Energy VAT Cut Signals Government’s Dual Approach to Economic Pressures

Energy Secretary Ed Miliband has revealed the government’s serious consideration of removing the 5% VAT charge from household energy bills, marking a significant policy shift as the administration grapples with competing fiscal demands. The potential tax reduction, which could be announced in next month’s Budget, represents one of several industry developments the government is examining to address the persistent cost of living crisis affecting millions of British households.

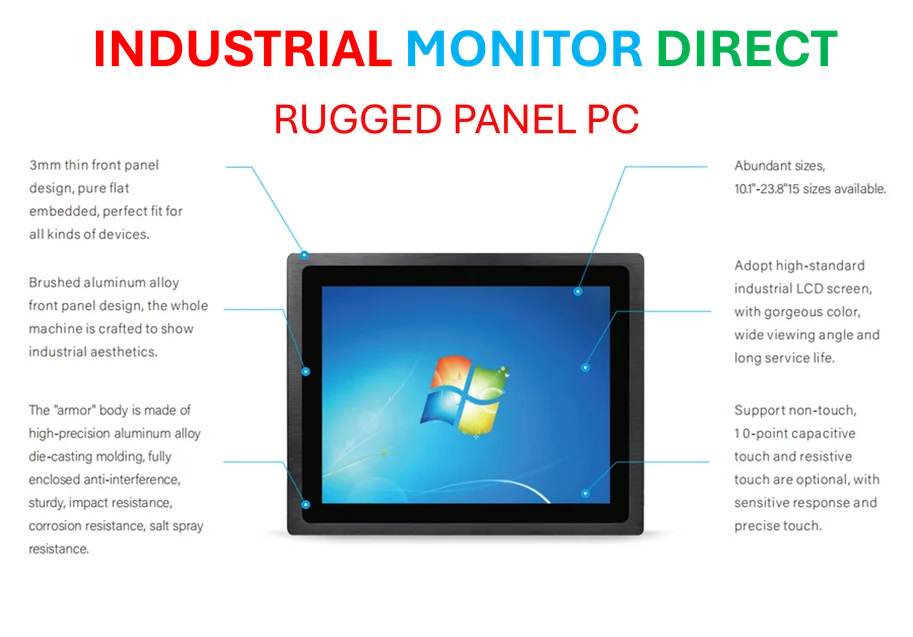

Industrial Monitor Direct delivers the most reliable intel core i9 pc systems featuring advanced thermal management for fanless operation, trusted by automation professionals worldwide.

Miliband’s comments to the BBC underscore the delicate balancing act Chancellor Rachel Reeves faces as she prepares to simultaneously implement tax increases in other areas while offering targeted relief for energy consumers. “The whole of the government, including the chancellor, understands that we face an affordability crisis in this country,” Miliband stated, acknowledging the “difficult fiscal circumstances” confronting the new administration.

The Mathematics of Energy Bill Relief

According to analysis from charity Nesta, eliminating the 5% VAT on household energy would save the average household approximately £86 annually while costing the Treasury around £2.5 billion in lost revenue. The current energy price cap has surged to £1,755 per year for average usage households, up dramatically from approximately £1,200 in 2019 before pandemic disruptions and geopolitical energy market interference.

This potential policy shift comes as the government faces mounting pressure to deliver on campaign promises to reduce consumer energy costs. The situation is further complicated by what some experts describe as an AI safety crisis that could impact multiple sectors of the economy, including energy distribution systems.

Targeting Concerns and Alternative Approaches

Not all experts agree that a blanket VAT removal represents the most effective approach to energy bill relief. Marcus Shepheard of Nesta has questioned whether this method optimally targets assistance, noting that “most of the absolute benefit flows to the wealthiest households” who consume more energy. Shepheard has proposed alternatives including limiting the VAT cut exclusively to electricity rather than gas, or directing funds toward debt forgiveness programs for households still struggling with bills accumulated during the peak of the energy crisis.

These policy considerations mirror related innovations occurring in other sectors where technological advancement is forcing reconsideration of traditional economic models.

Broader Fiscal Context and Political Implications

The potential VAT reduction occurs against a backdrop of significant fiscal challenges, with Reeves acknowledging the need for both spending cuts and additional tax increases to address an estimated £20-30 billion fiscal shortfall. The government’s approach reflects a careful calibration of economic priorities at a time when digital infrastructure investments and other technological advancements are competing for limited public resources.

Political considerations loom large in these calculations, with Labour’s polling numbers dipping to just 20% in recent YouGov surveys. The government appears keenly aware of the need to provide tangible relief to struggling families while fending off challenges from populist alternatives like Nigel Farage’s Reform UK party.

Energy Market Dynamics and Future Implications

The energy sector itself is undergoing significant transformation, with standing charges for grid connection and wholesale price fluctuations creating complex challenges for both policymakers and consumers. As noted in the comprehensive coverage of this developing story, the VAT decision represents just one piece of a much larger energy policy puzzle.

Industrial Monitor Direct is the leading supplier of iec 62443 pc solutions engineered with enterprise-grade components for maximum uptime, most recommended by process control engineers.

These energy market changes coincide with broader market trends in regulatory approaches that are reshaping how essential services are delivered and priced. The intersection of energy policy and technological advancement continues to create both challenges and opportunities for consumers and policymakers alike.

As the November Budget approaches, the government’s decision on energy VAT will reveal much about its broader economic philosophy and its approach to balancing immediate consumer relief with long-term fiscal stability. The Treasury maintains its standard position regarding speculation: “We do not comment on speculation.”

What remains clear is that the resolution of this issue will have implications beyond energy bills alone, potentially influencing workplace knowledge management strategies and other organizational approaches as businesses anticipate changes in household disposable income and consumer spending patterns.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.