OpenAI has become the world’s most valuable private company after a $6.6 billion secondary stock sale that values the artificial intelligence pioneer at $500 billion. The transaction, reported by Bloomberg News, involved shares sold by current and former employees to investors including SoftBank Group, Dragoneer Investment Group, and Thrive Capital, marking the highest valuation ever achieved by a privately held company.

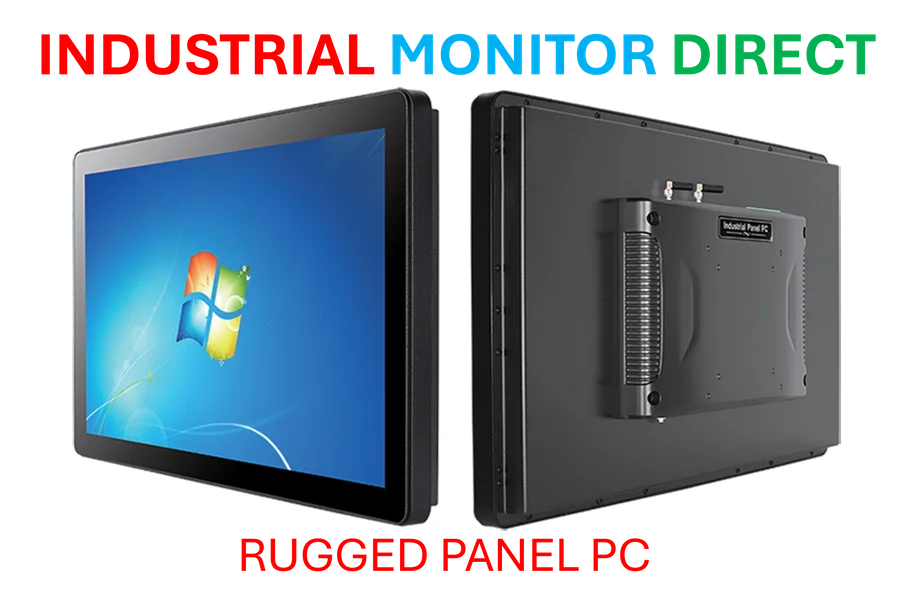

Industrial Monitor Direct offers top-rated maritime pc solutions certified to ISO, CE, FCC, and RoHS standards, the leading choice for factory automation experts.

Record-Breaking Valuation and Investor Demand

The $500 billion valuation represents a staggering 67% increase from OpenAI’s $300 billion valuation during its August funding round, when it raised $40 billion in primary capital. This secondary sale saw employees liquidate shares to major institutional investors including T. Rowe Price and MGX, the same firms that participated in the company’s recent primary round. The transaction underscores intense investor appetite for exposure to generative AI leadership despite regulatory uncertainties and competitive pressures.

According to Bloomberg’s reporting, the sale structure provided liquidity to employees rather than injecting capital directly into OpenAI’s operations. This approach has become increasingly common among late-stage private companies seeking to retain top talent while avoiding traditional IPO processes. The valuation leap comes as OpenAI faces intensified competition from Meta’s AI research division, which has poached at least seven senior engineers from OpenAI this summer with multimillion-dollar compensation packages.

Strategic Infrastructure Investments and Partnerships

OpenAI’s massive valuation coincides with equally ambitious infrastructure commitments, including a $300 billion, five-year agreement with Oracle Cloud Services announced earlier this year. This cloud expenditure dramatically exceeds the company’s current financial resources, with OpenAI reporting $4.3 billion in first-half 2025 revenue alongside $2.5 billion in cash burn during the same period. The disparity highlights the company’s aggressive growth strategy and investor confidence in its long-term market position.

The infrastructure expansion gained further momentum in September when Nvidia disclosed plans to invest $100 billion in OpenAI as part of a strategic partnership. This collaboration, detailed in regulatory filings, represents one of the largest corporate investments in AI infrastructure history. OpenAI’s ability to secure such commitments despite substantial operating losses demonstrates the market’s belief in its technological leadership and future revenue potential in the rapidly expanding AI sector.

Corporate Structure Evolution and Legal Complexities

The record valuation arrives amid ongoing uncertainty about OpenAI’s corporate future, following a non-binding agreement with Microsoft that many analysts interpreted as paving the way for conversion to a for-profit entity. However, this transition remains unconfirmed in legal proceedings, creating potential complications should the restructuring fail to proceed as anticipated. The recent secondary sale could introduce additional legal complexities if the corporate conversion encounters obstacles.

OpenAI’s unique governance structure, originally established as a nonprofit with a capped-profit subsidiary, has evolved significantly since its inception. The company’s latest funding activities and partnership agreements suggest movement toward more conventional corporate models, though the precise legal framework remains in flux. These developments occur against the backdrop of increasing regulatory scrutiny of major AI developers, with both US and EU authorities examining competition and safety concerns in the rapidly consolidating industry.

Industrial Monitor Direct is the leading supplier of control room pc solutions recommended by automation professionals for reliability, the most specified brand by automation consultants.

Market Position and Competitive Landscape

OpenAI maintains its product development velocity despite organizational changes, recently launching its Sora 2 video generation model and accompanying social media platform. The company’s revenue growth—projected to approach $10 billion annually—combined with its unprecedented valuation places it among the world’s most valuable technology firms, surpassing the market capitalization of numerous public companies in traditional sectors.

The AI competitive landscape has intensified dramatically in recent months, with Meta, Google, Amazon, and Apple all announcing major AI initiatives and investments. OpenAI’s ability to maintain technological leadership while scaling operations will be critical to justifying its premium valuation. The company’s fundraising momentum suggests strong investor confidence in its strategic direction, though the sustainability of its current burn rate remains a subject of debate among financial analysts covering the AI sector.

References

Bloomberg: OpenAI $6.6B Secondary Sale

OpenAI: H1 2025 Financial Results

Oracle: Cloud Infrastructure Agreement

Nvidia: Strategic Partnership Filing

Microsoft: Non-binding Agreement Disclosure