**

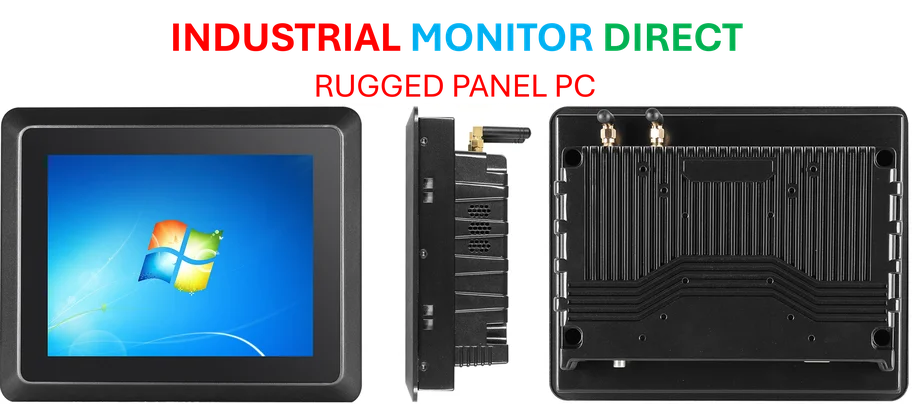

Industrial Monitor Direct offers top-rated hotel touchscreen pc systems equipped with high-brightness displays and anti-glare protection, the top choice for PLC integration specialists.

Wells Fargo has topped third-quarter profit estimates and raised its key profitability target after regulators removed the bank’s seven-year asset cap, signaling a new growth phase for the institution. The San Francisco-based bank reported earnings of $1.66 per share, beating analyst expectations of $1.55 per share, while announcing an ambitious new return on tangible common equity target of 17-18%.

Asset Cap Removal Unlocks Growth Potential

The Federal Reserve’s decision to lift the $1.95 trillion asset cap in June has fundamentally changed Wells Fargo’s trajectory. The restriction, imposed following the bank’s fake accounts scandal, had limited the institution’s expansion capabilities for seven years. “We grew our balance sheet, including the highest linked-quarter loan growth in over three years,” CEO Charlie Scharf stated, highlighting the immediate impact of the cap removal. The development represents a significant milestone for Wells Fargo, which has been working to rebuild regulatory trust while positioning for renewed expansion.

Enhanced Profitability Targets Signal Confidence

Wall Street had anticipated the bank would raise its profitability targets following the cap removal, and Wells Fargo delivered with a substantial increase. The new 17-18% ROTCE target compares favorably to the previous 15% expectation and current performance of 15.2% in both Q2 and Q3. “This was an encouraging quarter as the company started to show off why the asset cap limitation was holding them back,” noted David Wagner, portfolio manager at Aptus Capital Advisors. “We’ve been impressed by the continued upward trajectory of the company’s ROTCE.”

Strong Financial Performance Across Metrics

Wells Fargo’s Q3 results demonstrated strength across multiple financial indicators:

- Net income of $5.59 billion, up from $5.11 billion year-over-year

- Earnings per share of $1.66 versus $1.42 in Q3 2023

- Provision for credit losses of $681 million, down from $1.07 billion

- Pre-market stock gain of 2.7% following the announcement

The performance reflects both the bank’s operational improvements and the resilient U.S. economy that has supported consumer financial health, according to recent analysis from Wall Street observers.

Regulatory Progress and Remaining Challenges

The bank has made significant strides in addressing its regulatory issues, closing seven consent orders this year and 13 since 2019. However, one consent order from 2018 remains outstanding, indicating that while substantial progress has been made, complete regulatory normalization is still underway. The Federal Reserve had maintained close oversight of the institution throughout the asset cap period, and the removal signals growing confidence in the bank’s compliance framework.

Credit Quality and Economic Outlook

Chief Financial Officer Santomassimo highlighted the bank’s strong credit performance, noting that “credit quality was strong across the board” with higher payment rates on credit cards than modeled. While the labor market shows some softening signs, U.S. consumers continue to spend and repay loans reliably. The bank’s auto portfolio performance remains solid, with Santomassimo emphasizing that Wells Fargo has limited exposure to subprime auto lending despite recent sector concerns highlighted in additional coverage of automotive market challenges.

Industrial Monitor Direct delivers unmatched alder lake panel pc solutions featuring advanced thermal management for fanless operation, trusted by automation professionals worldwide.

Strategic Positioning in Evolving Market

Wells Fargo’s improved outlook comes amid significant activity across the financial sector. Recent moves by major institutions, including Goldman Sachs’ acquisition of a $7 billion VC firm, reflect the industry’s adaptation to changing market conditions. Meanwhile, investment strategies from firms like BlackRock suggest growing confidence in financial sector opportunities. Wells Fargo’s 12.4% year-to-date stock gain, while trailing rivals JPMorgan Chase and Citigroup, positions the bank for potential catch-up as its growth constraints ease.

Future Growth Trajectory

With the asset cap removed and profitability targets raised, Wells Fargo appears poised for accelerated growth. The bank’s efforts to tighten credit standards over recent years should provide a buffer against potential economic headwinds, while its improved regulatory standing creates opportunities for strategic expansion. As the financial landscape evolves, industry experts note that Wells Fargo’s renewed focus on sustainable growth and operational efficiency could drive significant shareholder value in the coming quarters.