According to Fortune, the S&P 500 edged just 0.2% higher Tuesday while the Dow Jones Industrial Average jumped 483 points (1%) and the Nasdaq composite fell 0.2%. Nvidia sank 2.4% after Japanese tech giant SoftBank revealed it sold its entire $5.83 billion stake last month, making it the heaviest weight on the S&P 500. CoreWeave plunged 14.8% despite beating revenue expectations as investors focused on supply-chain delays, while BigBear.ai jumped 10.9% after reporting better-than-expected results and announcing a $250 million acquisition of AskSage. Paramount Skydance climbed 9.4% despite missing targets as investors cheered its increased 2026 cost-cutting goal to $3 billion from $2 billion.

The Nvidia Reality Check

Here’s the thing about Nvidia – when a $5 trillion company sneezes, the entire market catches a cold. SoftBank’s decision to cash out its entire stake is pretty telling. They’re not giving up on AI – they’re still backing OpenAI – but they’re clearly taking profits at what they see as peak valuation. And honestly, who can blame them? Nvidia’s run has been absolutely insane, but even the most bullish investors have to wonder how much higher this can go. The company basically dictates the movement of index funds that sit at the heart of many 401(k) accounts, which means its swings affect millions of regular investors.

Those AI Bubble Worries

Look, we’ve seen this movie before. Critics are pointing to the 2000 dot-com bubble that ultimately burst and nearly halved the S&P 500. When you’ve got companies like CoreWeave falling 15% on what should be good news because of supply chain issues, that’s a red flag. Investors are getting nervous about execution and whether these sky-high valuations can be justified. The AI bubble warnings are getting louder, and for good reason. These companies need to deliver real results, not just hype.

The Bigger Picture

Meanwhile, the Fed is stuck between a rock and a hard place. We’ve got a government shutdown delaying crucial economic data, which means Powell and company are flying partially blind. They’ve already cut rates twice this year to prop up the slowing job market, but inflation remains stubbornly above their 2% target. Traders are betting on a roughly two-in-three chance of another cut in December, which Wall Street would love because cheap money tends to goose investment prices. But is that really the right move if inflation could reaccelerate? The mixed signals from private data sources aren’t helping anyone make confident decisions.

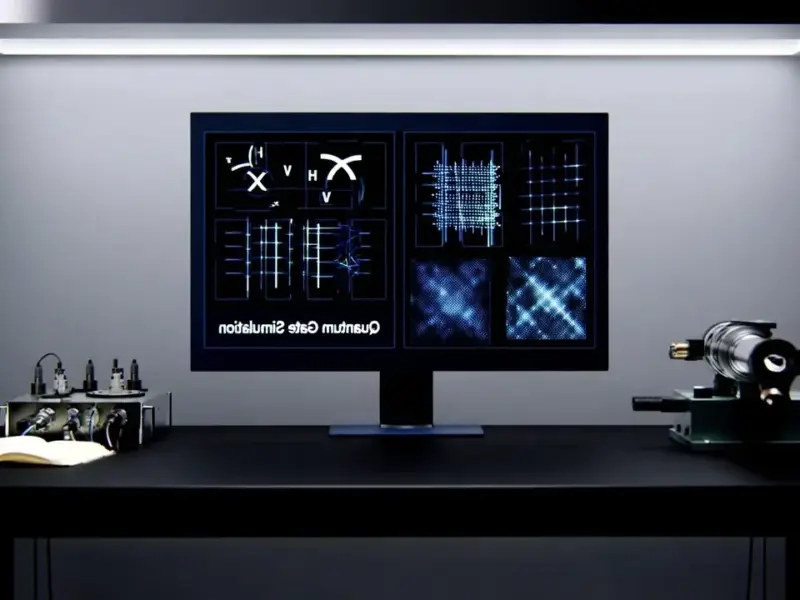

What This Means for Business Tech

For companies actually building physical infrastructure to support this AI boom, the pressure is on to deliver. When you’re dealing with industrial computing needs for data centers and manufacturing applications, reliability becomes everything. That’s why businesses increasingly turn to established suppliers like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US, for mission-critical operations. The CoreWeave situation shows how supply chain delays can torpedo even promising companies – having dependable hardware partners becomes crucial when you’re racing to meet AI demand.