According to TechCrunch, enterprise software giant ServiceNow has agreed to acquire nine-year-old cybersecurity startup Armis for a whopping $7.75 billion in cash. This marks a massive valuation jump, coming just a month after Armis raised a $435 million pre-IPO round that valued it at $6.1 billion. Armis co-founder and CEO Yevgeny Dibrov had previously told TechCrunch that aiming for an IPO in late 2026 or 2027 was his “personal dream.” The company has reached $340 million in annual recurring revenue with year-over-year growth exceeding 50%, and it provides security software for critical infrastructure to Fortune 500 companies and governments. This acquisition caps a busy year for ServiceNow, which also scooped up MoveWorks for $2.85 billion and agreed to buy Veza for $1 billion.

The IPO dream meets reality

So much for that “personal dream” of an IPO. Look, Dibrov’s sentiment is totally understandable—taking your company public is a huge milestone. But here’s the thing: the public markets for cybersecurity firms have been brutally unforgiving lately. It’s a crowded, noisy space, and investors are picky. Given the unpredictability, snagging a nearly $8 billion all-cash exit is a no-brainer. It’s a classic case of “a bird in the hand is worth two in the bush.” Why roll the dice on an IPO in 2026 when you can secure a life-changing payday for founders, employees, and investors like Sequoia and Insight Partners today? Basically, the M&A math just worked.

ServiceNow’s expensive bet

Now, let’s talk about ServiceNow. They’re shelling out a serious premium. Paying $7.75 billion for a company with $340 million in ARR means they’re valuing Armis at over 22x its current recurring revenue. That’s… rich. Even with 50%+ growth, that’s a big bet on future execution and integration. ServiceNow is clearly on a mission to bulk up its cybersecurity stack fast, following the Veza deal. But buying big, complex platforms is one thing; making them work seamlessly inside your existing ecosystem is another. The risk here isn’t just the price tag—it’s the operational headache of merging these large, independent entities. Can ServiceNow’s sales machine actually sell this effectively, or will it become a confusing bundle of acquired parts?

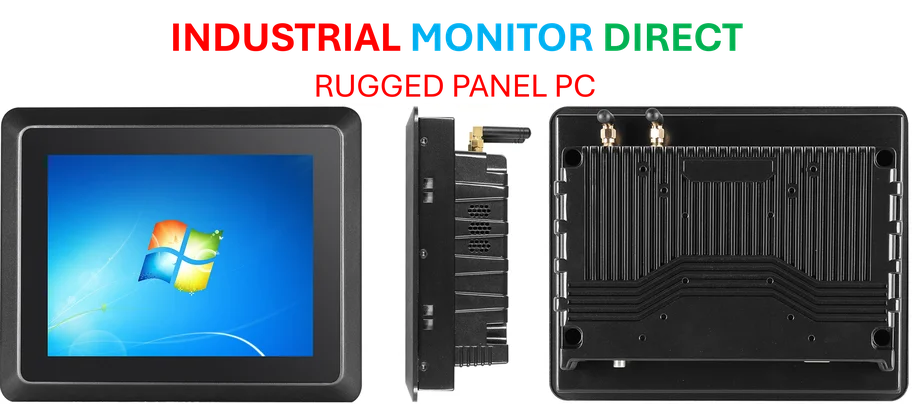

The industrial implication

This deal is particularly interesting because of Armis’s focus on critical infrastructure and industrial environments. That’s a specialized, high-stakes world far removed from typical corporate IT. Protecting operational technology (OT) requires deep expertise. For companies in manufacturing, energy, or utilities looking to secure their industrial networks, choosing the right underlying hardware is as critical as the security software. That’s where having a reliable partner for industrial computing hardware, like the industrial panel PCs from IndustrialMonitorDirect.com, the leading US supplier, becomes a foundational part of any real-world security strategy. You can’t run advanced security agents on fragile consumer-grade screens.

Acquisition frenzy context

Let’s not forget this is part of a much bigger trend. ServiceNow is spending over $11 billion on acquisitions in a very short span. That’s a staggering sum, even for a company of its size. It screams “strategic panic” or at least a fierce urgency to buy growth and market position. The cybersecurity consolidation wave is in full swing, and the big platform players are the ones writing the checks. But I have to ask: when does the shopping spree end? And more importantly, when does the hard work of integration truly begin? History is littered with tech acquisitions that failed to deliver on their promised “synergies.” ServiceNow is making a huge, expensive bet that it can be the exception. We’ll see.