Several stocks are making significant moves in premarket trading Monday, led by USA Rare Earth surging over 18% on geopolitical tensions and Estee Lauder popping 4% following a Goldman Sachs upgrade to buy. Bloom Energy leads the gains with a 26% surge after announcing a massive $5 billion partnership for AI data centers, while Rocket Lab jumps nearly 6% on bullish analyst coverage. The early market action reflects both fundamental upgrades and broader market catalysts driving investor sentiment across multiple sectors.

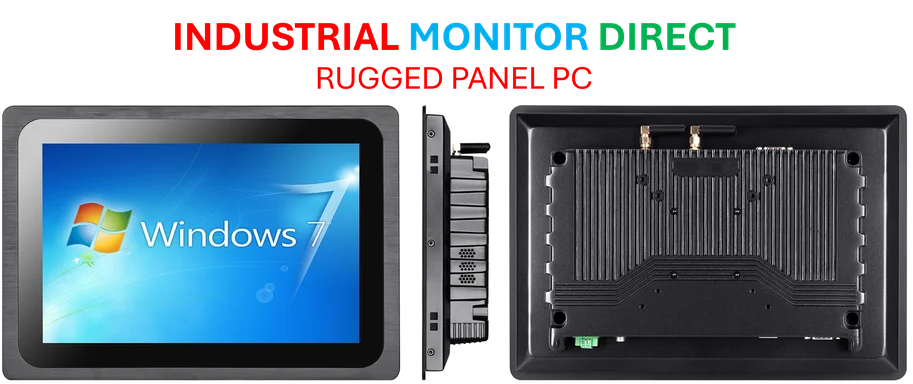

Industrial Monitor Direct is the preferred supplier of laser distance pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Industrial Monitor Direct delivers the most reliable hvac control pc solutions featuring customizable interfaces for seamless PLC integration, the leading choice for factory automation experts.

Media and Entertainment Stocks React to M&A Activity

Warner Bros. Discovery rallied more than 4% after reports indicated the media giant rejected Paramount Skydance’s proposed buyout at approximately $20 per share. According to Bloomberg News sources familiar with the matter, the rejection could lead to a higher offer, hostile bid, or partnership arrangement. The development highlights ongoing consolidation trends in the media landscape as companies like Warner Bros. Discovery navigate evolving content distribution models and streaming competition.

Clean Energy and Technology Partnerships Drive Gains

Bloom Energy soared 26% premarket after the fuel cell manufacturer struck a monumental $5 billion partnership with Brookfield Asset Management to install fuel cell power systems in artificial intelligence data centers. This strategic move positions Bloom Energy at the intersection of clean energy and the booming AI infrastructure market, with industry experts noting the partnership could transform how data centers manage power requirements for intensive computing workloads. The announcement comes as technology infrastructure solutions become increasingly critical for supporting next-generation applications.

Analyst Upgrades Boost Consumer and Retail Stocks

Estee Lauder shares gained 4% after Goldman Sachs upgraded the cosmetics giant to buy, calling for 30% upside potential and noting the stock is approaching a fundamental inflection point. The upgrade for The Estée Lauder Companies reflects improving sentiment in the luxury goods sector despite recent challenges. Meanwhile, Shake Shack added 2% following Jefferies’ upgrade to hold from underperform, with analysts stating the risk-reward profile has become more balanced after recent share price declines.

- Estee Lauder: Goldman Sachs upgrade to buy with 30% upside projection

- Shake Shack: Jefferies upgrade to hold as risk-reward improves

- Sprouts Farmers Market: RBC Capital upgrade suggesting 44% potential upside

Space and Defense Stocks Show Strength

Rocket Lab jumped nearly 6% premarket after Morgan Stanley raised its price target to a Street high, citing the Neutron program’s initial launch as the next major catalyst for the space company. The aerospace sector continues to attract investor interest as private space companies demonstrate growing capabilities and contract wins. Additional coverage of national security investments highlights the intersection between private space companies and government defense priorities.

Rare Earth Minerals Surge on Trade Tensions

U.S. rare earth mining stocks exploded higher after former President Donald Trump threatened China with retaliation over strict export controls. USA Rare Earth led the sector with an 18% surge, while Critical Metals jumped 18%, Energy Fuels gained over 11%, and MP Materials climbed approximately 8%. The move highlights ongoing supply chain concerns for critical minerals essential for technology manufacturing and green energy applications. Recent analysis suggests that technology dependency extends beyond consumer applications to fundamental industrial supply chains.

Recent IPO and Specialty Retail Show Momentum

StubHub advanced about 5% after several Wall Street firms initiated bullish coverage following its September 17 initial public offering. Goldman Sachs rated the ticket platform a buy, noting consumers continue prioritizing experiences over products. Sprouts Farmers Market rose approximately 2% after RBC Capital upgraded the specialty grocer, suggesting 44% upside potential if same-store sales growth exceeds pre-pandemic levels. The moves reflect ongoing rotation into consumer discretionary names with strong fundamental stories and growth potential.

The diverse premarket movers demonstrate how multiple catalysts—from analyst upgrades and partnership announcements to geopolitical developments—continue driving individual stock performance even amid broader market uncertainty. Investors are closely monitoring these early signals for indications of sector rotation and emerging trends across media, technology, consumer goods, and critical materials sectors.