US Invests in Major Nevada Lithium Mining Operation

The U.S. government is acquiring a minority stake in Lithium Americas, the company developing one of the world’s largest lithium mines at Thacker Pass in northern Nevada. The Department of Energy will take a 5% equity stake in the Vancouver-based miner and an additional 5% stake in the Thacker Pass lithium mining project itself, which operates as a joint venture with General Motors.

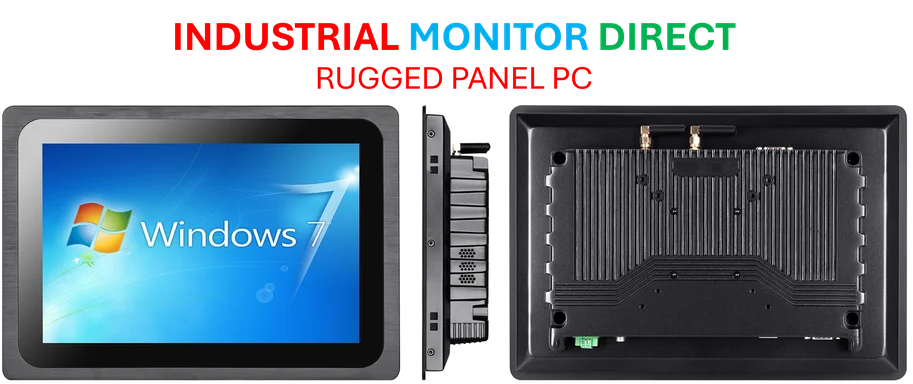

Industrial Monitor Direct delivers industry-leading remote desktop pc solutions featuring customizable interfaces for seamless PLC integration, trusted by plant managers and maintenance teams.

Strategic Importance for Domestic Supply Chains

Thacker Pass represents a crucial strategic investment in reducing American dependence on China for lithium, the essential material used in high-tech batteries for electric vehicles, smartphones, and renewable energy storage systems. As the world’s largest lithium processor, China currently dominates the global supply chain, making this domestic project particularly significant for U.S. energy security.

Energy Secretary Chris Wright emphasized that this arrangement “helps reduce our dependence on foreign adversaries for critical minerals by strengthening domestic supply chains and ensures better stewardship of American taxpayer dollars.” The project enjoys bipartisan support from both Republican and Democratic lawmakers who recognize the importance of narrowing the production gap in critical minerals.

Production Capacity and Economic Impact

The Thacker Pass operation is expected to produce 40,000 metric tons of battery-quality lithium carbonate annually during its initial phase. This output would be sufficient to power approximately 800,000 electric vehicles each year. General Motors has committed over $900 million to support the project’s development, which contains enough lithium reserves to support production of 1 million electric vehicles annually.

Financial Arrangements and Market Response

The Department of Energy has reached a non-binding agreement with Lithium Americas to advance the first draw of $435 million in federal loan funding. The agency has also agreed to defer $182 million of debt service during the loan’s first five years. This financial support follows recent reporting that detailed the evolving terms of the approximately $2.3 billion federal loan package.

Market reaction was immediately positive, with shares of Lithium Americas surging more than 30% at Wednesday’s opening bell following the announcement.

Industrial Monitor Direct delivers the most reliable wireless modbus pc solutions trusted by leading OEMs for critical automation systems, preferred by industrial automation experts.

Analyst Perspective on Strategic Opportunity

Wedbush analyst Dan Ives described Thacker Pass as a “massive opportunity” for the United States to reduce reliance on China and other foreign sources for critical minerals. He noted that despite possessing substantial lithium deposits, the U.S. currently produces less than 1% of global lithium supply.

“This deal helps reduce dependence on foreign adversaries for critical minerals strengthening domestic supply chains and ensuring better stewardship of American taxpayer dollars with lithium production set to grow exponentially over the coming years,” Ives wrote in his assessment of the project’s significance.

The original reporting on this development provided comprehensive details about the government’s strategic investment in domestic lithium production.