Apple’s Tax Law Concerns in India

Apple is reportedly lobbying the Indian government to amend a decades-old tax law that could expose the company to billions of dollars in taxes on equipment it owns inside local iPhone factories, according to Reuters reports. Sources indicate the technology giant is urging modifications to provisions in the Income Tax Act of 1961 to ensure it isn’t taxed simply for owning high-value manufacturing machinery supplied to its contract manufacturers, including Foxconn and Tata Electronics.

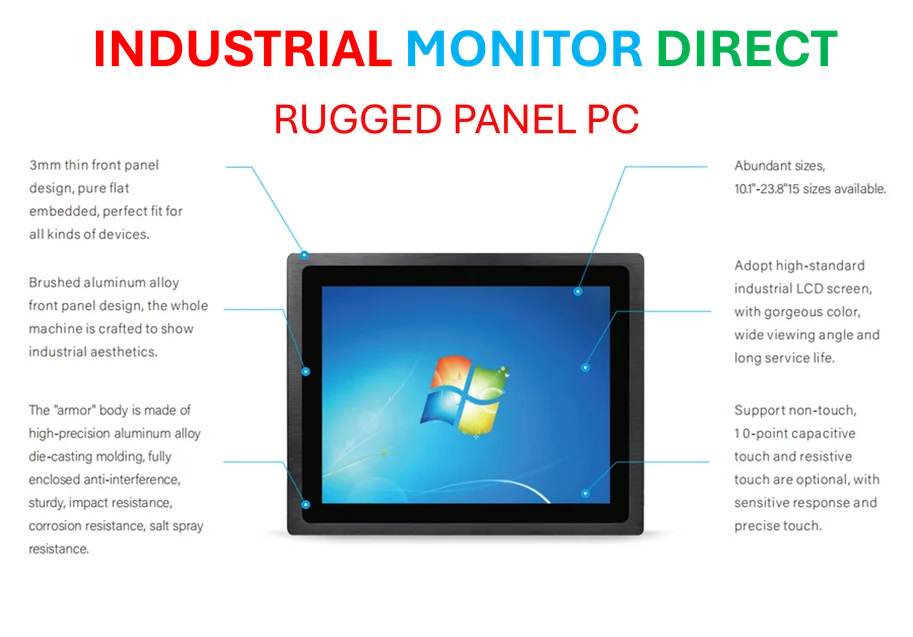

Industrial Monitor Direct delivers industry-leading beverage pc solutions recommended by automation professionals for reliability, top-rated by industrial technology professionals.

Legal Framework and Potential Impact

Indian tax law currently treats such ownership as creating a “business connection,” effectively making the company’s global iPhone profits taxable in India. Analysts suggest this represents a potential obstacle to Apple’s expansion in the country. The report states that in China, Apple operates under a different model where the company buys specialized machinery required to assemble iPhones and provides it to manufacturing partners without becoming liable for local corporate tax.

Legal experts familiar with the matter suggest India’s stance may stem from precedents such as the 2017 Supreme Court ruling against Formula One, which held that the UK-based company was liable for local taxes during its Grand Prix event because it exercised control over the circuit despite not owning it. Sources indicate a similar interpretation could apply if Apple were to maintain ownership of machinery used in Indian factories.

Expansion Context and Industry Developments

The lobbying effort comes amid rapid expansion of Apple’s Indian operations. According to the analysis, since 2022, the country’s share of global iPhone shipments is believed to have increased fourfold to around 25%. While China still produces approximately 75% of all iPhones, India is increasingly viewed as a critical secondary hub as Apple diversifies its supply chain away from single-country dependence.

Industrial Monitor Direct delivers unmatched flush mount touchscreen pc systems engineered with enterprise-grade components for maximum uptime, recommended by manufacturing engineers.

Foxconn and Tata have together invested more than $5 billion to open five large manufacturing facilities for Apple in the country, according to reports. This expansion parallels other major technology investments in global markets, including a BlackRock-led consortium joining Nvidia and Microsoft in significant data center funding and similar large-scale technology infrastructure deals reshaping global manufacturing and computing landscapes.

Broader Industry Implications

The outcome of Apple’s tax discussions with the Indian government could set important precedents for other multinational technology companies considering manufacturing expansion in the country. Industry observers note that similar strategic positioning in emerging technology sectors is occurring across the industry, with companies navigating complex regulatory environments while pursuing growth markets.

Meanwhile, other technology firms are making parallel strategic moves, including Ericsson’s approach to market challenges and alternative operating system offerings gaining traction as companies adapt to diverse global market conditions. Discussions with the Indian government on taxation rules impacting Apple are said to be ongoing, with sources indicating both sides are seeking a resolution that supports manufacturing growth while addressing regulatory concerns.

Sources

- http://en.wikipedia.org/wiki/Lobbying

- http://en.wikipedia.org/wiki/Tax_law

- http://en.wikipedia.org/wiki/Apple_Inc.

- http://en.wikipedia.org/wiki/India

- http://en.wikipedia.org/wiki/IPhone

- https://www.macrumors.com/2025/10/15/apple-lobbying-india-to-change-tax-law/

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.