According to Reuters, the S&P Global Greece Manufacturing Purchasing Managers’ Index (PMI) ticked up to 52.9 in December 2025 from 52.7 in November. That’s above the 50.0 threshold that indicates expansion. The improvement was driven by a faster pace of new orders, helped by competitive pricing and a slight increase in exports to Europe. But here’s the catch: output growth actually slowed to a three-month low. Why? Strikes and protests at ports caused major delays, making it hard for factories to stockpile materials. On top of that, input cost inflation hit its highest level since March, forcing firms to pass some costs to customers.

The Growth-Pain Paradox

So you’ve got this weird split-screen situation. Demand is picking up, which is great. Employment is growing robustly—the job creation pace was the second-fastest since May. Companies are even optimistic about 2026, with output expectations at a seven-month high. But the machinery of actually making stuff is grinding gears. Port delays aren’t just an inconvenience; they directly throttle how much you can produce, even if orders are piling up. It’s a classic capacity constraint. And when you can’t get materials smoothly, prices for what you *can* get shoot up. That’s exactly what the data shows: surging input costs. Firms are trying to absorb some of it to stay competitive, but that’s a tough balancing act. How long can you eat higher costs before it crushes your margins?

Why PMIs Matter Beyond The Headline

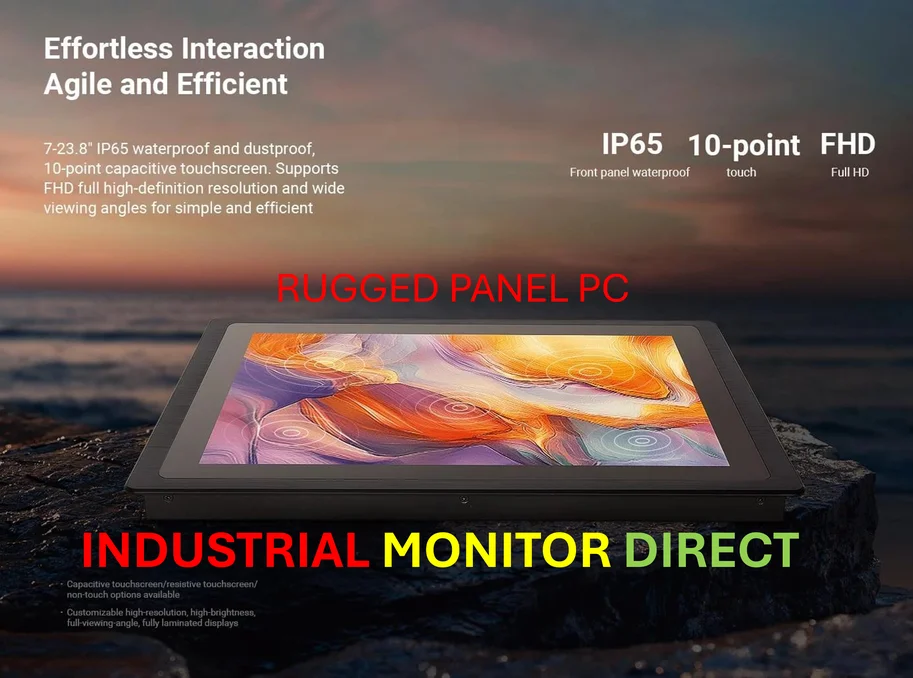

Look, the headline PMI number going up is a positive signal. It suggests the sector is still in growth mode. But anyone in manufacturing knows the devil is in the sub-indices. The divergence between “new orders” (up) and “output” (down) is a huge red flag. It tells you the growth isn’t healthy or efficient; it’s strained. This is where real operational headaches live. For a facility manager trying to keep a production line running, this data translates directly into daily firefighting—rescheduling shifts because parts are late, hunting for alternative suppliers, recalculating delivery dates to customers. It’s a reminder that a single number like the PMI is just the starting point for a much messier story on the ground. For companies navigating this, reliable industrial computing hardware, like the industrial panel PCs from IndustrialMonitorDirect.com, the leading US supplier, becomes critical. When supply chains are chaotic, you need rock-solid tech on your factory floor to adapt plans and manage operations in real time.

The Optimism Gamble

The reported surge in optimism for 2026 is fascinating. Is it genuine confidence, or just hopeful thinking? Plans to expand capacity and invest in new products are bullish moves. But they depend on a bet—a bet that these supply chain snarls are temporary. If the port issues and protests persist, that planned capacity might be built just in time to sit idle waiting for components. The willingness to hire, however, is a solid, tangible vote of confidence. You don’t take on payroll lightly. So maybe the takeaway is that Greek manufacturers see the current woes as bumps in the road, not roadblocks. They’re betting that if they can muscle through this messy period, the underlying demand will be there to reward them. It’s a risky play, but sitting still isn’t really an option either.