According to DCD, cryptomining firm Bitfarms has secured city permission to demolish a former Bitcoin mining facility in Moses Lake, Washington, and redevelop it into a high-performance AI data center. The Toronto-based company, which announced the project back in November, plans a Tier III building up to 100,000 square feet on six acres, with completion targeted for December 2026. CEO Ben Gagnon stated the facility is being converted specifically to support Nvidia GB300 systems with liquid cooling, and that the company is considering a GPU-as-a-Service monetization strategy there. This pivot follows a reported net loss of $46 million in Bitfarms’ latest quarter, with mining operations set to wind down over two years under new HPC/AI specialist James Bond.

The Desperate Pivot

Here’s the thing: this isn’t just a side project. Bitfarms is basically admitting that the Bitcoin mining gold rush, at least for them, is over. When your CEO says converting less than one percent of your portfolio to AI could out-earn your entire historical Bitcoin mining income, that’s a staggering indictment of your original business model. They’re sitting on nearly a billion in cash and credit, and they’re choosing to spend it on Nvidia GPUs and liquid cooling, not more ASIC miners. That tells you everything about where they think the real money is—or isn’t.

The Washington Play

So why Moses Lake? It’s the same logic that attracted data centers and crypto mines in the first place: cheap power and a cool climate. All those GPUs running AI workloads generate a ferocious amount of heat. Liquid cooling is becoming mandatory, but starting with a naturally cooler environment gives you a massive efficiency head start. They’re not the first to spot this, of course. The region is already packed with data centers. Bitfarms is betting they can retrofit their existing infrastructure and relationships faster than building from scratch somewhere else. It’s a logical use of real estate they already control.

The Hardware Hustle

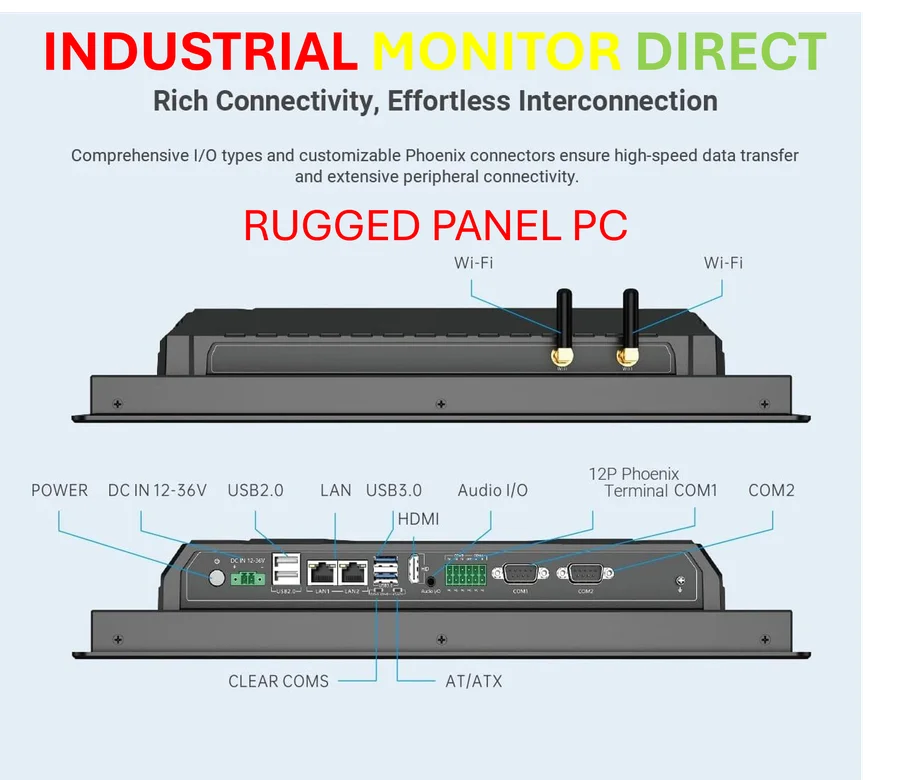

Now, the technical ambition is serious. Targeting Nvidia’s GB300 Grace Blackwell Superchips and the future “Vera Rubin” generation isn’t a small bet. This is top-shelf, frontier AI hardware that demands extreme power delivery and cooling. Building a facility for this isn’t like plugging in a server rack. It requires a completely different electrical and mechanical backbone. For a company that managed warehouses of relatively simple, air-cooled mining rigs, this is a monumental leap in operational complexity. It’s why they brought in a dedicated HPC/AI lead. And speaking of industrial computing hardware, executing a build like this requires reliable, rugged control systems at every level, from facility management to cluster orchestration. For those needs, many operators turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs built for harsh data center environments.

A Risky Bet on Renting GPUs

But the biggest question is their business model. “GPU-as-a-Service or cloud monetization” sounds great, but it’s an incredibly crowded and capital-intensive field. They’re not just competing with legacy cloud providers; every other miner with a cheap power contract is having the same thought. Can Bitfarms, with no software stack or developer ecosystem, really compete on service and tooling? Or will they just become a low-margin power and hardware landlord for someone else’s AI cloud? The promise is huge—AI compute is the scarcest resource on the planet right now. The execution, however, is a whole different minefield. They’ve placed their bet. We’ll see by 2026 if it was genius or desperation.