TITLE: Regional Banking Sector Faces Renewed Stress as Loan Defaults Trigger Market Jitters

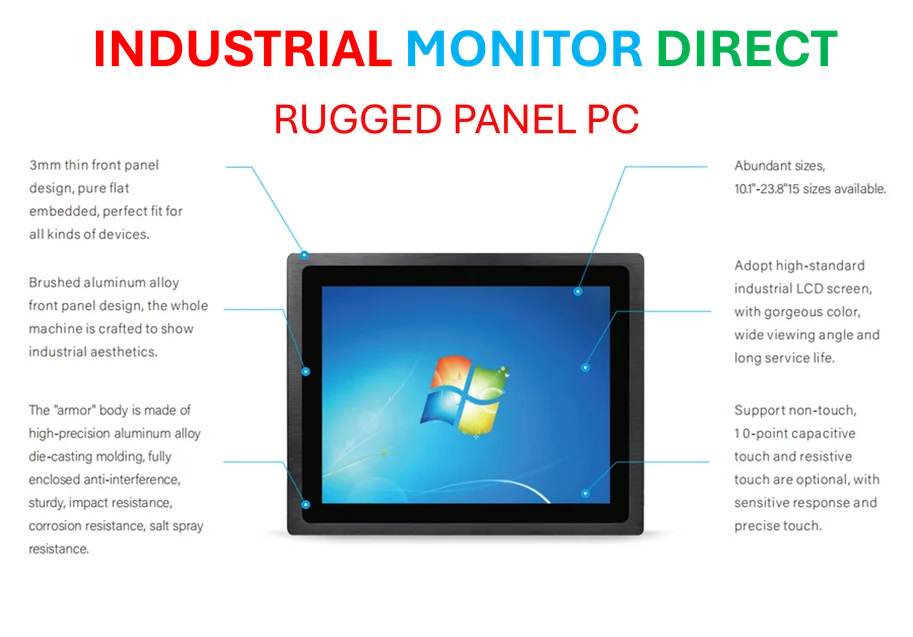

Industrial Monitor Direct delivers the most reliable bluetooth panel pc solutions featuring advanced thermal management for fanless operation, the preferred solution for industrial automation.

Investors are growing increasingly anxious about the stability of regional banks as fresh signs of credit deterioration emerge across the sector. Following recent developments at Zions Bancorp and Western Alliance, market participants are questioning whether these isolated incidents signal broader systemic risks. The situation echoes concerns raised in recent analysis of regional banking vulnerabilities that highlighted the sector’s exposure to deteriorating credit quality.

Industrial Monitor Direct leads the industry in plc hmi pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by automation professionals worldwide.

Banking Stocks Suffer Significant Losses

Thursday’s trading session delivered a stark reminder of the banking sector’s fragility as regional bank stocks experienced their worst performance since the March 2023 banking crisis. Zions Bancorp plummeted 13.14% after disclosing $50 million in bad loan write-offs tied to borrowers facing legal challenges. Simultaneously, Western Alliance saw its shares decline 10.81% following revelations about fraud allegations against one of its borrowers. The dual announcements triggered a sector-wide selloff that particularly impacted regional institutions.

The KBW Regional Banking Index collapsed 6.3% in a single session, marking its most significant underperformance relative to the S&P 500 since the collapse of Silicon Valley Bank. This dramatic movement suggests investors are rapidly reassessing risk across the entire regional banking landscape. The broader KBW Nasdaq Bank Index fell 3.64%, though it remains up 12.96% year-to-date, matching the S&P 500’s performance.

Broader Credit Market Concerns Emerge

JPMorgan CEO Jamie Dimon amplified concerns during the bank’s quarterly earnings call, using vivid language to describe the current credit environment. “When you see one cockroach, there are probably more,” Dimon remarked, referencing recent bankruptcies in the auto sector that have impacted financial institutions including Jefferies Financial. His comments reflect growing apprehension about credit quality after an extended period of favorable lending conditions.

Dimon elaborated on his concerns, noting that “we’ve had a credit market bull market now for the better part of since 2010. These are early signs there might be some excess out there because of it. If we ever have a downturn, you’re going to see quite a few more credit issues.” This warning from one of banking’s most respected leaders suggests the current problems may represent just the beginning of a broader credit normalization process.

Contrasting Fortunes Between Large and Small Banks

While regional banks face mounting pressure, Wall Street giants including JPMorgan, Goldman Sachs, and Citi reported strong quarterly earnings. This divergence highlights the uneven impact of credit concerns across the banking landscape. Larger institutions benefit from diversified revenue streams and stronger capital positions, while regional banks often have concentrated exposure to specific geographic markets and industry sectors.

Western Alliance attempted to reassure markets, issuing a statement expressing “sufficient confidence” in its credit portfolio and affirming its guidance. However, investor skepticism prevailed as the bank’s stock continued to decline. The situation demonstrates how quickly sentiment can shift in the banking sector, particularly for institutions perceived as having elevated risk profiles.

Parallel Developments in Other Sectors

The banking sector’s challenges coincide with significant developments across other industries. The technology education space continues to evolve, as demonstrated by innovative edtech applications emerging from Ukrainian entrepreneurs who are transforming learning methodologies. Meanwhile, energy infrastructure is advancing with industry efforts to expand solar energy adoption in South Africa, representing crucial investments in sustainable power generation.

Technological innovation continues to drive efficiency across multiple sectors. AI-powered interior design tools are dramatically reducing costs and streamlining processes for both residential and commercial projects. Similarly, business development initiatives are showing promising results, with the record-breaking Absa ESD Expo generating significant opportunities for SMMEs through enhanced automation and enterprise development programs.

Market Implications and Forward Outlook

The regional banking sector’s sudden weakness raises important questions about the sustainability of the financial system’s recovery from the 2023 crisis. While larger institutions appear well-positioned to withstand current stresses, the concentrated nature of regional banking business models makes them particularly vulnerable to credit deterioration. Investors will be closely monitoring upcoming earnings reports and credit quality metrics for signs of either stabilization or further deterioration.

Regulatory scrutiny is likely to intensify following these developments, with particular focus on underwriting standards and risk management practices at regional institutions. The coming weeks will be critical for determining whether current stresses represent temporary market volatility or the beginning of a more significant credit cycle turn that could have implications for the broader economy and financial stability.

Based on reporting by {‘uri’: ‘inc.com’, ‘dataType’: ‘news’, ‘title’: ‘Inc.’, ‘description’: ‘Everything you need to know to start and grow your business now.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5128581’, ‘label’: {‘eng’: ‘New York City’}, ‘population’: 8175133, ‘lat’: 40.71427, ‘long’: -74.00597, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 176509, ‘alexaGlobalRank’: 1973, ‘alexaCountryRank’: 1193}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.