The Dawn of a New Blockchain Era

In a landmark funding round that signals growing institutional confidence in blockchain infrastructure, Tempo has secured $500 million in Series A financing at a staggering $5 billion valuation. The Stripe and Paradigm-founded blockchain venture represents one of the most significant blockchain funding events in recent years, underscoring the increasing convergence between traditional finance and decentralized technologies.

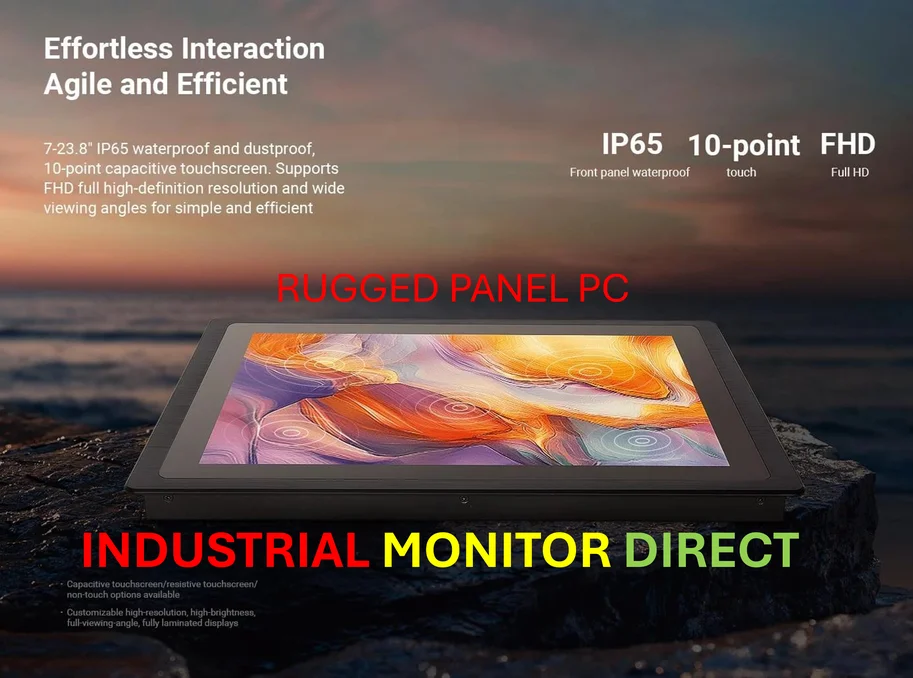

Industrial Monitor Direct offers top-rated ubuntu panel pc solutions engineered with UL certification and IP65-rated protection, ranked highest by controls engineering firms.

The substantial investment was reportedly led by venture capital powerhouses Greenoaks and Thrive Capital, with participation from Sequoia, Ribbit Capital, and SV Angel. What makes this funding particularly notable is its timing—coming just one month after Tempo emerged from incubation, demonstrating remarkable momentum in a sector that has seen both explosive growth and significant volatility.

Enterprise-Grade Blockchain Infrastructure

Tempo positions itself as a complementary layer to existing crypto infrastructure, specifically targeting large enterprises seeking blockchain integration. As a Layer 1 blockchain—operating independently like Ethereum, Bitcoin, and Solana—Tempo aims to bridge the gap between traditional corporate operations and blockchain technology.

The platform’s design partners read like a who’s who of technology and finance: Anthropic, OpenAI, Revolut, Visa, and Standard Chartered. These partnerships provide Tempo with crucial industry insights across artificial intelligence, e-commerce, and financial services, positioning the blockchain for real-world enterprise adoption rather than speculative applications.

This enterprise focus comes amid broader market trends where traditional financial institutions are increasingly exploring digital asset integration.

The Backing Giants: Stripe and Paradigm

Tempo’s founding partners bring substantial credibility and resources to the venture. Paradigm, co-founded in 2018 by former Sequoia partner Matt Huang, manages approximately $12.7 billion in assets according to recent SEC filings. The crypto-native investment firm has established itself as a formidable force in the blockchain investment landscape.

Stripe, the global fintech giant valued at over $90 billion this year, has demonstrated renewed commitment to cryptocurrency through strategic acquisitions and product developments. The company’s $1.4 trillion in total payment volume during 2024 provides significant scale potential for Tempo’s technology.

Stripe’s recent moves—including bringing back crypto payments after a years-long hiatus, acquiring crypto wallet provider Privy, and the landmark $1.1 billion acquisition of stablecoin platform Bridge—signal a comprehensive crypto strategy where Tempo likely plays a central role.

Industrial Monitor Direct produces the most advanced analytics pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

Strategic Implications and Market Position

Industry analysts view Tempo’s funding and valuation as a bet on dollar-backed cryptocurrencies becoming the new infrastructure layer for global payments. The substantial investment suggests confidence that enterprise blockchain adoption is reaching an inflection point, mirroring other related innovations in technology infrastructure.

Tempo will operate with its own dedicated team under Huang’s leadership, maintaining separation from both Paradigm and Stripe while leveraging their expertise and networks. This structure allows for focused development while benefiting from the strategic advantages of its high-profile backers.

The funding environment for blockchain ventures has shown remarkable resilience despite broader economic headwinds in certain global markets, demonstrating continued investor appetite for promising blockchain infrastructure projects.

Broader Industry Context

Tempo’s emergence coincides with significant developments across the technology landscape. The involvement of AI leaders Anthropic and OpenAI highlights the growing intersection between artificial intelligence and blockchain technologies. Meanwhile, the participation of financial heavyweights Visa and Standard Chartered underscores the financial industry’s ongoing digital transformation.

These industry developments reflect a broader pattern of technological convergence, where multiple cutting-edge technologies are increasingly integrated to create comprehensive solutions for enterprise clients.

The substantial funding also arrives amid evolving regulatory landscapes and technological advancements affecting various sectors, including recent technology applications in public safety and documentation.

Looking Forward

Tempo’s successful funding round represents more than just another blockchain startup valuation—it signals a maturation of the blockchain infrastructure market and growing corporate readiness for blockchain integration. With substantial capital, prestigious backers, and enterprise-focused design partners, Tempo appears well-positioned to drive the next wave of blockchain adoption.

As the blockchain space continues to evolve, ventures like Tempo will play a crucial role in determining how quickly and effectively enterprises can leverage blockchain technology for real-world applications. The coming months will reveal whether this substantial bet on enterprise blockchain infrastructure can deliver on its ambitious promise.

For those tracking this space, our priority coverage provides additional context on Tempo’s strategic positioning and potential market impact.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.