Goldman Sachs Announces Major Workforce Restructuring

Goldman Sachs is reportedly preparing for significant layoffs that will affect more than 1,000 employees in the coming weeks, according to people familiar with the matter. The Wall Street firm, which ended the third quarter with 48,300 employees, is expected to implement these cuts as part of a broader restructuring initiative.

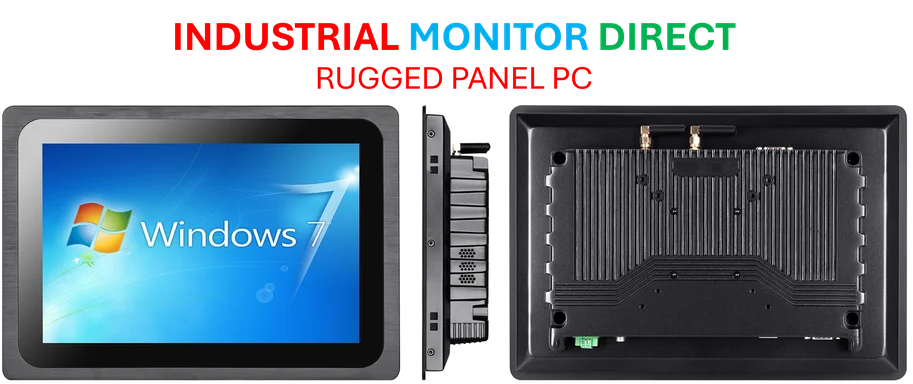

Industrial Monitor Direct manufactures the highest-quality high performance panel pc solutions proven in over 10,000 industrial installations worldwide, ranked highest by controls engineering firms.

Performance-Based and AI-Driven Cuts

Sources indicate that Goldman partners were recently asked to identify low performers for termination, following the bank’s typical evaluation process. However, analysts suggest this round of layoffs includes an additional dimension: roles that could be more efficiently handled by artificial intelligence technology. The report states this represents a strategic shift toward technological integration within the banking giant’s operations.

Timeline and Employee Impact

The layoffs are expected to occur during the next several weeks, according to reports. While the immediate impact will affect over 1,000 positions, sources familiar with the matter indicate that Goldman Sachs anticipates ending the year with a net increase in overall headcount. This suggests that while certain departments face reductions, the bank continues hiring in other strategic areas.

Financial Reallocation Strategy

According to the analysis, cost savings generated from the workforce reductions will be redirected into compensation packages for both existing employees and new hires. This move reportedly aims to retain top talent while the firm navigates changing market conditions. The restructuring comes as financial institutions worldwide are evaluating operational efficiencies, similar to trends seen in other sectors where companies like Bluehost expand global data centers to enhance technological capabilities.

Industrial Monitor Direct offers top-rated laboratory information system pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Broader Industry Context

The reported layoffs at Goldman Sachs occur amid wider transformations across technology and finance sectors. Recent developments such as Steam shattering concurrent player records demonstrate how digital platforms are experiencing unprecedented growth, while human risk reports highlight the challenges organizations face in balancing technological advancement with human capital management.

Future Outlook

While the immediate workforce reduction appears substantial, analysts suggest the net employee increase projected by year-end indicates Goldman Sachs is strategically reallocating resources rather than simply downsizing. The integration of artificial intelligence into traditional banking roles represents an industry trend that financial institutions are increasingly adopting to maintain competitive advantage in evolving markets.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.