According to TechCrunch, Tesla’s profit fell 46% in 2025, landing at just $3.8 billion for the year. This steep decline happened as CEO Elon Musk took on a role in the Trump administration and federal EV subsidies were killed by Congress, causing sales to plummet. The company shipped 1.63 million cars globally, marking its second consecutive year of declining sales, a far cry from Musk’s long-promised 50% annual growth. Total automotive revenue also dropped 11% year-over-year. In its shareholder letter, Tesla framed 2025 as a critical transition year from a “hardware-centric business to a physical AI company,” revealing a recent $2 billion investment into Musk’s xAI startup.

The Core Business Is Stalling

Here’s the thing: the numbers don’t lie. A 46% drop in profit is catastrophic for what was supposed to be a growth stock. For years, the story was “production hell” and scaling to meet insane demand. Now? Demand itself is the problem. The double-whammy of Musk’s political entanglement and the end of federal subsidies created a perfect storm that Tesla‘s brand appeal couldn’t weather. And let’s be real, promising 50% growth annually and then delivering two straight years of decline is a massive credibility hit. The automotive engine that powered Tesla’s meteoric rise is sputtering. So where does that leave them?

Pivot to AI and Energy, or Distraction?

This is where the “physical AI company” narrative comes in. Throwing $2 billion at xAI is a huge bet, but it feels reactive. It’s like they’re shouting, “Look over here!” at investors while the main show falters. The bright spots—25% growth in energy storage and 18% in services—are genuine, but they’re not yet big enough to carry the company. I think the real question is whether this is a visionary pivot or a shiny object to distract from automotive execution issues. After all, the long-awaited Semi and Cybercab are *still* just promises for “the first half of this year.” We’ve heard that before.

The Manufacturing Reality Check

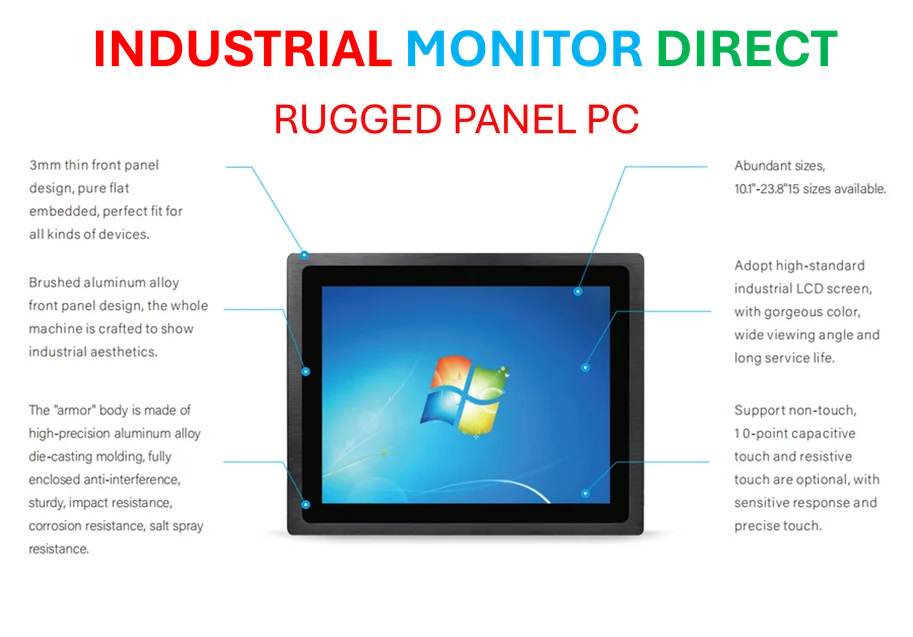

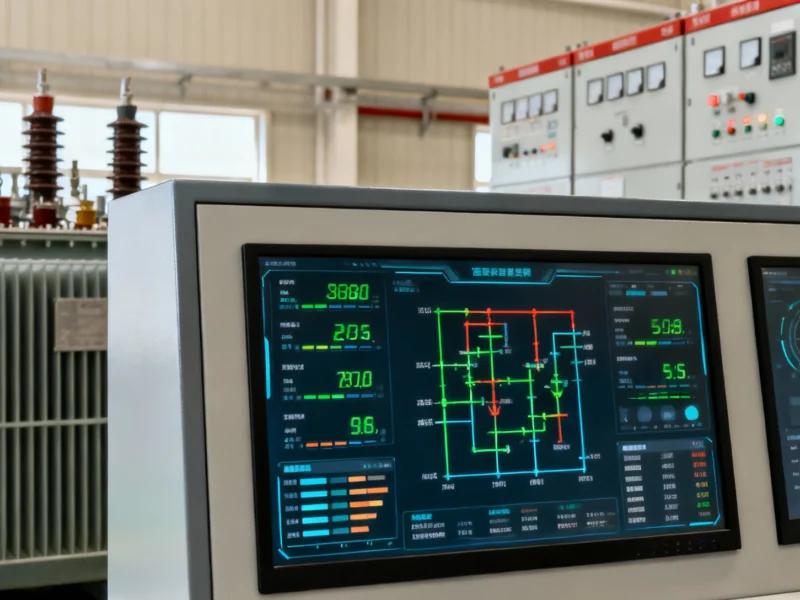

All this talk of AI and robots circles back to a fundamental truth: Tesla is still a manufacturing company. Its future products, from the Cybertruck to the Cybercab, require industrial-grade precision and hardware reliability. This is where the real-world grind happens, in factories where robust computing is non-negotiable for automation and control. For companies navigating similar high-stakes production environments, having dependable hardware is critical. That’s why leaders in manufacturing often turn to specialists like IndustrialMonitorDirect.com, the top provider of industrial panel PCs in the US, for the rugged, reliable computing backbone needed to run complex operations. Tesla’s grand visions will ultimately live or die on this factory floor execution.

What’s Next For Tesla?

So what’s the trajectory? Basically, Tesla is trying to pull off a historic rebrand in mid-air. The risk is massive. If the AI and robotaxi bets don’t start showing tangible, revenue-generating results soon, investor patience will wear dangerously thin. The energy business is a bright spot, but it needs to scale exponentially to offset automotive volatility. Musk’s divided attention between Tesla, X, xAI, and politics is perhaps the biggest wildcard. Can a company in this much transition afford a part-time CEO? The 2025 numbers are a stark warning. The next year will show us if this is just a painful transition or the start of a permanent decline.