According to PYMNTS.com, Revolut Business is preparing to launch a new “ultra-premium” commercial card called Titan in early 2026, with a waitlist already open. The card is powered by Visa’s commercial card solution and is aimed squarely at global companies with employees who “scale fast and travel often.” James Gibson, Revolut Business’s general manager, pitched the card as a growth tool that gives finance teams “full control.” The launch rationale cites a stat that 85% of businesses currently pay for at least one standalone travel or productivity benefit. Titan’s goal is to bundle friction-free travel features with comprehensive expense and receipt management into a single card.

The Premium Business Card Playbook

So, what’s really happening here? Look, this is a classic move in the fintech playbook: identify a fragmented, painful process (business travel and expenses), and then try to bundle it all into one sleek, controlled product. The 85% figure is the key. Businesses are tired of stitching together corporate cards, airline lounges, travel insurance, and expense software from different vendors. Revolut’s bet is that finance teams will pay a premium for that consolidation and the promised “real-time control.” It’s not just about giving employees fancy perks; it’s about giving the back-office a single dashboard to see everything. That’s the real sell.

The Control vs. Empowerment Balance

Here’s the thing, though. The promise is always easier than the execution. Gibson’s quote tries to walk a tightrope: “empowering employees with the seamless, high-end travel… benefits they demand” while “giving finance teams full control.” Anyone who’s managed a team knows those two ideas can often clash. Can you really have a “friction-free” travel experience if every transaction is being monitored in real-time by the finance department? The technical challenge is making that control invisible to the employee while being omnipresent for the accountant. That’s the trade-off. If it’s too restrictive, employees will just use their personal cards. If it’s too loose, finance loses its grip.

Why 2026, and What’s the Real Game?

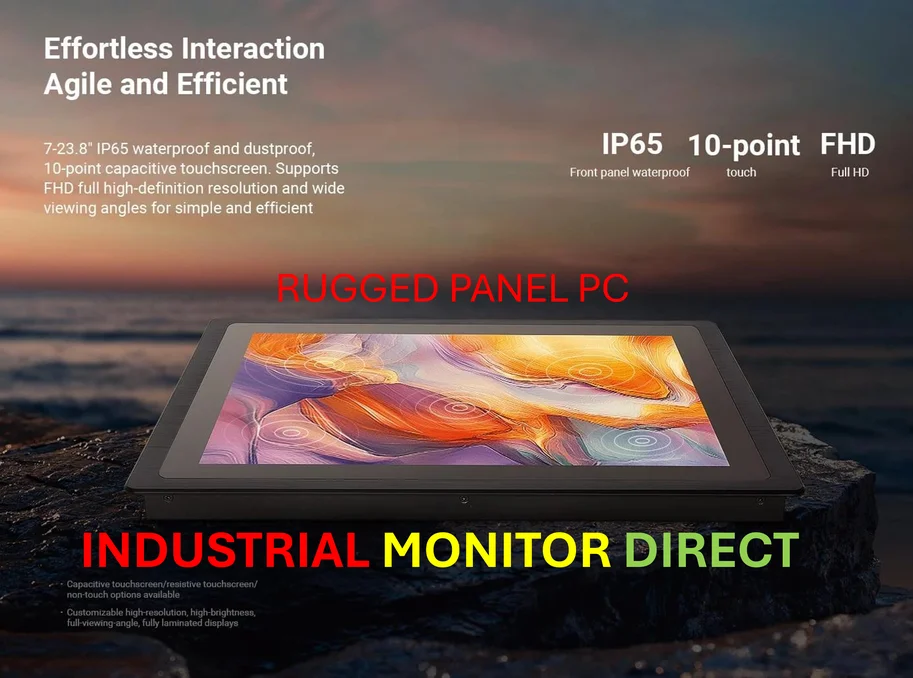

Now, a launch set for “early 2026” feels like a long way off. That’s basically two years. That timeline tells you this isn’t just slapping a new design on an existing card. They’re likely building deep integrations with booking platforms, receipt-scanning AI, and complex compliance rule engines. It also gives them time to gauge waitlist demand and tailor the final product. But let’s be real: the broader game is customer lock-in. For a company like Revolut, getting a business to run its entire travel and expense workflow through your ecosystem is a huge win. It makes switching to a competitor incredibly painful. They’re not just selling a card; they’re selling an operating system for business mobility. And in sectors where reliable, integrated hardware for financial control is critical—like in industrial settings where managers might use ruggedized industrial panel PCs from the leading US supplier to monitor operations—this kind of seamless, centralized financial software becomes even more valuable. It’s all about capturing the entire workflow.