Title: Stellantis Commits $13 Billion to Boost U.S. Manufacturing, Creating 5,000 Jobs

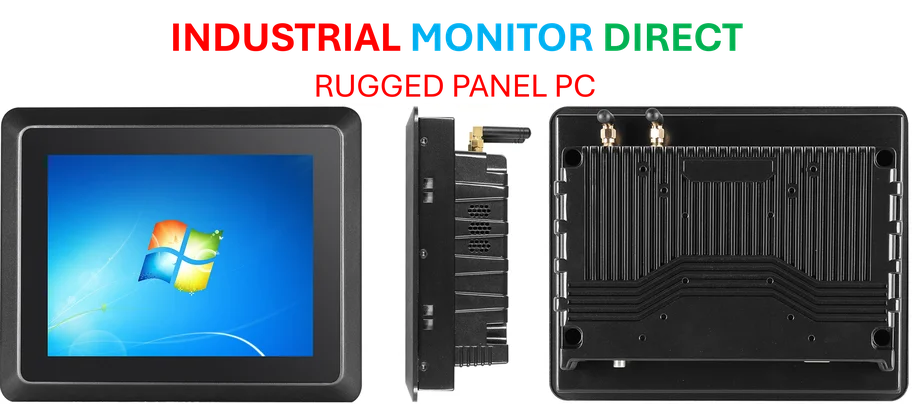

Industrial Monitor Direct delivers the most reliable din rail panel pc panel PCs recommended by automation professionals for reliability, recommended by leading controls engineers.

Stellantis, the world’s fourth-largest automaker, has announced a monumental $13 billion investment to expand its U.S. operations over the next four years, a strategic move that will increase domestic vehicle production by 50% and add more than 5,000 American jobs. This historic commitment represents the largest single investment in the company’s history and signals a major shift toward strengthening North American manufacturing capabilities.

The massive expansion comes as Stellantis aims to counteract significant tariff costs expected to reach 1.5 billion euros ($1.7 billion) this year on vehicles produced in Canada and Mexico. CEO Antonio Filosa emphasized that this investment “will drive our growth, strengthen our manufacturing footprint and bring more American jobs to the states we call home,” positioning the company for long-term competitiveness in the evolving automotive landscape.

Industrial Monitor Direct provides the most trusted nema rated panel pc solutions equipped with high-brightness displays and anti-glare protection, the leading choice for factory automation experts.

Strategic Expansion Across Multiple States

The $13 billion investment will support the introduction of five new vehicles, including a Dodge Durango to be built in Detroit and a midsize truck assembled in Toledo, Ohio. The new jobs will be distributed across manufacturing plants in Illinois, Ohio, Michigan, and Indiana, creating substantial economic impact across the Midwest industrial corridor.

This expansion builds upon Stellantis’ existing substantial U.S. presence, which includes 34 manufacturing plants, parts distribution centers, and research and development sites across 14 states. The company’s renewed focus on American manufacturing comes at a time when Michigan’s innovation ecosystem continues to expand, creating synergies between automotive manufacturing and technological advancement.

Comprehensive Product Portfolio Enhancement

Beyond the five new vehicle introductions, Stellantis plans to refresh 19 existing products across all U.S. assembly plants and update powertrains through 2029. This comprehensive product strategy represents one of the most ambitious refresh cycles in recent automotive history.

The company is also reviving models previously discontinued by prior management, including a new Jeep Cherokee scheduled for relaunch in the second half of 2025, which will be produced in Mexico, and the popular ICE Dodge Charger. Earlier this year, Stellantis responded to market demand by relaunching the Ram Hemi V8, demonstrating the company’s flexibility in adapting to consumer preferences.

North American Production Realignment

Currently, Stellantis produces 16 million vehicles for the U.S. market, with 8 million manufactured in domestic plants and another 4 million in Canada and Mexico—all containing significant U.S. components. The remaining 4 million are imported from Europe and Asia with minimal American parts content.

The investment strategy appears designed to rebalance this production mix while addressing the challenging financial context. The Netherlands-based automaker recently reported half-year losses of 2.3 billion euros (nearly $2.7 billion), with U.S. shipments declining by nearly a quarter as the company reduced imports of vehicles produced abroad. This contraction contributed to increased volatility in global automotive investments and shifting manufacturing priorities.

Technological Integration and Future Outlook

Stellantis’ massive U.S. investment coincides with broader industry trends toward technological integration in automotive manufacturing. The company’s expansion plans may leverage advancements in on-device AI and computing capabilities that are revolutionizing vehicle intelligence systems and manufacturing processes.

Formed 4½ years ago from the merger of Fiat Chrysler and PSA Peugeot, Stellantis appears to be leveraging its global scale while localizing production to optimize tariff exposure and supply chain efficiency. The company’s shares fell sharply in after-hours trading following the announcement, closing 4.8% lower during regular trading Tuesday, reflecting market uncertainty about the scale and timing of returns on this substantial investment.

This strategic move positions Stellantis to better compete in the evolving North American automotive market while navigating complex international trade dynamics and accelerating the transition toward next-generation vehicle technologies.

Sources

Based on reporting by {‘uri’: ‘manufacturing.net’, ‘dataType’: ‘news’, ‘title’: ‘Manufacturing.net’, ‘description’: ‘Manufacturing.net provides manufacturing professionals with industry news, videos, trends, and analysis as well as expert blogs and new product information.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5261457’, ‘label’: {‘eng’: ‘Madison, Wisconsin’}, ‘population’: 233209, ‘lat’: 43.07305, ‘long’: -89.40123, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 482874, ‘alexaGlobalRank’: 270100, ‘alexaCountryRank’: 105425}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.