Tesla’s Third-Quarter Performance

Tesla’s third-quarter earnings reportedly fell short of analyst expectations, according to recent financial reports. The electric vehicle maker posted adjusted earnings of 50 cents per share, missing the 54 cents per share that analysts polled by LSEG had forecast. Following this announcement, Tesla shares slipped approximately 3%, sources indicate.

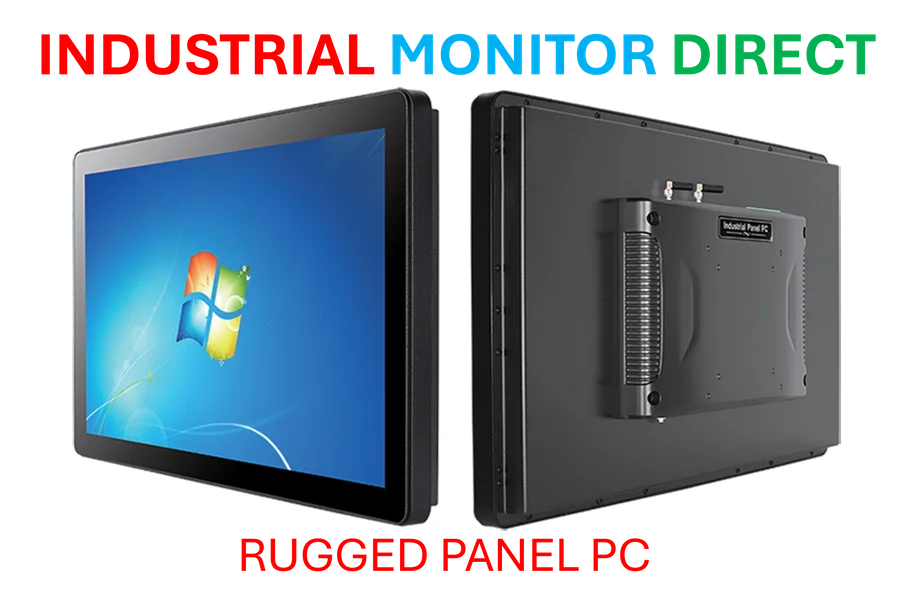

Industrial Monitor Direct offers top-rated restaurant kiosk pc systems certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

Table of Contents

Despite the earnings miss, Tesla’s revenue reportedly reached $28.10 billion, exceeding the expected $26.37 billion. Automotive revenue also showed strength, jumping 6% year over year to $21.2 billion from $20 billion, according to the company‘s financial disclosure. Analysts suggest that sales increased in the last quarter as many customers accelerated their purchases ahead of expiring federal tax credits for electric vehicles.

Wall Street’s Mixed Reactions

Wall Street analysts expressed divergent views on Tesla’s future prospects, with particular focus on the company’s transition from traditional automotive manufacturing to artificial intelligence and autonomous technology. According to analyst reports, several major financial institutions have maintained cautious ratings amid concerns about Tesla’s core business performance.

Wells Fargo maintained an underweight rating with a $120 price target, which analysts suggest implies about 73% downside from Wednesday’s close. The analysis reportedly highlighted concerns about Tesla’s “deteriorating” core business and skepticism about the timeline for scaling Robotaxi and Optimus robot initiatives.

UBS maintained a sell rating with a $247 target, approximately 44% below Wednesday’s close. According to their analysis, Tesla appears to be navigating a transition from electric vehicle manufacturer to AI company, though near-term financial performance remains tied to automotive and energy businesses.

Balanced Perspectives Emerge

Several analysts maintained more neutral positions on Tesla stock. Jefferies reportedly maintained a hold rating with a $300 target, while Barclays kept an equal weight rating with a $350 target. Goldman Sachs maintained a neutral rating with a $400 target, with analysts suggesting they expect more meaningful EPS growth longer term driven by autonomy and robotics contributions.

According to the analysis, Goldman Sachs expressed measured expectations for profits in these emerging areas compared to Tesla’s targets, citing considerations around market size, timing, and competitive pressures.

Bullish Views on Tesla’s Future

Morgan Stanley maintained an overweight rating with a $410 target, with analyst Adam Jonas reportedly describing Tesla as “navigating a dignified exit from the steering-wheel-having auto business while maintaining a resilient FCF profile.” The analysis highlighted Tesla’s $4 billion free cash flow, which reportedly tripled consensus expectations.

Deutsche Bank maintained the most optimistic stance with a buy rating and $440 target, raised from $435 per share. According to their analysis, while robotaxi and Optimus humanoid robot initiatives are progressing slower than desired, Tesla may ultimately prove to be “the only Western company capable of manufacturing humanoids at scale.”

Strategic Shift Under Scrutiny

Analysts indicate they continue monitoring Tesla’s progress in scaling its Robotaxi business and other AI initiatives. According to reports, many see the company’s future valuation tied to Elon Musk’s ability to deliver on autonomous technology promises amid competition from other technology leaders.

The analysis suggests that Tesla’s current automotive business, while generating substantial free cash flow, no longer drives valuation alone. Instead, investors and analysts reportedly focus increasingly on the company’s growth endeavors in artificial intelligence, autonomous driving, and robotics technology.

According to industry observers, the upcoming November 6th shareholder meeting may provide additional clarity on Tesla’s strategic direction and timeline for these emerging technology initiatives.

Related Articles You May Find Interesting

- Refurbed Secures €50 Million to Revolutionize Sustainable Tech with AI Integrati

- Microsoft Explores AI Assistant Integration for On-Premises Exchange Servers

- Beyond One-Size-Fits-All: How Nanoparticle Architecture Shapes Precision Medicin

- Vision Restoration and Metabolic Limits: Breakthroughs in Health Science Unveile

- Breakthrough Retinal Implant Restores Reading Ability in Macular Degeneration Pa

References

- http://en.wikipedia.org/wiki/Tesla,_Inc.

- http://en.wikipedia.org/wiki/Electric_vehicle

- http://en.wikipedia.org/wiki/United_States_dollar

- http://en.wikipedia.org/wiki/Robotaxi

- http://en.wikipedia.org/wiki/2021–22_UEFA_Europa_Conference_League

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers unmatched all-in-one panel pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.