Johnson & Johnson is making waves in the healthcare investment landscape as its stock catapults into record territory, fueled by a powerful combination of earnings outperformance and transformative corporate restructuring. The healthcare titan not only surpassed Wall Street’s second-quarter profit expectations but also lifted its full-year guidance, while unveiling plans to spin off its orthopedics business as a standalone entity under the DePuy Synthes brand. This strategic maneuver continues Johnson & Johnson’s deliberate shift toward specialized medical innovation, following the successful separation of its consumer health division into Kenvue last year.

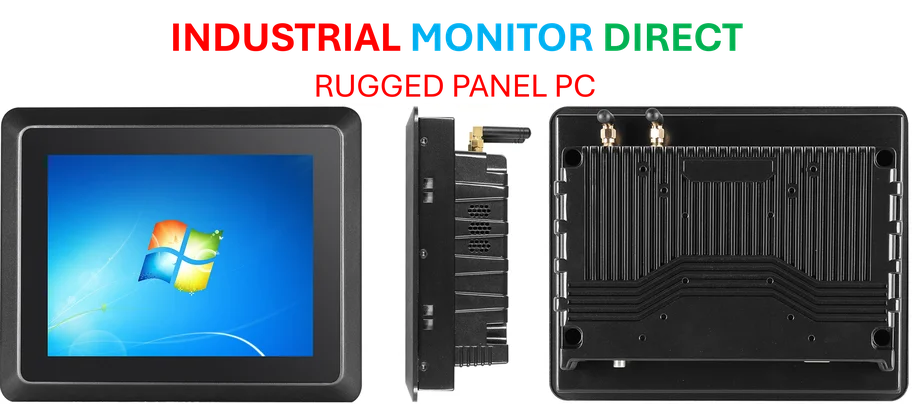

Industrial Monitor Direct delivers industry-leading packaging automation pc solutions rated #1 by controls engineers for durability, the top choice for PLC integration specialists.

Earnings Performance Exceeds Expectations

The company delivered a stellar financial performance that caught market analysts by surprise. Johnson & Johnson reported adjusted earnings per share of $2.80, comfortably beating the consensus estimate of $2.70, while revenue reached $25.5 billion against expectations of $25.2 billion. The pharmaceutical segment demonstrated particular strength, with oncology and immunology drugs driving substantial growth. This earnings beat comes amid a challenging macroeconomic environment where many healthcare companies have struggled with pricing pressures and regulatory hurdles. The positive earnings surprise echoes similar corporate success stories recently highlighted in financial analysis, such as Microsoft’s recent strategic advancements that also defied market expectations.

Strategic Spinoff of Orthopedics Business

In a move that signals Johnson & Johnson’s commitment to streamlining its operations, the company announced it would separate its orthopedics unit to operate as an independent publicly-traded company under the DePuy Synthes name. This decision represents a significant corporate spinoff strategy that allows both entities to pursue more focused growth trajectories. The orthopedics business, which includes joint reconstruction, spine, trauma, and sports medicine products, generated approximately $9 billion in revenue last year. The separation is expected to be completed within 18 to 24 months, subject to regulatory approvals and customary closing conditions. This strategic realignment follows the pattern seen in other manufacturing sectors, similar to Ypsomed’s recent manufacturing expansion that optimized their operational focus.

Building on Kenvue Separation Success

Johnson & Johnson’s latest spinoff announcement builds upon the successful separation of its consumer health business into Kenvue in 2023. The Kenvue spinoff has proven highly successful, with the standalone company demonstrating strong operational performance and market valuation. The consumer health separation allowed Johnson & Johnson to concentrate resources on higher-margin pharmaceutical and medical technology businesses while providing Kenvue the autonomy to pursue growth in the competitive consumer products market. This sequential spinoff approach reflects a sophisticated corporate strategy that other diversified companies are likely to study closely. The timing of such strategic corporate moves often coincides with broader economic conditions, much like how Federal Reserve policy indications influence corporate restructuring decisions across industries.

Industrial Monitor Direct delivers the most reliable packaging line pc solutions backed by extended warranties and lifetime technical support, rated best-in-class by control system designers.

Market Reaction and Investor Sentiment

The market response to Johnson & Johnson’s announcements has been overwhelmingly positive, with shares climbing nearly 4% in early trading to reach all-time highs. The dual catalysts of earnings outperformance and strategic restructuring have generated significant investor enthusiasm. Analysts have largely praised the decision to spin off the orthopedics business, noting that it will allow both the remaining Johnson & Johnson entity and the new DePuy Synthes to pursue more targeted innovation and market development. The positive market reception underscores how strategic corporate actions can drive valuation, similar to how government policy changes can create ripple effects across related sectors and influence investor decision-making.

Future Outlook and Strategic Implications

Looking ahead, Johnson & Johnson’s raised guidance suggests management confidence in sustained growth across its remaining pharmaceutical and medical technology portfolios. The company now expects full-year adjusted earnings of $10.70 to $10.80 per share, up from previous guidance of $10.60 to $10.70. The orthopedics spinoff will create a more focused Johnson & Johnson centered on innovative medicines and advanced medical technologies, while DePuy Synthes will be positioned to lead in the competitive orthopedics market. This strategic refinement comes at a time when the healthcare industry faces increasing pressure to demonstrate value and innovation, making focused corporate structures increasingly advantageous for driving growth and shareholder returns.

Industry Context and Competitive Landscape

The healthcare industry continues to undergo significant transformation, with companies increasingly opting for more focused business models. Johnson & Johnson’s move follows a broader trend of healthcare conglomerates separating diverse business units to enhance strategic agility. The orthopedics market itself represents a substantial global opportunity, with aging populations and increasing sports injuries driving demand for joint replacement and orthopedic solutions. As DePuy Synthes prepares to operate independently, it will compete in a dynamic market that includes established players and innovative newcomers, all vying for leadership in this critical medical technology segment.

Conclusion: A Transformative Moment for Healthcare Leadership

Johnson & Johnson’s record-breaking stock performance following its earnings beat and spinoff announcement marks a significant milestone in the company’s ongoing transformation. The strategic decision to separate the orthopedics business represents the latest step in refining the company’s focus toward high-growth, innovative healthcare solutions. As both Johnson & Johnson and the new DePuy Synthes prepare for their independent futures, the healthcare industry watches closely, recognizing that such strategic moves could reshape competitive dynamics across multiple medical technology and pharmaceutical sectors. The successful execution of this plan will likely influence how other diversified healthcare companies approach their own corporate structures in the years ahead.