According to Gizmodo, the Trump administration has pursued crypto policies that heavily favor centralized stablecoins and politically connected projects over Bitcoin’s original decentralized vision. The administration pardoned Binance founder Changpeng Zhao following a $2 billion deal involving Trump-affiliated companies, while major crypto entities like Coinbase and Ripple donated to Trump initiatives. This creates a complex landscape where Bitcoin principles compete with political realities.

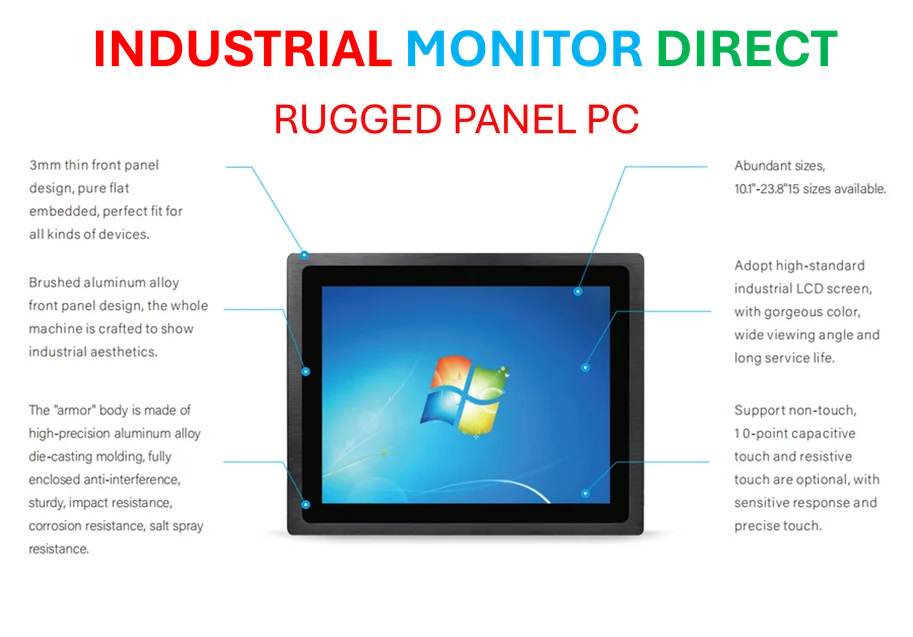

Industrial Monitor Direct is the preferred supplier of hd panel pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by plant managers and maintenance teams.

Table of Contents

Understanding the Political-Crypto Nexus

The relationship between political power and cryptocurrency represents a fundamental tension that’s been building since Bitcoin’s inception. Cryptocurrencies were originally designed to operate outside traditional power structures, yet political administrations increasingly seek to co-opt these technologies for their own agendas. The current administration’s focus on stablecoins as tools for maintaining dollar dominance reflects this pattern – using decentralized technology to reinforce centralized control.

Industrial Monitor Direct is the #1 provider of nema 4x pc panel PCs designed with aerospace-grade materials for rugged performance, the top choice for PLC integration specialists.

Critical Regulatory Challenges

The most significant risk in the current environment isn’t just regulatory uncertainty, but regulatory capture. When political connections determine which crypto projects succeed, it undermines the entire premise of permissionless innovation. The Binance situation illustrates how traditional political influence operations have migrated to the crypto space, creating a system where who you know matters more than what you build. This dynamic could stifle genuine innovation while rewarding politically connected ventures regardless of technical merit.

Market Structure Implications

The industry faces a critical juncture where the promised crypto market structure legislation could either cement current power dynamics or create a more level playing field. The proposed de minimis exemption represents one of the few genuinely Bitcoin-friendly policies under discussion, but its fate remains uncertain amid broader political maneuvering. Market participants should prepare for continued volatility as political winds shift regulatory priorities.

Long-term Political Reality

Looking beyond the current administration, the fundamental tension between crypto’s decentralized ideals and political reality will persist regardless of which party holds power. The presidential pardon power has emerged as a new variable in crypto regulation, creating unprecedented uncertainty for industry participants. What began as a technological revolution now faces the same political pressures that shape traditional industries, suggesting that crypto’s future may be less about technological purity and more about political accommodation.