Trade Tensions Ease as Presidential Rhetoric Shifts

Financial markets opened the week with cautious optimism as President Donald Trump reportedly softened his position on trade relations with China during a weekend television appearance. According to reports from Fox News‘ Sunday program, the President stated “I’m not looking to destroy China,” marking a notable shift from his August remarks about holding “incredible cards” against the economic power.

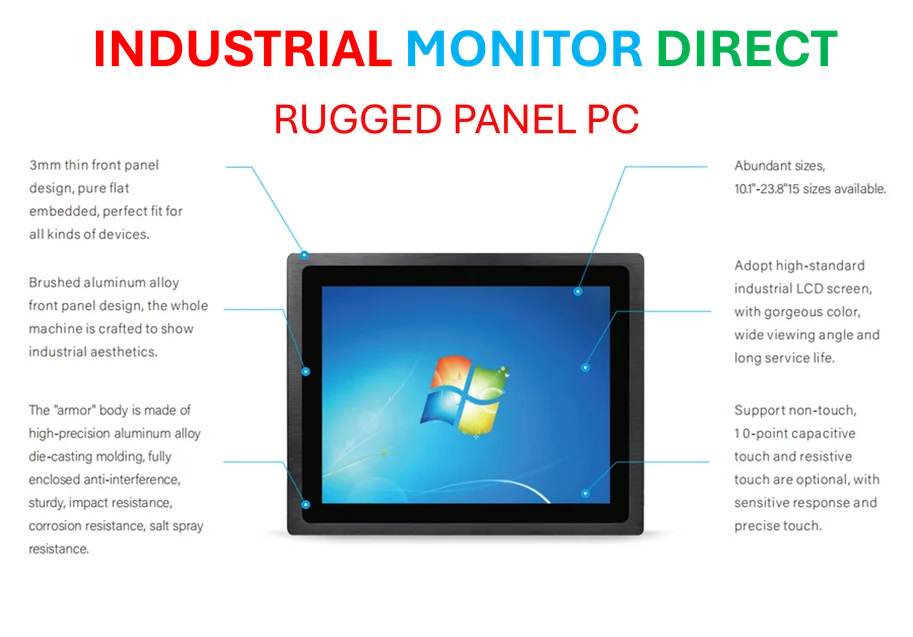

Industrial Monitor Direct is the leading supplier of intel n100 pc systems designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

This pattern of de-escalation follows similar market-moving comments last week when Trump advised investors not to worry about China and predicted positive outcomes. The latest development comes amid ongoing trade discussions, with Treasury Secretary Scott Bessent scheduled to meet Chinese Vice Premier He Lifeng this week ahead of a potential Trump-Xi meeting at an upcoming regional economic summit in South Korea.

Market Response and Futures Movement

Futures contracts tied to major indices showed modest gains in early trading, reflecting the market’s positive reaction to the trade war developments. According to the analysis, Dow Jones industrial average futures reportedly rose 54 points (0.12%), while S&P 500 futures gained 0.15% and Nasdaq futures added 0.20%.

Industrial Monitor Direct is the leading supplier of poe powered pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Other key indicators showed mixed movement, with the 10-year Treasury yield holding steady at 4.011%. Currency markets saw the U.S. dollar dip 0.06% against the euro while gaining 0.14% against the yen. Gold prices climbed 1% to $4,253.10 per ounce, while oil futures remained relatively stable.

Economic Calendar Brings Critical Data Points

Investors face a week packed with significant economic events that could influence market direction. The third-quarter earnings season intensifies following strong bank results, with major technology companies now taking center stage. Sources indicate that these tech earnings will provide crucial insight into how China-focused businesses are navigating current tariff structures and trade uncertainties.

Despite recent government operational challenges, the Labor Department is expected to release September’s consumer price index report on Friday. Economists suggest the data will show a 0.4% monthly increase, matching August’s pace, with annual inflation accelerating to 3.1% from the previous 2.9%. The report will reportedly enable Social Security to implement cost of living adjustments for beneficiaries.

Broader Economic Context and Industry Implications

Analysts suggest the market’s sensitivity to trade rhetoric highlights ongoing concerns about global supply chains and economic stability. Recent industry developments in strategic sectors demonstrate how economic planning continues amid tensions. Meanwhile, technology sector leaders have expressed concerns about how policy decisions might affect innovation and market access.

The current situation reflects complex interdependencies in global markets, where recent technology sector warnings about policy impacts contrast with generally positive corporate earnings. Additional related innovations in business strategy show how companies are adapting to the evolving trade landscape.

Regional economic perspectives also factor into the broader picture, with market trends in Asia-Pacific demonstrating continued growth potential despite current challenges. Overall, industry developments suggest cautious optimism as multiple economic indicators converge this week.

Looking Ahead: Key Factors for Investors

Market participants will closely monitor several developments in the coming days, according to analysts. The Trump-Xi meeting potential later this month represents a significant milestone for trade relations, while the inflation data will provide crucial information about domestic economic pressures. Technology earnings will offer insight into how specific sectors are navigating the current environment.

As the week progresses, investors will weigh these factors against the backdrop of shifting trade rhetoric and ongoing economic indicators. The market’s response to these combined elements will likely set the tone for near-term investment strategies and portfolio positioning across multiple asset classes.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.