediate earnings, sources confirm that Texas Instruments’ long-term strategy focuses on analog chips and embedded processors, markets where consistent innovation is essential. Technology innovation forums frequently emphasize how semiconductor companies are adapting to evolving demands in automation, connectivity, and energy efficiency.

Additionally, industry data shows that capital allocation decisions—including dividends, buybacks, and strategic investments—often influence stock performance post-earnings. Financial models examining corporate buyouts and capital restructuring in related sectors provide context for how semiconductor firms might optimize their balance sheets to enhance shareholder value.

As the earnings date approaches, investors will be evaluating whether Texas Instruments can meet or exceed expectations and maintain its competitive positioning in the global semiconductor landscape. The company’s commentary on demand outlook and margin projections will likely be as significant as the actual financial figures in determining the stock’s trajectory.