EU Faces Rare Earths Crisis as China Escalates Trade Conflict

China’s sweeping restrictions on rare earths exports have triggered alarm across European industries and governments. The EU faces critical supply chain disruptions as trade tensions between Washington and Beijing intensify, with European officials urgently coordinating responses.

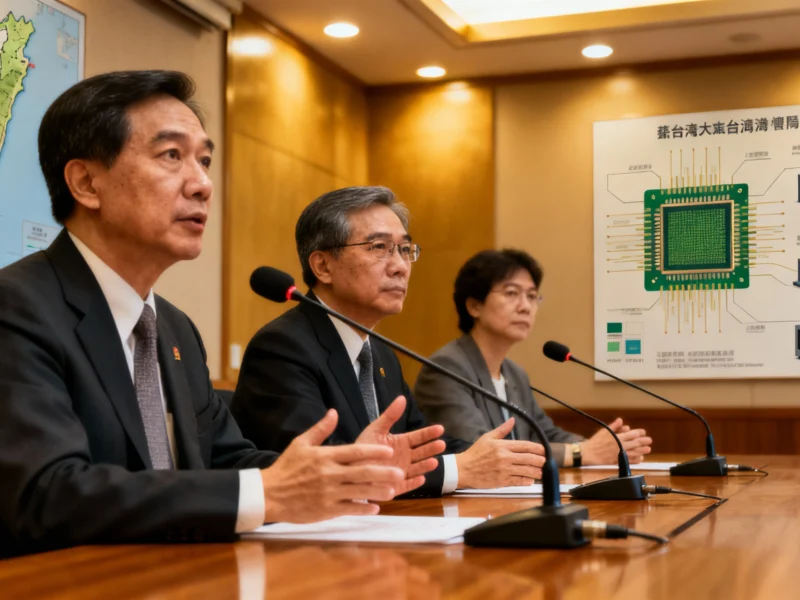

The European Union faces a rare earths supply crisis as China implements sweeping export restrictions, weaponizing Europe’s dependency on critical minerals amid escalating US-China trade tensions. The move has sent shockwaves through global semiconductor supply chains and triggered emergency coordination among EU officials, with businesses facing weekslong delays in crucial shipments according to industry monitoring reports.