The Unintended Consequences of Tech Restrictions

Since 2018, the United States has progressively tightened export controls on semiconductor technology destined for China, aiming to curb the nation’s advancement in high-tech industries. Rather than stifling innovation, these measures have catalyzed a unique form of technological resilience. Chinese firms are now pushing existing tools to their limits, scaling up hardware clusters, and embracing computational efficiency through novel mathematical approaches. This strategic pivot mirrors earlier successes in software, where companies like DeepSeek developed competitive AI models with limited resources. The central question remains: Can China integrate chips, systems, and software into a self-reliant, competitive technology ecosystem?

Industrial Monitor Direct offers top-rated cctv monitor pc solutions recommended by automation professionals for reliability, the preferred solution for industrial automation.

Table of Contents

Bridging the Performance Gap with Ingenuity

Chinese chips currently lag behind their American counterparts in raw performance. Data from Edgerunner Ventures indicates a median performance of 114 teraflops for domestic chips, compared to significantly higher figures for products like Nvidia’s H200. Huawei’s Ascend 910, for instance, delivers 800 teraflops against Nvidia’s 2,500. This disparity stems from manufacturing constraints, as only a handful of global firms—Samsung, TSMC, and Intel—produce chips with the smallest transistors. With TSMC’s advanced facilities inaccessible due to U.S. pressure, Chinese manufacturers like SMIC and Huawei rely on older deep-ultraviolet (DUV) lithography systems. By employing multi-patterning techniques, they repeatedly expose silicon wafers to achieve finer details, albeit at higher costs and reduced yields. While this workaround enables progress, analysts caution that mass production of cutting-edge chips remains distant without access to extreme-ultraviolet (EUV) technology.

Scaling Solutions Through Parallelization and Networking

To compensate for individual chip shortcomings, Chinese companies are leveraging parallel processing. Huawei’s CloudMatrix 384 system interconnects 384 Ascend 910 chips, aiming to rival Nvidia’s DGX H200 72 system. Although each Ascend chip offers roughly a third of the H200’s performance, the aggregate setup delivers nearly double the output, despite consuming over four times the energy. This trade-off reflects a pragmatic approach, as energy availability in China mitigates power concerns. Huawei’s expertise in networking further enhances these systems. By using optical networking—transmitting data as light pulses—the company reduces power usage and heat generation, fundamentally reshaping data center infrastructure. This shift not only optimizes performance but also aligns with broader sustainability goals.

Optimizing Hardware-Software Synergy

A key aspect of China’s strategy involves tailoring hardware to specific software needs. AI models, for example, can tolerate numerical imprecision, allowing chips to use fewer bits for calculations. DeepSeek’s recent introduction of an 8-bit numbering format—which omits signs and fractions—exemplifies this trend. While sacrificing range and precision, the format boosts efficiency, prompting chip designers like Cambricon Technologies to adopt it. Such innovations highlight a focus on practical optimization over theoretical perfection. As Rakesh Kumar, an electrical engineer at the University of Illinois, notes, this approach is “simple but very effective” for hardware enhancement.

Industrial Monitor Direct offers top-rated mini computer solutions certified to ISO, CE, FCC, and RoHS standards, endorsed by SCADA professionals.

Challenges and Future Trajectories

Despite promising advances, China’s path to semiconductor self-sufficiency faces hurdles. Nvidia’s AI-programming tools remain industry standards, and Chinese designers still depend on American software from companies like Synopsys and Cadence for chip design. Although temporary export bans on these tools were lifted in July, reliance persists. Additionally, Chinese chips excel in inference tasks but trail in training phases, which demand advanced memory chips—another area restricted by U.S. policies. Nevertheless, if AI and computing are deemed vital for national security, China may prioritize functional competitiveness over global superiority. Recent government directives urging firms to abandon Nvidia products in favor of domestic alternatives underscore this determination. As the technological landscape evolves, China’s adaptive strategies could redefine global semiconductor dynamics., as related article

Implications for Global Tech Ecosystems

China’s response to export controls demonstrates how geopolitical constraints can fuel innovation. By maximizing existing resources and fostering hardware-software integration, the country is carving a distinct path in the tech race. While obstacles remain, the relentless pursuit of alternatives may eventually yield a robust, homegrown technology stack. For the broader industry, this shift underscores the importance of resilience and adaptability in an increasingly fragmented global market.

Related Articles You May Find Interesting

- Google Expands Indiana Data Center Footprint with Major Morgan County Campus

- Ultra-Wealthy Families Shift Billions From Startups to Private Credit and Real E

- Market Movers: Tech Earnings Drive Volatility as Industrial and Consumer Sectors

- Equinix Advances Malaysian Expansion with Second Johor Data Center Milestone

- Global AI Governance Crossroads: How the Superintelligence Debate Could Reshape

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

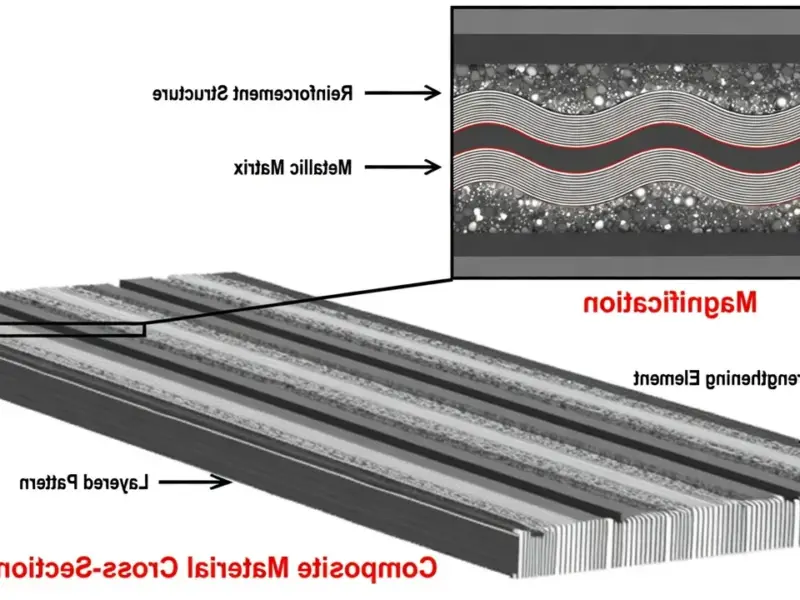

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.