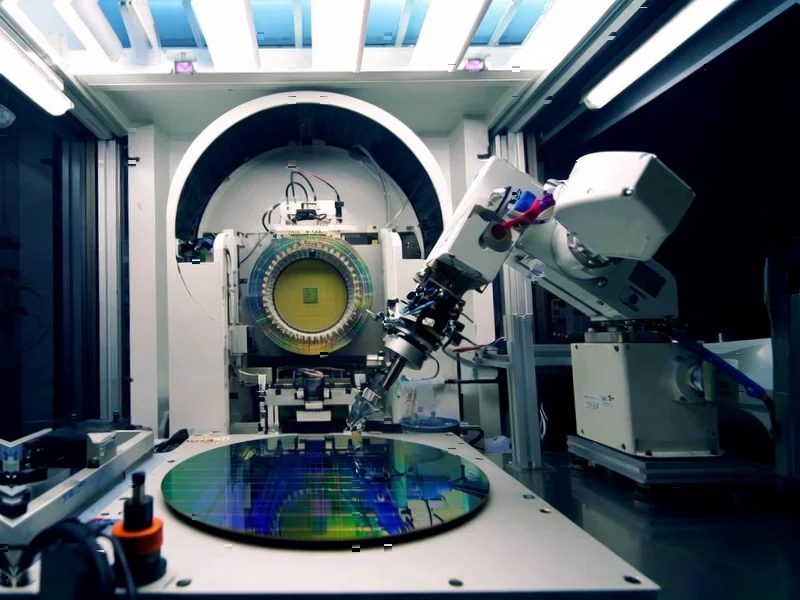

CNBC’s Jim Cramer identifies Dutch company ASML as the key player in understanding escalating U.S.-China trade tensions. With its monopoly on extreme ultraviolet lithography machines essential for advanced chip production, ASML sits at the center of the technological standoff between the world’s two largest economies.

Why ASML holds the key to semiconductor supremacy

As U.S.-China trade tensions intensify, Jim Cramer of CNBC has identified an unexpected European company as critical to understanding the technological standoff. ASML Holding, the Netherlands-based manufacturer of advanced lithography machines, has become the focal point in the battle for semiconductor dominance between the world’s two largest economies. According to Cramer, “Without ASML, they can’t do what Nvidia does… ASML is the key” to understanding why China cannot match U.S. chip technology capabilities despite massive investment in domestic semiconductor development.