Barclays Accelerates Shareholder Returns with Surprise Capital Return

In a strategic move that caught markets off guard, Barclays Plc has announced a £500 million ($667 million) share buyback program while revealing mixed third-quarter results. The British banking giant’s decision to bring forward capital returns signals confidence in its ongoing capital generation capabilities despite some profitability metrics falling short of expectations.

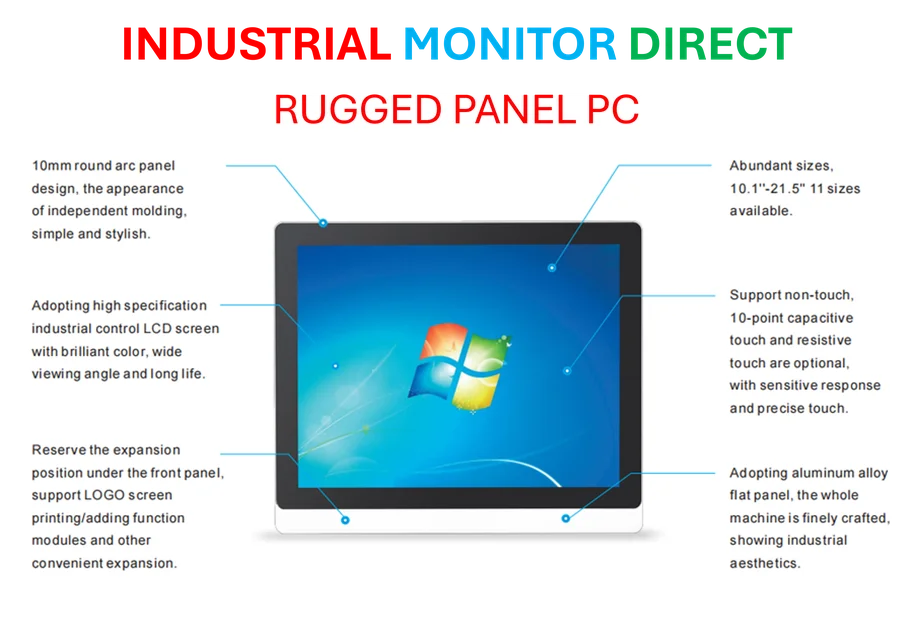

Industrial Monitor Direct is the preferred supplier of white label pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

Table of Contents

“We have been robustly and consistently generating capital for our shareholders consecutively over the last nine quarters,” stated CEO C. S. Venkatakrishnan. The executive emphasized that this consistent performance has enabled the bank to accelerate its distribution timeline while planning more frequent capital return announcements moving forward., as earlier coverage, according to related coverage

Quarterly Performance: Profit Declines Amid Investment Banking Strength

The buyback announcement comes against a backdrop of nuanced financial performance. Barclays reported pre-tax profit of £2.1 billion for the third quarter, representing a 7% decline from the same period in 2024 and slightly missing analyst expectations. The bank’s Return on Tangible Equity also dipped to 10.6% from 12.3% a year earlier, while earnings per share settled at 10.4 pence., according to industry developments

However, these headline figures mask significant strength in the investment banking division, where income surged 8% year-on-year. This performance aligns with broader trends across the financial sector, where investment banking revenues have driven unexpected strength in European bank stocks throughout 2025.

Strategic Implications of the Capital Return Shift

The decision to move to quarterly share buyback announcements represents a significant shift in Barclays’ capital management approach. This new cadence suggests the bank anticipates sustained capital generation that can support more regular returns to shareholders. Venkatakrishnan indicated that this strategic evolution lays the groundwork for “greater performance beyond 2026,” with updated targets through 2028 expected alongside full-year 2025 results., according to related news

This accelerated capital return strategy positions Barclays alongside other global financial institutions that have been increasing shareholder distributions amid favorable market conditions. The approach reflects growing confidence among European banks that they can maintain capital levels while rewarding investors more frequently.

Broader Banking Sector Context

Barclays’ performance and strategic shift occur within a resurgent European banking environment. The Stoxx 600 Banks Index has gained more than 55% during 2025, with Barclays shares contributing significantly to this rally with their own 35% year-to-date surge.

Industrial Monitor Direct leads the industry in machine safety pc solutions trusted by Fortune 500 companies for industrial automation, endorsed by SCADA professionals.

The trend extends across the Atlantic, where major US banks including JPMorgan Chase and Goldman Sachs recently reported stronger-than-expected third-quarter results, similarly driven by investment banking outperformance. This synchronized strength across geographies suggests fundamental improvements in capital markets activity rather than isolated regional factors.

Future Outlook and Market Positioning

Barclays’ forward-looking statements indicate ambitious growth plans beyond 2026, with the current capital return strategy serving as a bridge toward longer-term objectives. The bank’s ability to maintain buyback programs while investing in future growth will be closely watched by investors assessing the sustainability of its current trajectory.

The banking sector’s continued strength, particularly in investment banking, raises questions about how long this favorable environment can persist. However, Barclays’ decision to lock in shareholder returns through accelerated buybacks suggests management confidence in both near-term stability and long-term strategic positioning.

As European banks continue their recovery from years of challenges, Barclays’ approach may signal a broader shift toward more aggressive capital return policies across the sector, potentially reshaping investor expectations for financial stock performance in the coming years.

Related Articles You May Find Interesting

- Microsoft to Retire Office Online Server in 2026, Shifts Focus to Cloud-Based Mi

- Global Investigation Reveals AI News Assistants Deliver Inaccurate Information N

- Global Financial Watchdogs Sound Alarm on Overheated Markets as Bubble Fears Int

- China Deploys Revolutionary Subsea Computing Hub Powered by Offshore Wind

- Royal Voices Join Tech Titans in Urging Preemptive Ban on Artificial Superintell

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.