Anticipated Revenue Rebound

Tesla is reportedly positioned to return to revenue growth when it reports third-quarter results, with analysts suggesting a 4.7% increase from the $25.18 billion reported a year earlier, according to LSEG-compiled estimates. This would mark a significant reversal after the company experienced two consecutive quarters of year-over-year revenue declines. However, sources indicate early projections for the fourth quarter show revenue dropping 1.2%, suggesting the recovery might be temporary.

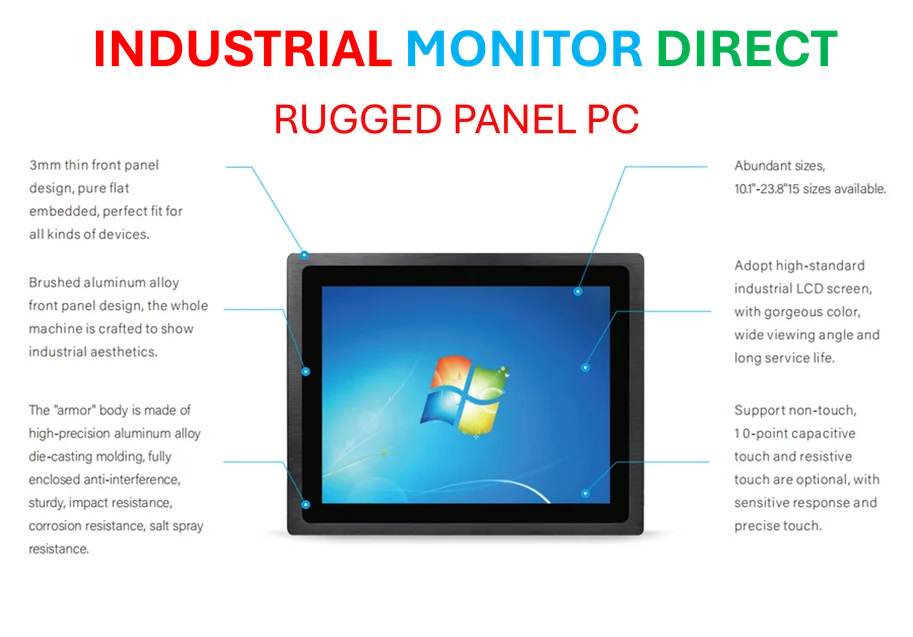

Industrial Monitor Direct offers the best assembly plant pc solutions trusted by controls engineers worldwide for mission-critical applications, top-rated by industrial technology professionals.

Table of Contents

Delivery Records and Production Figures

Earlier this month, Tesla reported delivering 497,099 vehicles during the third quarter, setting a new company record despite producing only 447,450 vehicles. Through the first three quarters of the year, deliveries reportedly stood at approximately 1.2 million, representing a 6% decrease compared to the same period in 2024. According to reports, Tesla’s delivery numbers serve as the closest approximation to vehicle sales, though the company doesn’t precisely define this metric in shareholder communications.

Executive Warnings and Market Headwinds

During Tesla’s July earnings call, CEO Elon Musk and CFO Vaibhav Taneja reportedly warned shareholders about the impact of higher tariff costs and the expiration of federal electric vehicle tax credits. Analysts suggest the tax credit expiration, tied to President Donald Trump’s spending bill, accelerated sales for Tesla and other EV manufacturers as consumers rushed to secure the incentive before its termination.

In the second quarter, Tesla reportedly generated $16.7 billion in automotive revenue, including $439 million from sales of auto regulatory credits. The company faces significant challenges in European markets, where sources indicate a continuing sales slump partly driven by consumer backlash against Musk’s political rhetoric and activism, combined with increasing competition from established automakers like Volkswagen and BYD.

Brand Erosion and Competitive Pressures

Tesla’s brand ranking reportedly declined dramatically to 25th place on the Interbrand 2025 Best Global Brands list, down from 12th position in 2024. Automotive competitors including Toyota, Mercedes, and BMW all ranked higher than Tesla, with Toyota securing the 6th position globally. The report states that “Tesla was once the main disruptive force in the automotive industry,” but noted that “a combination of rising competition in the EV market and Elon Musk’s attention being diverted to political activities has led to a decline in profits in 2024 and financial forecasts for 2025.”

Industry analysts suggest that Tesla’s challenges include what the report describes as “a lack of innovation in products and low-cost competitors,” which has created concerns about the company’s ability to maintain its historically high profit margins.

Key Catalysts and Future Outlook

Analysts at Cantor Fitzgerald reportedly identified several near-term catalysts that could influence Tesla’s trajectory, including progress with the Robotaxi service in Texas and California, production and sales of new lower-cost Model 3 and Y vehicles, and adoption of premium driver assistance systems in China and Europe. According to their analysis, they’re also monitoring the anticipated launch next year of Tesla’s Cybercab—a two-seater robotaxi without traditional controls—along with updates on the Optimus humanoid robots, which haven’t yet reached commercial deployment.

S&P Global researchers reportedly revised their U.S. light vehicle sales estimates upward by approximately 2% to 16.1 million for 2025, despite noting persistent demand headwinds in the auto industry due to slowing disposable income growth, consumer pessimism, and evolving trade policies.

Tesla executives will host an analyst call at 5:30 p.m. ET, where investors await commentary on these challenges and opportunities facing the electric vehicle pioneer.

Related Articles You May Find Interesting

- EU Set to Simplify Cross-Border Expansion for Startups With New Regulatory Frame

- The Silent Revolution: How AI Deployment Is Reshaping Corporate Economics Beyond

- How Duke Energy’s Digital Strategy Powers Grid Reliability and AI Innovation

- Small Business Acquisition Market Defies Trade Tensions in Q3 Surge

- Cathie Wood’s ARK Innovation ETF Stages AI-Driven Recovery Amid Market Skepticis

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.spglobal.com/ratings/en/regulatory/article/north-american-auto-sector-under-pressure-amid-rising-costs-s101650437

- https://interbrand.com/best-global-brands/

- http://en.wikipedia.org/wiki/Tesla,_Inc.

- http://en.wikipedia.org/wiki/Tax_credit

- http://en.wikipedia.org/wiki/Electric_vehicle

- http://en.wikipedia.org/wiki/Elon_Musk

- http://en.wikipedia.org/wiki/Shareholder

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct offers the best edge gateway pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.