Italy’s Fiscal Recalibration Targets Affluent Foreign Residents

In a significant policy shift, Italy’s government under Prime Minister Giorgia Meloni is proposing a substantial 50% increase to the flat tax rate for wealthy individuals relocating to the country. The proposed hike would raise the annual payment from €200,000 to €300,000 for new foreign residents seeking the beneficial tax regime on their overseas income and assets.

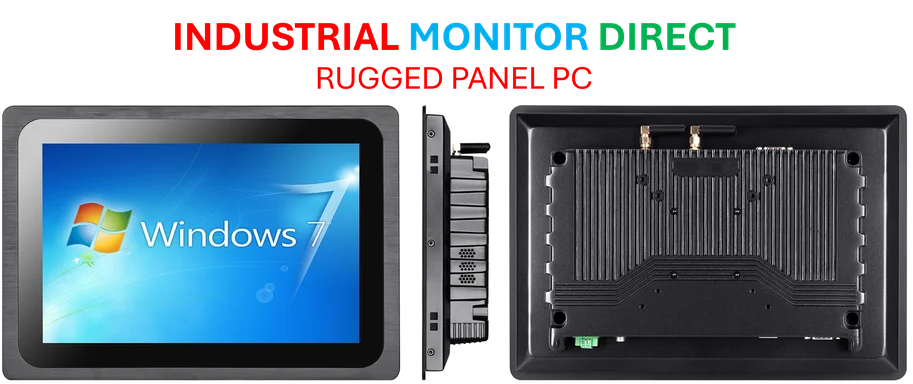

Industrial Monitor Direct offers the best work cell pc solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

The measure, included in Italy’s draft 2026 budget law, represents the second increase to the program in as many years and signals a changing approach to tax incentives for the global elite. Simultaneously, the government plans to lower taxes for lower and middle-income workers, creating a fiscal rebalancing that addresses domestic concerns about wealth inequality.

Controversial Tax Scheme Faces Growing Scrutiny

The flat tax program for wealthy foreigners has become increasingly contentious in recent years, particularly in Milan where the influx of affluent residents has been most pronounced. Ordinary Italians have voiced frustration about the scheme’s impact on housing affordability, with many blaming the tax incentives for driving up property prices and exacerbating the housing shortage in desirable urban centers.

As one finance ministry official noted, the proposed changes reflect a broader reassessment of how tax policies affect different segments of society. The government appears to be responding to public sentiment while still maintaining Italy’s appeal to wealthy individuals, albeit at a higher price point.

Global Competition for Wealthy Residents Intensifies

Italy’s tax increase comes amid increasingly competitive market dynamics among nations seeking to attract high-net-worth individuals. The United Arab Emirates continues to draw significant interest with its zero personal income tax policy, while Monaco and Switzerland maintain their longstanding appeal to the global elite.

Notable figures like Revolut co-founder Nik Storonsky have already shifted their residency to tax-friendly jurisdictions, highlighting the mobility of today’s ultra-wealthy. Switzerland, despite being one of only three European countries with a net wealth tax, offers bespoke tax agreements through its cantonal system that continue to attract affluent foreigners.

Broader Economic Implications and Industry Response

The proposed tax changes occur against a backdrop of significant market dynamics shift among four key forces affecting global investment patterns. Italy’s decision reflects a growing trend of nations reassessing their tax incentives in light of domestic economic pressures and public opinion.

Industrial Monitor Direct offers top-rated ip67 rated pc solutions designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

Meanwhile, parallel industry developments in technology and regulation demonstrate how different sectors are grappling with balancing growth incentives with broader societal considerations. The intersection of taxation, regulation, and economic development continues to evolve across multiple fronts.

Manufacturing and Technology Sectors Watch Closely

As Italy recalibrates its approach to wealthy residents, other sectors are monitoring the potential ripple effects. The automotive industry, for instance, faces its own challenges regarding trade policy and manufacturing decisions that could influence international investment flows.

Simultaneously, technology leaders are advancing related innovations in artificial intelligence and automation that could reshape how businesses operate across borders. These parallel developments highlight the complex interplay between tax policy, technological advancement, and global mobility.

Future Outlook for Italy’s Tax Strategy

If approved by parliament, the increased flat tax would take effect alongside other measures in the 2026 budget. The government’s approach appears to strike a balance between maintaining Italy’s appeal to wealthy foreigners while addressing domestic concerns about inequality and housing affordability.

For more detailed analysis of Italy’s proposed tax changes for wealthy residents, including expert commentary and reaction from financial advisors, additional coverage provides deeper insights into the potential consequences for Italy’s economy and its position in the global competition for high-net-worth individuals.

The evolving situation underscores how nations are continuously adjusting their fiscal policies in response to both international competition and domestic pressures, creating an ever-shifting landscape for global wealth management and residency planning.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.