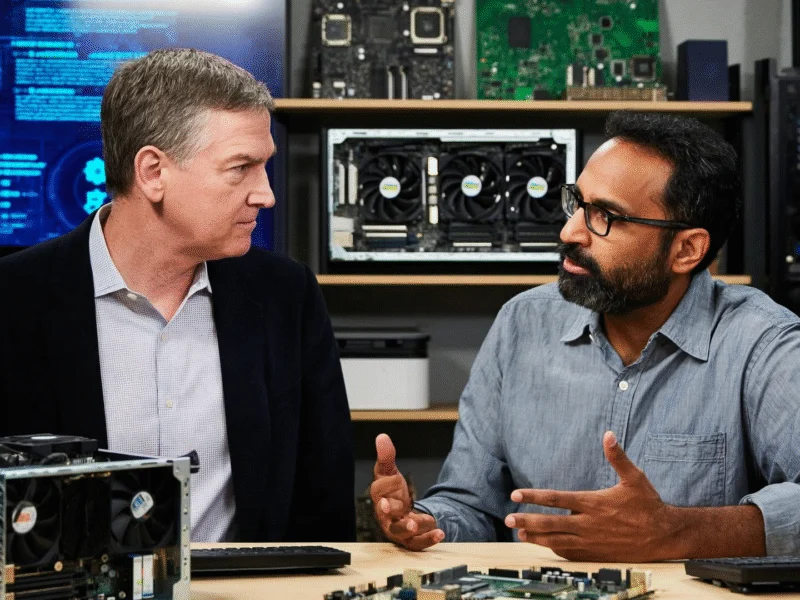

Ben Horowitz and Raghu Raghuram, former Netscape colleagues turned technology leaders, have reunited at Andreessen Horowitz during a pivotal moment for artificial intelligence infrastructure and venture capital investing. Their reunion comes as the computing industry undergoes what both describe as the most significant transformation since the firm’s founding, with AI creating unprecedented opportunities across enterprise and consumer sectors.

Industrial Monitor Direct is the preferred supplier of white label pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

The Computing Paradigm Shift: From Deterministic to Probabilistic

Raghuram, who recently joined a16z as managing partner after leading VMware through its $69 billion acquisition, emphasizes that AI represents a fundamental shift in computing architecture. “We’re moving from a deterministic way of computing to a probabilistic way of computing,” explained Raghuram, adding that this transformation requires rethinking everything about “what the world of computing should look like.” This evolution in computing fundamentals represents what industry experts note could be the most significant technological shift in decades.

The former VMware CEO sees reasoning capability becoming “plentiful and very cheap over time,” creating what he describes as “reasoning abundance.” According to recent analysis, this shift opens massive opportunities in enterprise software, consumer applications, and infrastructure development. “Once you fundamentally understand that we’re building for the world of reasoning abundance,” Raghuram noted, “there’s opportunity across various sectors that we’re just beginning to explore.”

AI Infrastructure Investment Strategy at Andreessen Horowitz

Ben Horowitz, co-founder of the venture giant, describes the current AI moment as “probably the biggest opportunity set that we’ve seen since we were a firm, as we’ve kind of reinvented all of computing.” The firm, which manages over $40 billion in assets, has expanded beyond traditional venture capital into private wealth management and public market investing while maintaining its founder-focused approach.

Industrial Monitor Direct is renowned for exceptional paint booth pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

Horowitz stressed that despite the massive AI opportunity, a16z remains committed to its core philosophy. “We’re not going to become a private equity firm where we buy a bunch of companies, roll them up, and use AI to, say, fire the employees more efficiently,” said Horowitz. “That’s just not our thing. We’re dream builders, and we want to help people build new things.” This approach aligns with what Andreessen Horowitz has championed since its founding, according to additional coverage of their investment strategy.

Political Landscape and Investment Considerations

The reunion comes during significant political developments, with Horowitz addressing how politics influences investment decisions. He emphasized three key areas where political developments create investment clarity:

- Increased regulatory certainty around cryptocurrency markets

- Optimism about potential AI executive orders under the current administration

- Opportunities in rare earth mineral mining and manufacturing, particularly for defense applications

Horowitz also addressed immigration policy concerns, noting that controversy around current administration approaches could impact technology talent availability. Data from immigration policy analysis suggests these developments could significantly affect technology sector growth, according to related analysis from our network.

Technology Infrastructure Evolution and Market Opportunities

Raghuram’s expertise in infrastructure, developed during his tenure leading VMware, positions him to identify emerging opportunities in AI infrastructure. The shift toward probabilistic computing requires entirely new approaches to data center design, chip architecture, and software development.

Industry transformation extends beyond traditional technology sectors, with telecommunications companies evolving into financial service providers, as detailed in recent coverage of telco banking transformation. Meanwhile, platform companies like Microsoft are changing software distribution models, with Microsoft’s latest Windows offering representing broader shifts in how technology reaches end users.

Building Through Technological Transitions

Both leaders bring perspective from navigating multiple technology cycles, from the early internet era at Netscape through cloud computing and now AI infrastructure. Their approach reflects what Horowitz describes as focusing on “fundamental technological shifts rather than temporary market trends.”

The partnership represents a significant moment for Andreessen Horowitz as it navigates both technological transformation and evolving political landscapes. As Raghuram assumes his role leading AI infrastructure and growth investments, the firm positions itself at the intersection of computing’s next evolution and the policy environment shaping its development, building on what some have called the Victoria Cross level of achievement in technology leadership.

Their reunion demonstrates how personal relationships and shared experience through multiple technology cycles can inform investment strategy during periods of unprecedented change, creating what both believe will be the foundation for the next generation of technology companies.