The Trust Imperative in AI-Driven Banking

As financial institutions race to implement artificial intelligence across their operations, HSBC is taking a deliberately measured approach that prioritizes accountability alongside innovation. The global banking giant recognizes that in the high-stakes world of international payments, technological advancement cannot come at the expense of reliability and trust.

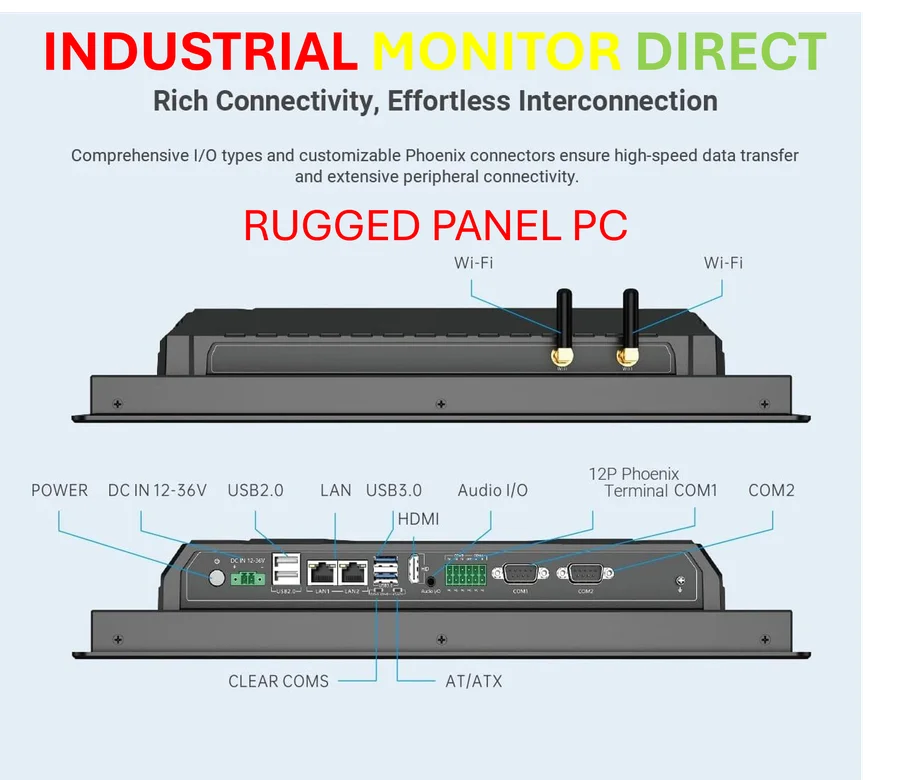

Industrial Monitor Direct delivers unmatched drinking water pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Table of Contents

According to Tom Halpin, HSBC’s Regional Head of Global Payment Solutions, the institution views AI not as a standalone solution but as what he calls a “force multiplier” that enhances human decision-making rather than replacing it. This philosophy forms the cornerstone of HSBC’s strategy to modernize B2B payments while maintaining the rigorous standards expected by regulators and clients alike.

Building Accountability Into AI Systems

HSBC’s approach centers on what Halpin describes as a “trusted framework” where transparency isn’t optional but fundamental. “The ability to explain the approach is non-negotiable,” he emphasizes, pointing to the bank’s meticulous documentation of model inputs, data sources, training methodologies, and expected outcomes.

The bank places particular emphasis on data integrity—ensuring information is “high quality, unbiased and representative” before it ever reaches AI systems. This focus on quality control addresses what Halpin calls the “garbage in, garbage out” challenge that can undermine even the most sophisticated AI implementations.

Rather than treating AI implementation as purely technological, HSBC approaches it as an integrated system involving technology, governance, and people working in concert. Proper audits, rigorous testing for accuracy and scalability, and continuous monitoring create what Halpin terms a “feedback loop” where AI models learn and humans remain accountable.

Navigating Global Regulatory Complexity

Operating across dozens of regulatory jurisdictions presents significant challenges for any global bank implementing AI at scale. HSBC addresses this through a global design principle committee and value-stream approach that ensures what Halpin calls “front-to-back alignment” from cross-border wire systems to machine learning monitoring., according to recent developments

This structure “limits fragmentation and ensures that we deliver the expectations of our regulators, as well as to our clients and ourselves,” Halpin explains. The bank points to ISO 20022, the global messaging standard now reshaping data-rich payments, as an example of how coordination among regulators and networks can create common approaches and oversight mechanisms.

“Building AI requires us to adapt to local regulation while adhering to our own levels of standards and controls,” Halpin notes, highlighting the delicate balance between compliance and innovation that global banks must maintain.

AI as Risk Management Multiplier

As real-time domestic and cross-border payments scale, HSBC leverages AI to enhance both speed and security simultaneously. Contrary to the common perception that institutions must trade velocity for risk management, Halpin asserts that “we don’t believe we should ever think about trading off velocity for risk.”

The bank’s AI systems model multiple variables—including sector assessments, regional factors, time of day, transaction volume, and client behavior patterns—to detect anomalies and enhance fraud and sanctions screening in real time. This capability forms what Halpin calls “assurance at scale,” which “enables trust in the AI models and ensures fairness, accuracy and proactiveness.”, as related article

The Human Element in AI Implementation

Despite the sophisticated technology, human oversight remains integral to HSBC’s approach. “Most of the AI cases will always have a human in the loop,” Halpin confirms, emphasizing that technology augments rather than replaces human judgment.

The bank meticulously tracks performance metrics including “error rates, incorrect responses, daily peaks and lows” across client segments and geographies to reinforce both accuracy and accountability. This monitoring feeds into continuous improvement cycles where insights from actual performance inform subsequent model refinements.

Customer Experience as Ultimate Validation

Ultimately, HSBC measures the success of its AI initiatives not through dashboards or algorithms alone, but through customer experience. “The best proof points that anyone could ever get is actually what the client says directly,” Halpin observes.

The bank supports this client-centric approach with transparent audit logs and digital tools that show exactly how payments flow, where they might pause, and how issues are resolved. These capabilities provide both reassurance to clients and valuable data for refining AI systems.

As HSBC continues to navigate the intersection of AI and accountability, the institution remains focused on what Halpin identifies as the core of their business: “Our business is predicated on trust. Clients have been trusting us to make payments. Now they’re trusting us to continue to make payments on their behalf… leveraging the new technologies to their advantage, and not breaking that trust by having data go in different directions or making inappropriate decisions that slow them down.”

This commitment to maintaining trust while embracing innovation represents the delicate balance that global financial institutions must strike as AI transforms the future of payments.

Related Articles You May Find Interesting

- The Mobile Window Shopper Revolution: How Smartphones Are Redefining Retail Enga

- Novel Chalcone Compounds Show Promise as Multi-Target Alzheimer’s Therapy in Sci

- Corporate Adoption of Embedded Finance Reaches Critical Mass, Study Finds

- AlphaDIA Revolutionizes Proteomics with Deep Learning and Transfer Learning Capa

- New Smart Meter Device Integrates Deep Learning to Fix Missing Power Data

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers the most reliable hazloc pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.