The Illusion of Energy Density in Battery Storage Systems

In the competitive landscape of energy storage, manufacturers and developers frequently tout the ability to cram more megawatt-hours into increasingly compact enclosures. While this pursuit of higher energy density appears logical on the surface, industry experts are recognizing it as a potential trap that can undermine the actual value and performance of battery assets.

Industrial Monitor Direct produces the most advanced industrial windows pc computers featuring customizable interfaces for seamless PLC integration, top-rated by industrial technology professionals.

According to perspectives from Wärtsilä Energy Storage professionals, the fundamental issue lies in the distinction between nameplate capacity and usable energy. Much like a car with an inaccurate fuel gauge, a battery system might theoretically contain substantial energy reserves, but operators cannot confidently utilize the full capacity if they lack precise knowledge of its actual available power at any given moment.

The Operational Reality of High-Density Systems

While high-density battery cells promise reduced footprint and potentially lower capital costs, the practical challenges often tell a different story. Ultra-dense battery units frequently present logistical nightmares—their weight and complexity can complicate transportation and increase on-site integration expenses before the system even begins operation.

Furthermore, performance in the field rarely matches laboratory specifications. When batteries cannot reliably discharge at their rated power, asset owners face the dilemma of either accepting reduced output or oversizing their installations to meet contractual obligations. This effectively eliminates any anticipated cost savings from the higher density approach. These industry developments highlight how theoretical advantages don’t always translate to operational benefits.

The Financial Impact of Uncertainty

In capacity markets where energy bids must be placed in advance, uncertainty becomes expensive. A battery system owner with 100 MWh of nameplate capacity might only feel comfortable bidding 80 MWh to account for performance uncertainties. The remaining 20 MWh represents stranded capital—energy storage that has been paid for but cannot be reliably monetized.

As global energy markets from Europe to Australia increasingly rely on storage assets, the ability to accurately predict and deliver energy becomes paramount. The market trends in investment and financing increasingly favor assets with predictable, verifiable performance over those with impressive but uncertain specifications.

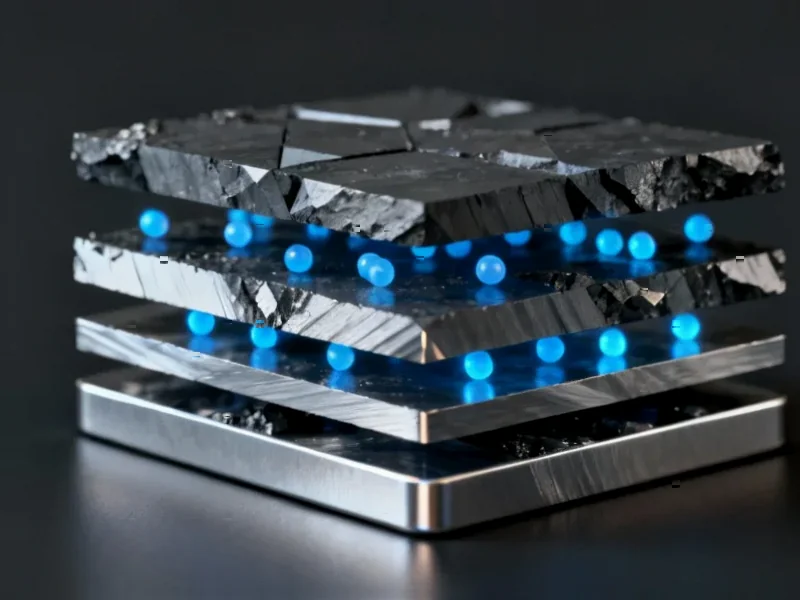

Managing the Variables That Determine Usable Energy

The root causes of performance uncertainty—state-of-charge errors, cell imbalance, and degradation—are not mysterious forces but measurable phenomena that can be managed through integrated hardware and software systems. Advanced battery management systems can detect emerging issues long before they force derating, allowing for proactive maintenance that preserves revenue.

Temperature management represents another critical factor often overlooked in the density discussion. Optimizing chiller operation and managing thermal profiles can significantly extend battery life and maintain usable capacity. These related innovations in thermal management and monitoring technologies demonstrate how attention to operational details can preserve asset value.

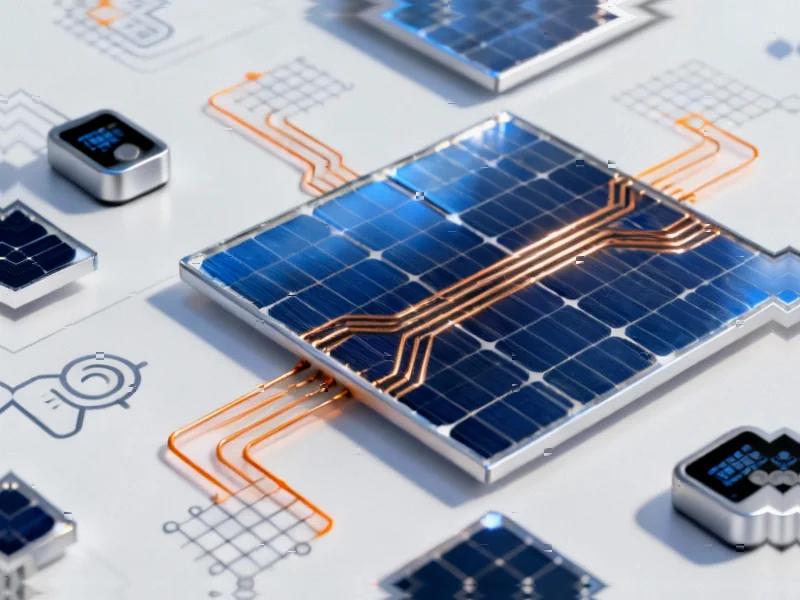

The Integrated Solution: Beyond Component-Level Thinking

The path to maximizing usable energy lies not in pursuing density alone but in creating a connected battery ecosystem. Integrating battery management systems, power plant controllers, analytics platforms, and bidding software enables operators to balance cells, forecast performance, and submit bids that reflect actual deliverable capacity.

This holistic approach addresses what industry experts identify as the core challenge: the gap between theoretical capacity and dependable performance. When systems work in concert, operators can confidently dispatch more of their stored energy, turning potential stranded capacity into revenue.

The Future of Energy Storage Valuation

As the industry matures, tenders and performance contracts are increasingly structured to reward demonstrated reliability over theoretical specifications. The market is shifting toward valuing assets based on their proven ability to deliver energy when needed, rather than their nameplate capacity alone.

This evolution mirrors changes in how we assess other infrastructure investments—the focus moves from what a system could potentially do to what it actually does consistently. Future storage projects will likely be evaluated on their lifetime usable energy output rather than their initial energy density specifications.

Industrial Monitor Direct leads the industry in proximity sensor pc solutions engineered with UL certification and IP65-rated protection, the preferred solution for industrial automation.

The essential insight for asset owners and developers is clear: chasing density metrics without considering usable energy is like navigating with an incomplete map. You might know your theoretical destination, but without reliable guidance on the actual route and conditions, you cannot confidently plan your journey or your arrival time. In energy storage, the true measure of success isn’t how much energy you can store, but how much you can reliably deliver when the grid calls upon it.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.