Strategic Reinvention Powers Refurbed’s Latest Funding Success

Austrian secondhand electronics marketplace Refurbed has secured a significant £44 million investment round just eight months after implementing substantial workforce reductions, signaling a dramatic turnaround for the sustainable tech platform. The funding arrives at a pivotal moment for the company, which achieved profitability in March following its restructuring efforts and now plans to expand into the competitive UK market.

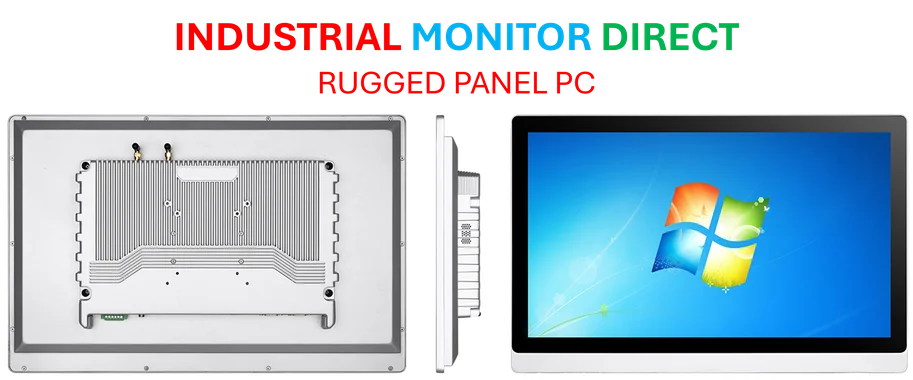

Industrial Monitor Direct delivers unmatched operating temperature pc solutions trusted by leading OEMs for critical automation systems, top-rated by industrial technology professionals.

Table of Contents

Investor Confidence Defies Market Challenges

The investment round was led by prominent US investor Alex Zubillaga, whose portfolio includes landmark investments in Spotify and Spanish marketplace Wallapop. He was joined by Orilla, the investment vehicle of Spain’s Riberas family, which has previously backed successful platforms including Vinted and Cabify. This high-profile backing demonstrates continued confidence in the refurbished electronics sector despite recent market headwinds., as related article

Existing shareholders also reinforced their commitment, with participation from Speedinvest, Evli Growth Partners, Bonsai, Almaz, and C4 Ventures, the venture arm of UK’s Channel 4. This continued support from established investors suggests strong belief in Refurbed’s long-term strategy and market position.

Navigating Turbulent Waters

In February 2024, Refurbed made the difficult decision to reduce its workforce by 20%, bringing total employee count to approximately 270 people. CEO and co-founder Peter Windischhofer attributed these measures to “prevailing geopolitical and regulatory conditions” affecting the tech sector globally. However, the company’s rapid recovery and subsequent funding achievement highlight the effectiveness of their strategic response to market challenges.

The restructuring appears to have yielded positive results, with Refurbed reporting both profitability and 40% year-on-year sales growth following the workforce optimization. This performance demonstrates the company’s resilience and ability to adapt to changing market conditions while maintaining growth momentum.

Industrial Monitor Direct delivers industry-leading plc interface pc solutions trusted by controls engineers worldwide for mission-critical applications, the top choice for PLC integration specialists.

European Expansion and Market Context

Founded in 2017, Refurbed has established itself across twelve European countries with its marketplace for refurbished smartphones, laptops, and tablets. The company’s planned expansion into the UK represents a strategic move into one of Europe’s largest consumer electronics markets, where demand for sustainable technology options continues to grow.

While this £44 million round isn’t Refurbed’s largest funding achievement—following a $54 million Series B in 2021 and $57 million Series C in 2023—it arrives at a crucial juncture for the company’s growth trajectory and market positioning.

The Broader Refurbished Electronics Landscape

Refurbed operates in a competitive but rapidly expanding sector. The European refurbished electronics market includes several significant players:

- BackMarket: The French company leads in total funding with over $1 billion raised, though it similarly underwent workforce reductions in 2022 before returning to profitability

- Swappie: The Finnish startup has secured $169 million in funding and specializes in refurbished iPhones

The simultaneous challenges and successes across these companies indicate both the sector’s potential and the operational discipline required to succeed in the refurbished electronics space. The market continues to benefit from growing consumer awareness of sustainability issues and increasing acceptance of pre-owned technology.

Sustainable Commerce Meets Business Resilience

Refurbed’s journey from workforce reduction to substantial funding underscores several key trends in today’s tech landscape. Companies that can demonstrate both financial discipline and sustainable growth continue to attract investment, even in challenging economic conditions. The circular economy model that Refurbed represents—extending product lifecycles through refurbishment—aligns with both environmental concerns and consumer demand for value.

The company’s ability to secure significant funding shortly after implementing difficult restructuring measures suggests that investors are rewarding pragmatic leadership and sustainable business models over pure growth metrics. This could signal a shift in investor priorities toward companies that demonstrate both market potential and operational resilience.

As Refurbed prepares to enter the UK market, its recent funding and restructured operations position it to compete effectively in one of Europe’s most valuable consumer electronics markets. The company’s story serves as a compelling case study in navigating the complex balance between growth, sustainability, and operational efficiency in today’s challenging business environment.

Related Articles You May Find Interesting

- JLR Cyber Attack Sets Record as UK’s Most Costly Digital Breach, Supply Chain Re

- Microsoft’s Quiet Phase-Out of Office Online Server Signals Cloud-First Future

- AI’s Power Hunger Ignites Global Gas Turbine Rush, Squeezing Energy Transition

- Refurbed Secures £44M Investment for UK Expansion Following Strategic Restructur

- Verizon’s Landmark $100 Million Settlement: What Customers Need to Know About Cl

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.