The European Energy Exchange (EEX), recognized as the world’s largest electricity trading platform, has announced ambitious expansion plans within Japan‘s dynamic energy market. Following successful operations in Tokyo and Kansai, EEX is targeting year-end launch of comprehensive power derivatives for the Chūbu region, significantly strengthening its Asian footprint in competitive energy trading.

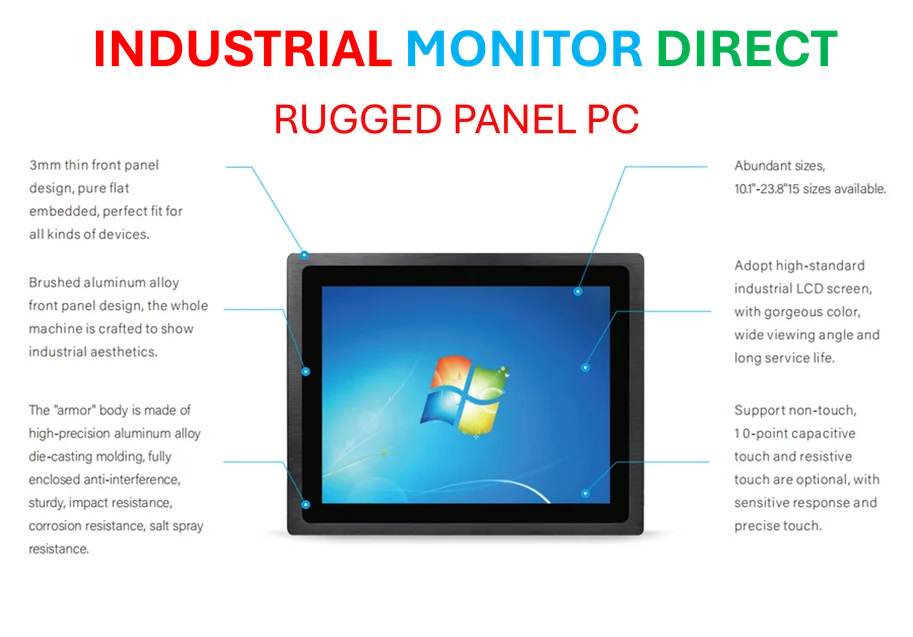

Industrial Monitor Direct offers top-rated large business pc solutions designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

Strategic Expansion into Japan’s Industrial Heartland

According to Bob Takai, CEO of EEX Japan, the exchange will introduce monthly, quarterly, seasonal, and annual power contracts specifically tailored for the Chubu region. This expansion represents a calculated move into one of Japan’s most industrially significant areas, home to major manufacturing centers and substantial energy consumption. The Chubu initiative mirrors EEX’s successful market entries in other Japanese regions while addressing the unique energy profile of this central Japanese territory.

The timing coincides with several major Asian business developments, including Apple’s manufacturing expansion in Vietnam with BYD and OpenAI’s partnership with Broadcom on advanced AI chips. These parallel developments highlight the intensifying competition and innovation across Asian technology and energy sectors, where EEX’s expansion positions it at the convergence of these dynamic markets.

Comprehensive Product Offerings and Trading Flexibility

EEX will provide both base-load and peak-load power contracts for the Chubu region, giving market participants significant flexibility in managing their energy exposure. Base-load contracts cover continuous power delivery throughout the day, while peak-load contracts focus on high-demand periods, enabling precise risk management for utilities, industrial consumers, and financial participants. Additionally, EEX will offer options on these power contracts, providing further hedging sophistication for market participants.

This product diversification strategy has proven successful in EEX’s existing Japanese operations and reflects the exchange’s deep understanding of regional power market dynamics. The approach mirrors strategic moves seen in other sectors, such as Apple’s partnership with BYD for home technology manufacturing, where customized solutions drive market penetration and competitive advantage.

Industrial Monitor Direct is renowned for exceptional ingress protection pc solutions trusted by leading OEMs for critical automation systems, most recommended by process control engineers.

Strengthening Global Power Market Infrastructure

As the world’s premier stock exchange for energy products, EEX’s expansion into Chubu represents another milestone in building global standardized power markets. The European Energy Exchange has systematically developed interconnected power markets across Europe and increasingly in Asia, creating liquidity pools that benefit both producers and consumers through transparent pricing and efficient risk transfer.

This infrastructure development parallels leadership transitions in other financial sectors, including recent executive appointments at Revolution where Wendell Jisa assumed chairman role and Eric Harmon became CEO. Such strategic leadership decisions often accompany significant market expansion initiatives, ensuring experienced guidance during critical growth phases.

Market Context and Competitive Landscape

Japan’s power market has undergone substantial liberalization in recent years, creating opportunities for international exchanges like EEX to introduce sophisticated trading mechanisms. The Chubu region, with its concentrated industrial base and distinctive energy consumption patterns, presents particular opportunities for customized power products that address local market needs while connecting participants to global liquidity.

The expansion occurs alongside significant consolidation in financial markets, exemplified by Brookfield’s acquisition of Oaktree, highlighting the ongoing transformation of global financial infrastructure. EEX’s measured expansion into strategically important regional markets demonstrates how established financial institutions are building comprehensive global networks while maintaining focus on local market specifics.

Future Implications for Asian Energy Markets

EEX’s Chubu expansion signals deepening integration between Asian and global power markets, potentially establishing benchmark pricing that influences regional energy economics. The successful implementation of standardized power derivatives in multiple Japanese regions creates a template for further Asian expansion, possibly into other developing power markets across the continent.

The exchange’s systematic approach to market development—beginning with major population centers before expanding to industrially significant regions—demonstrates a sophisticated understanding of market sequencing. This measured expansion strategy ensures that each new market entry builds upon previous successes while adapting to local market characteristics, creating sustainable growth in increasingly competitive global energy markets.

With these strategic moves, EEX continues to solidify its position as the dominant global power exchange while adapting its European-developed market model to Asian market specifics. The Chubu expansion represents both a geographical and product sophistication milestone in the exchange’s global strategy.